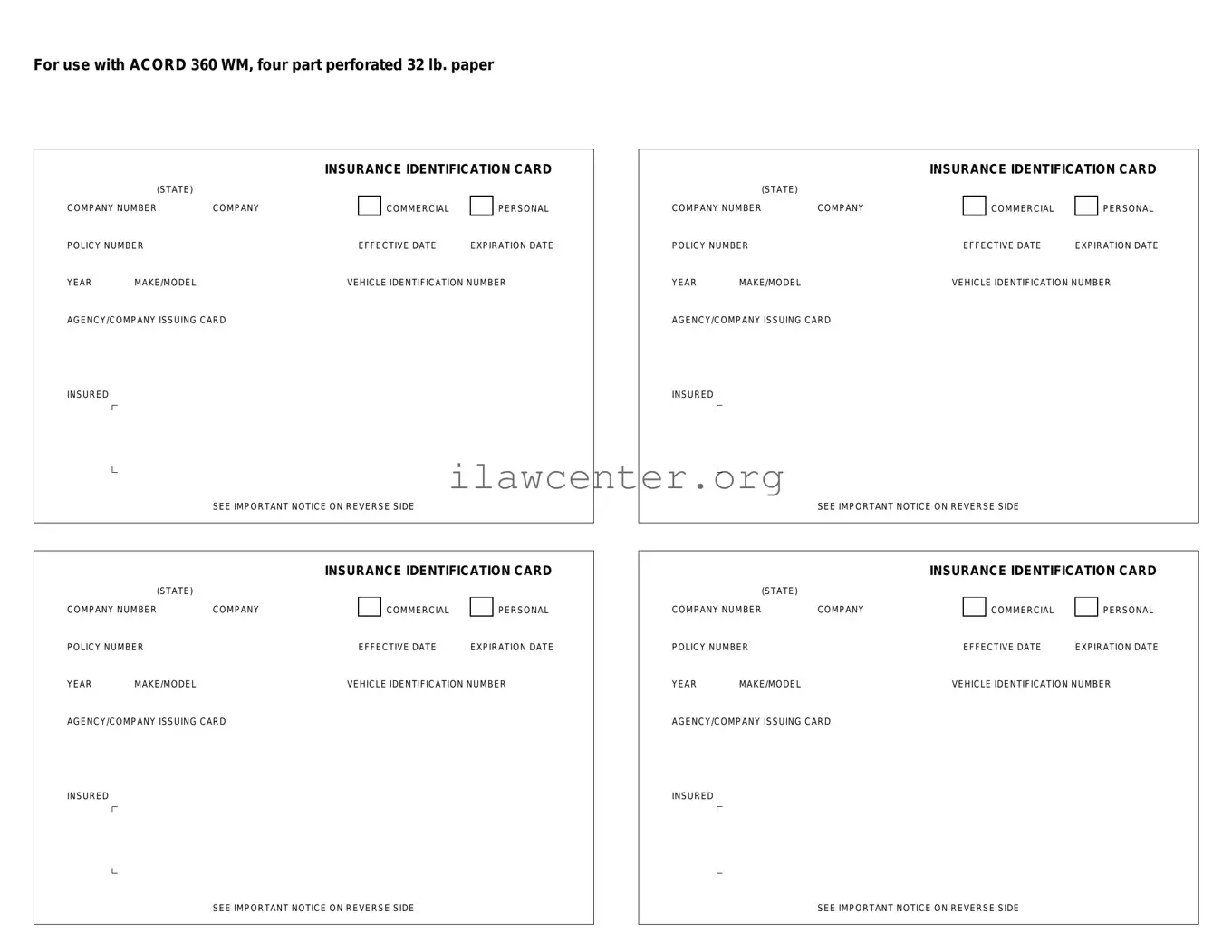

Instructions on Utilizing Acord 50 WM

Filling out the Acord 50 WM form is a straightforward process that requires some specific information. After completing the form, you will typically submit it to the relevant insurance provider or regulatory body for their review. Here are the steps to effectively complete the form.

- Read the Instructions: Before you start, familiarize yourself with any instructions that accompany the form.

- Gather Required Information: Collect all necessary information, such as policy details, contact information, and any other relevant data.

- Fill in the Applicant Information: Start by entering your name, address, and contact information in the designated sections.

- Provide Business Details: If applicable, include the business name, address, and other relevant business information.

- List Coverage Information: Specify the types and amounts of coverage needed or being requested.

- Complete Additional Sections: Review and fill out any additional sections that may pertain to your specific situation.

- Review for Accuracy: Carefully check your entries for any errors or omissions.

- Sign and Date: Finally, sign and date the form where indicated.

- Submit the Form: Send the completed form to the appropriate recipient, either electronically or via mail.