Instructions on Utilizing Adp Pay Stub

Filling out the ADP Pay Stub form is straightforward, but attention to detail is important to ensure accuracy. By following the steps outlined below, you’ll be able to complete the form correctly.

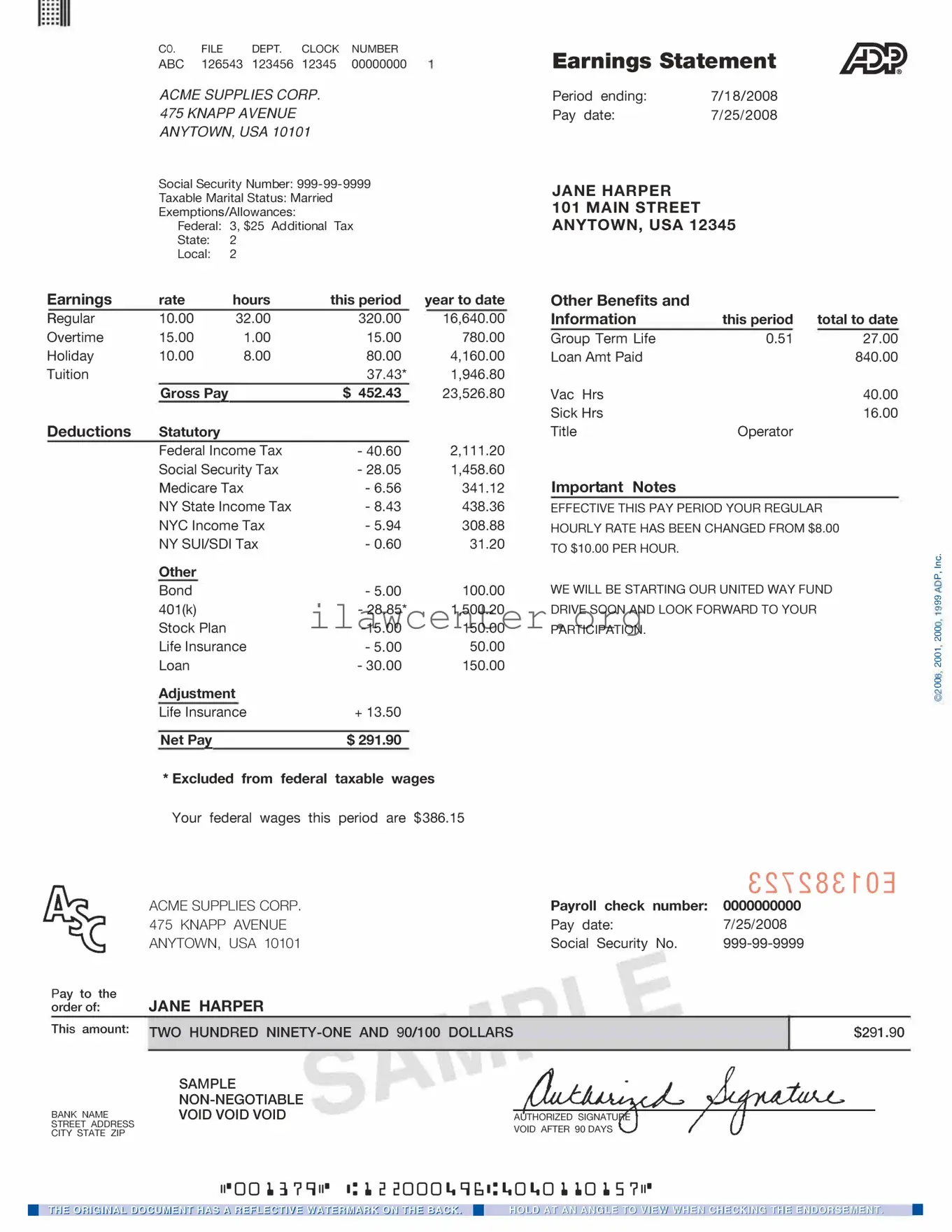

- Start with the employee’s personal details. Enter the name, employee identification number, and address in the designated sections.

- Provide payroll information. Fill in the pay period dates and the date of payment.

- Disclose earnings. List all types of income received during the pay period, such as regular hours, overtime hours, bonuses, and commissions.

- Document deductions. Include details for all deductions taken from the gross pay, like federal and state taxes, Social Security, Medicare, and any benefits contributions.

- Calculate net pay. Subtract the total deductions from the total earnings to determine the net pay for the period.

- Review the form. Double-check all entries for accuracy and completeness. Ensure that all numbers add up correctly.

- Sign and date the form, if required, to confirm that the information provided is accurate and truthful.

Once you have completed the form, it is ready for submission to your payroll department or for your own records. Remember to keep a copy for your personal reference.