What is an Alabama Bill of Sale?

An Alabama Bill of Sale is a legal document that records the transfer of ownership of personal property from one person to another. This form is commonly used for transactions involving vehicles, boats, and other valuable items. It serves as proof that the buyer has acquired the property and protects both parties in case of disputes regarding ownership or condition of the item sold.

Is a Bill of Sale required in Alabama?

While a Bill of Sale is not specifically required by law for all personal property transactions in Alabama, it is recommended. Having this document can help to clarify the terms of the sale and provide legal protection for both the buyer and the seller. For vehicle sales, in particular, a Bill of Sale may be required to register the vehicle with the Department of Revenue.

What information should be included in the Bill of Sale?

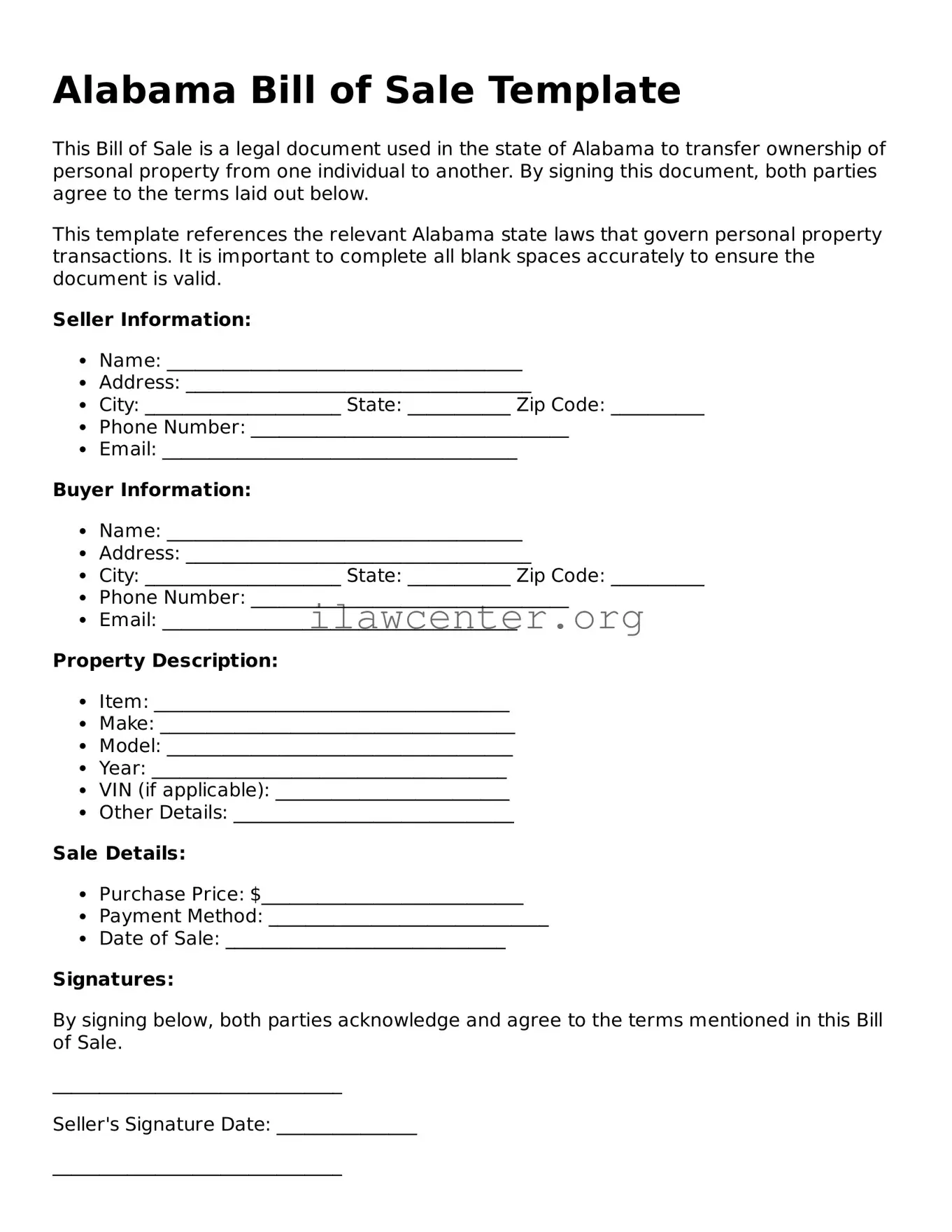

An Alabama Bill of Sale should include important details such as the names and addresses of both the buyer and seller, a description of the item being sold (including its condition, VIN for vehicles, or serial number), the purchase price, and the date of the transaction. Additionally, both parties should sign the document to acknowledge their agreement to the terms outlined.

Can I create a Bill of Sale on my own?

Yes, you can create a Bill of Sale on your own. Several template options are available online that you can customize to suit your specific transaction. Ensure that the document includes all necessary information to avoid legal issues in the future. However, for more complex transactions, consulting a legal professional might be beneficial.

Do I need to have the Bill of Sale notarized?

Notarization of a Bill of Sale is not strictly required in Alabama; however, it can add an extra layer of authenticity and prevent disputes. If either party has concerns about the transaction or wishes to ensure that the document is legally recognized, having it notarized is a good precaution to take.

How long should I keep a Bill of Sale?

It is advisable to keep a copy of the Bill of Sale for at least a few years after the sale. Having documentation of the transaction is essential for buyers and sellers alike, especially if any disputes arise regarding ownership, condition, or payment. Keeping the document can also be useful for tax purposes and when registering the item with the state.