Instructions on Utilizing Alabama Deed

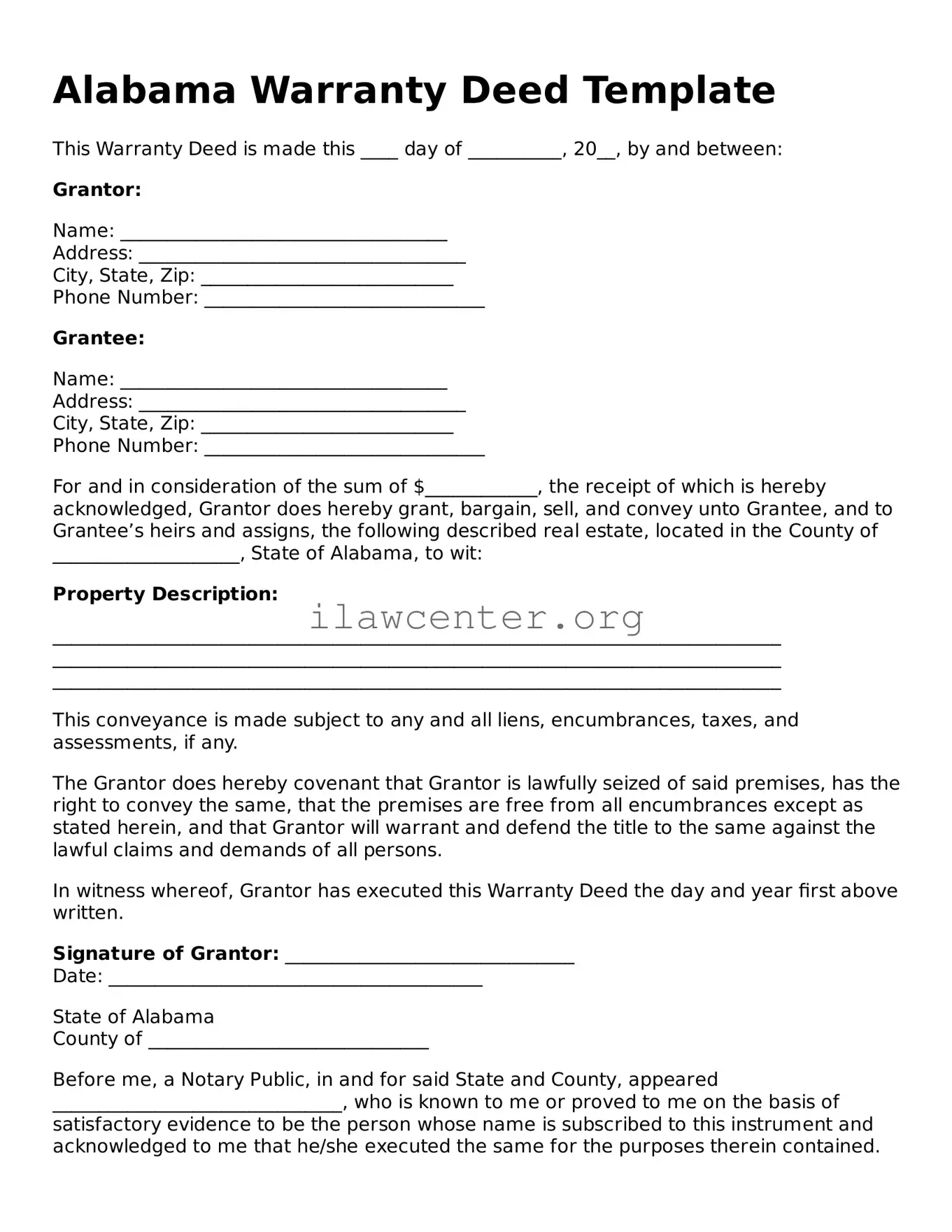

After gathering the necessary information, you will be ready to complete the Alabama Deed form. This step is pivotal in ensuring that the transfer of property rights is recorded accurately. Follow these steps to fill out the form correctly.

- Obtain the Form: Download or request a printed copy of the Alabama Deed form from a local courthouse or an online legal forms provider.

- Identify the Parties: Clearly state the names of the Grantor (the person transferring the property) and the Grantee (the person receiving the property). Include their status (individuals, couples, or entities) and addresses.

- Describe the Property: Provide a detailed description of the property being transferred. This includes the address, legal description, and parcel number if available.

- Consideration Amount: Indicate the consideration amount (the price paid for the property). This may also be stated as "for love and affection" if no monetary exchange occurs.

- Signatures: Ensure that the Grantor(s) sign the form in the designated area. If the property is owned jointly, all owners must sign.

- Notarization: Take the completed form to a notary public. The notary will verify the identity of the Grantor(s) and witness the signing, then provide their official seal.

- File the Deed: Submit the completed and notarized deed to the local county probate court or recording office. Some counties may also allow electronic submissions.

- Pay Filing Fees: Be prepared to pay any applicable filing fees required by the recording office at the time of submission.

Upon the successful recording of your deed, a copy will be returned to you, confirming the transfer of property ownership. This document will serve as a vital record in future transactions and ownership verification.