Instructions on Utilizing Alabama Durable Power of Attorney

Filling out the Alabama Durable Power of Attorney form allows you to designate someone to make important decisions on your behalf when you cannot. It’s essential to ensure that the document is completed accurately to uphold its validity. Follow these steps to fill out the form effectively.

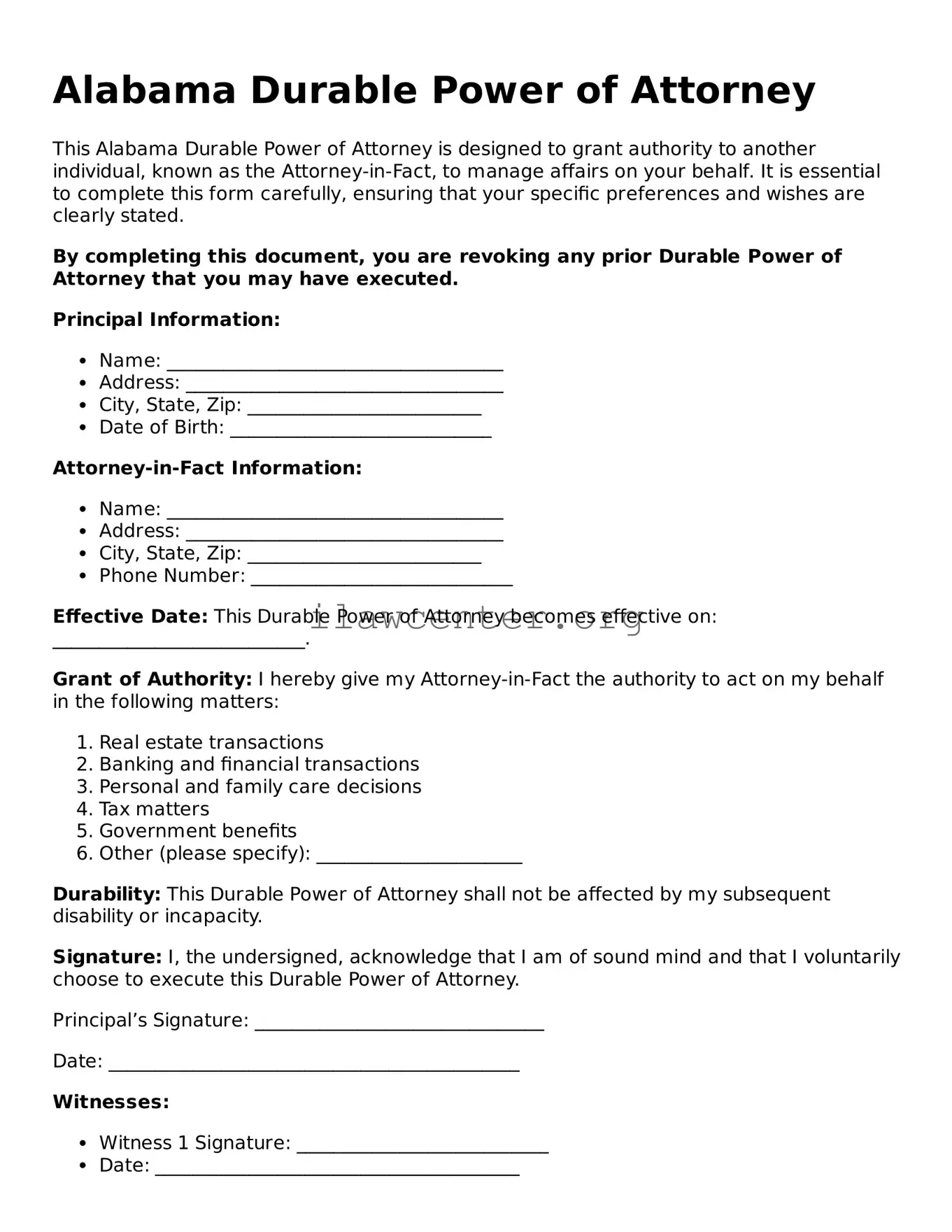

- Begin by obtaining the Alabama Durable Power of Attorney form. You can find this form online or through legal service providers.

- At the top of the form, fill in your name and address. This is the principal’s information, which identifies who is granting the power.

- Next, provide the name and address of the agent. This person will have the authority to act on your behalf.

- Specify the powers you want to grant. You may choose to give general powers or specify particular powers, such as managing finances or making healthcare decisions.

- Indicate the effective date of the power of attorney. You may choose it to be effective immediately or at a future date when you become incapacitated.

- Sign and date the form in the designated area. It’s important that your signature matches your legal name.

- Next, the form may require a witness signature. Make sure you have at least one person over the age of 19 witness your signature.

- In some cases, notarization may be necessary. If so, bring the completed form to a notary public to have it officially notarized.

Once you complete the form, it’s advisable to provide copies to your agent and any relevant parties, such as family members or financial institutions. Keeping the original document in a safe place ensures it remains accessible when needed.