Instructions on Utilizing Alabama General Power of Attorney

After receiving the Alabama General Power of Attorney form, it is crucial to complete it with careful attention to detail. This ensures that your wishes will be accurately reflected, and the document will be legally valid. Following the steps below will guide you through the process effectively.

- Obtain the Alabama General Power of Attorney form, which can typically be found online or at legal stationery stores.

- Read through the entire form to familiarize yourself with its sections and requirements.

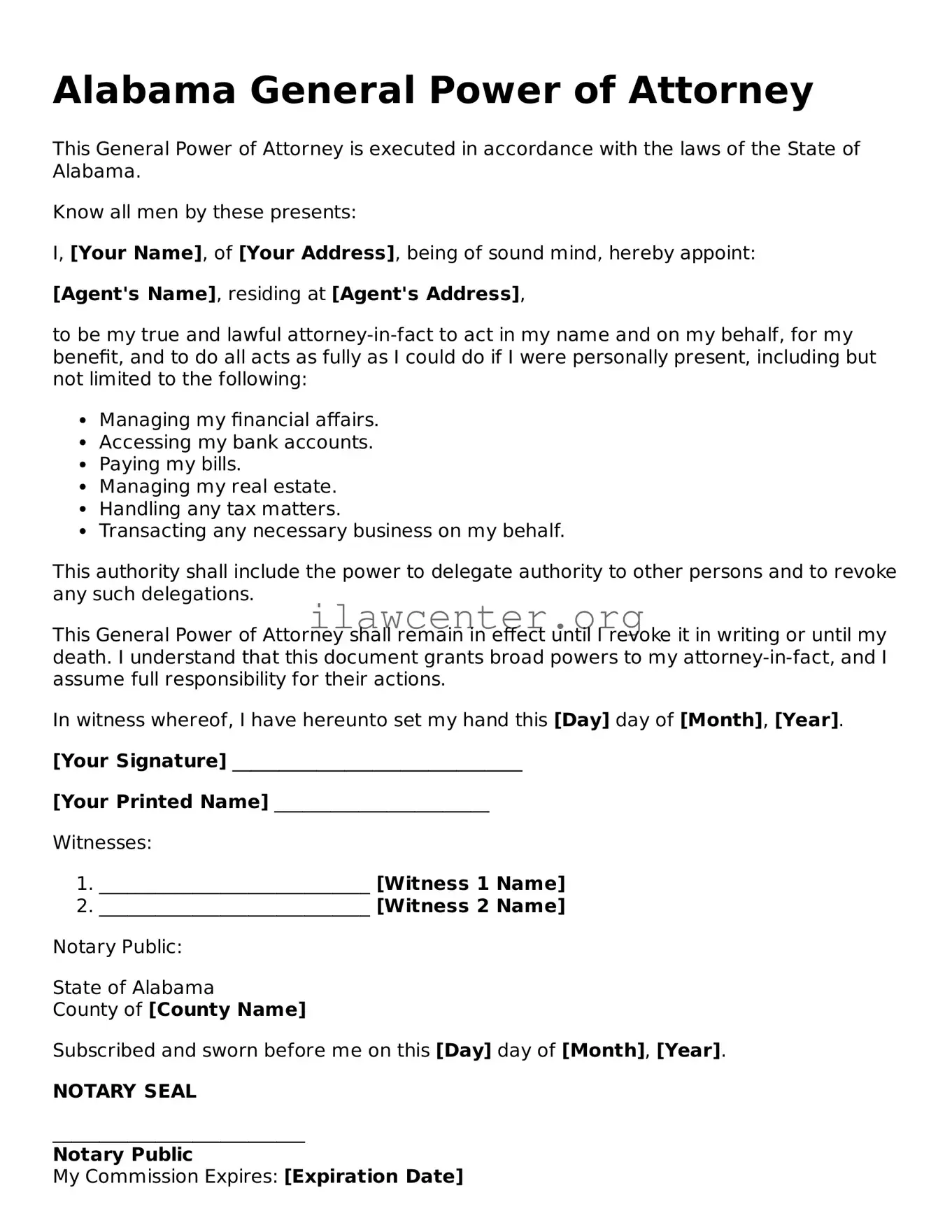

- Begin by entering your full name and address at the top of the document as the principal.

- Add the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Clearly define the powers you wish to grant your agent. This may include financial decisions, medical decisions, or other specific authorities.

- Consider whether the powers should be effective immediately or only in the event of your incapacity. Indicate your preference on the form.

- If desired, list any limitations or specific instructions regarding your agent’s powers.

- Sign and date the form in the designated area. Make sure to do so in the presence of a notary public.

- Have the form notarized to ensure it meets legal standards. The notary will verify your identity and confirm that you signed the form willingly.

- Distribute copies of the completed and notarized form to your agent, your bank, and any other relevant institutions.