Instructions on Utilizing Alabama Power of Attorney

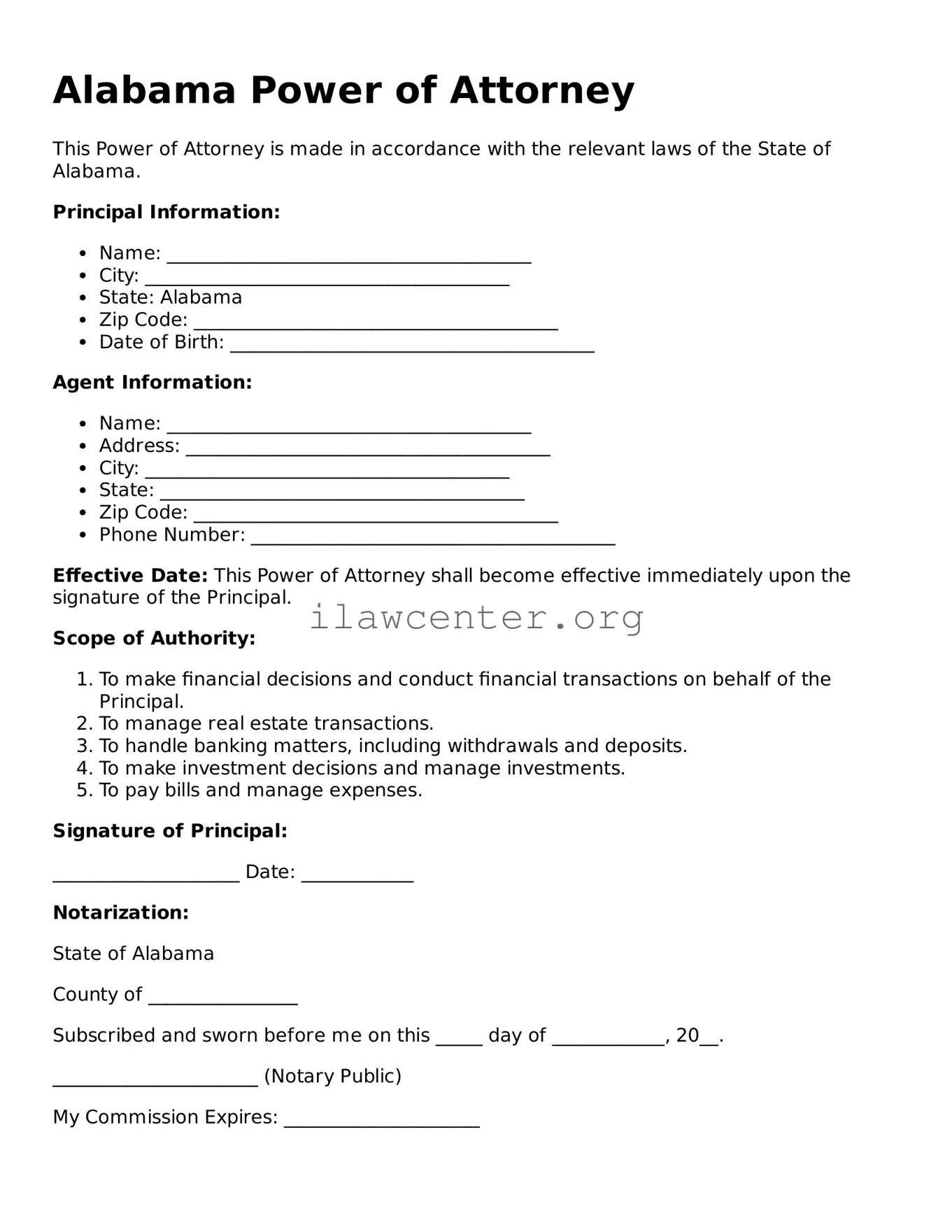

Once you have the Alabama Power of Attorney form in hand, it’s important to fill it out accurately. Make sure you have all the necessary information ready before you begin. Following the steps precisely will help ensure that the form is completed correctly.

- Begin by writing the date at the top of the form.

- Clearly print your name and address in the designated areas. Make sure this information is correct.

- Next, identify the person you are granting power to. Write their name and address where indicated on the form.

- Detail the specific powers you wish to grant. Be as clear as possible about the scope of authority.

- Include any limitations you want to impose on the authority granted. Specify if certain actions are not allowed.

- Sign and date the document in the appropriate places. Ensure your signature matches the name you've written on the form.

- Have the form notarized. This step is crucial for the legitimacy of the document.

- Make copies of the completed form for your records and for the person you are granting power to.

After filling out the form, you should be ready to distribute copies as needed. Ensure the appointed individual understands their responsibilities and the extent of their authority.