What is a quitclaim deed?

A quitclaim deed is a legal document used to transfer ownership of real property. This type of deed conveys whatever interest the grantor has in the property, without making any guarantees regarding the validity of that interest. It is often used between family members or in situations where the exact interest being transferred is not in question.

How do I complete a quitclaim deed in Alabama?

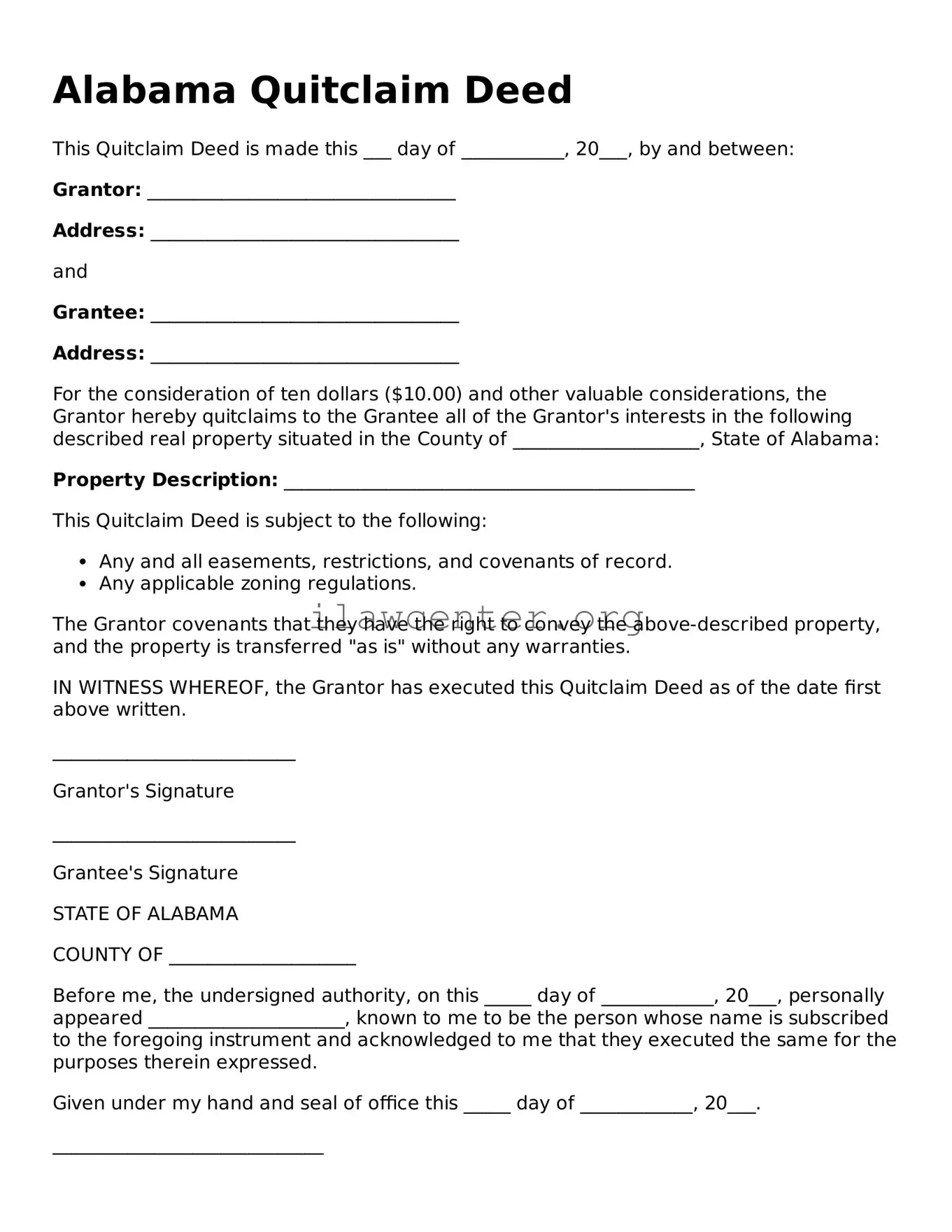

To complete a quitclaim deed in Alabama, you will need to start by gathering necessary information including the names of the grantor and grantee, a legal description of the property, and the address. The document should then be filled out accurately, ensuring that all parties involved have provided their consent. The deed must be signed and notarized before it can be submitted for recording at the local county courthouse.

Are there any fees associated with filing a quitclaim deed in Alabama?

Yes, there are fees associated with filing a quitclaim deed in Alabama. These fees vary by county but generally include recording fees and possibly transfer tax, depending on the property's value. It is advisable to check with the local county recorder's office for specific fee amounts and payment methods.

What is the difference between a quitclaim deed and a warranty deed?

The main difference between a quitclaim deed and a warranty deed lies in the guarantees provided. A quitclaim deed transfers whatever interest the grantor has without any warranties about the title. In contrast, a warranty deed provides assurances that the title is clear and the grantor holds the legal right to transfer it. This distinction can have significant legal implications, especially in disputes over property title.

Can a quitclaim deed be revoked in Alabama?

Once a quitclaim deed has been executed and recorded, it cannot be unilaterally revoked. However, the grantor and grantee may agree to a new deed that reverses the transaction. This would typically involve another quitclaim deed or a different type of deed to undo the previous transfer. Consulting with a legal professional can provide guidance tailored to individual circumstances.

Do I need an attorney to create a quitclaim deed in Alabama?

While it is not legally required to hire an attorney to create a quitclaim deed in Alabama, doing so can be beneficial. An attorney can ensure that all necessary legal requirements are met and help avoid potential issues. If the parties are not entirely comfortable navigating the process, seeking legal assistance may be a prudent approach.

Is a quitclaim deed valid if not notarized?

A quitclaim deed must be notarized to be considered valid for recording purposes in Alabama. Notarization serves as verification that the signatures on the deed were made willingly and without coercion. Recording the notarized deed with the county serves as public notice of the property transfer and protects the interests of the grantee.