Instructions on Utilizing Alabama Transfer-on-Death Deed

After you have gathered the necessary information and accessories, the next step is to complete the Alabama Transfer-on-Death Deed form accurately. This deed will allow you to designate one or more beneficiaries who will receive your property after your death, providing a smooth transition of ownership without the need for probate.

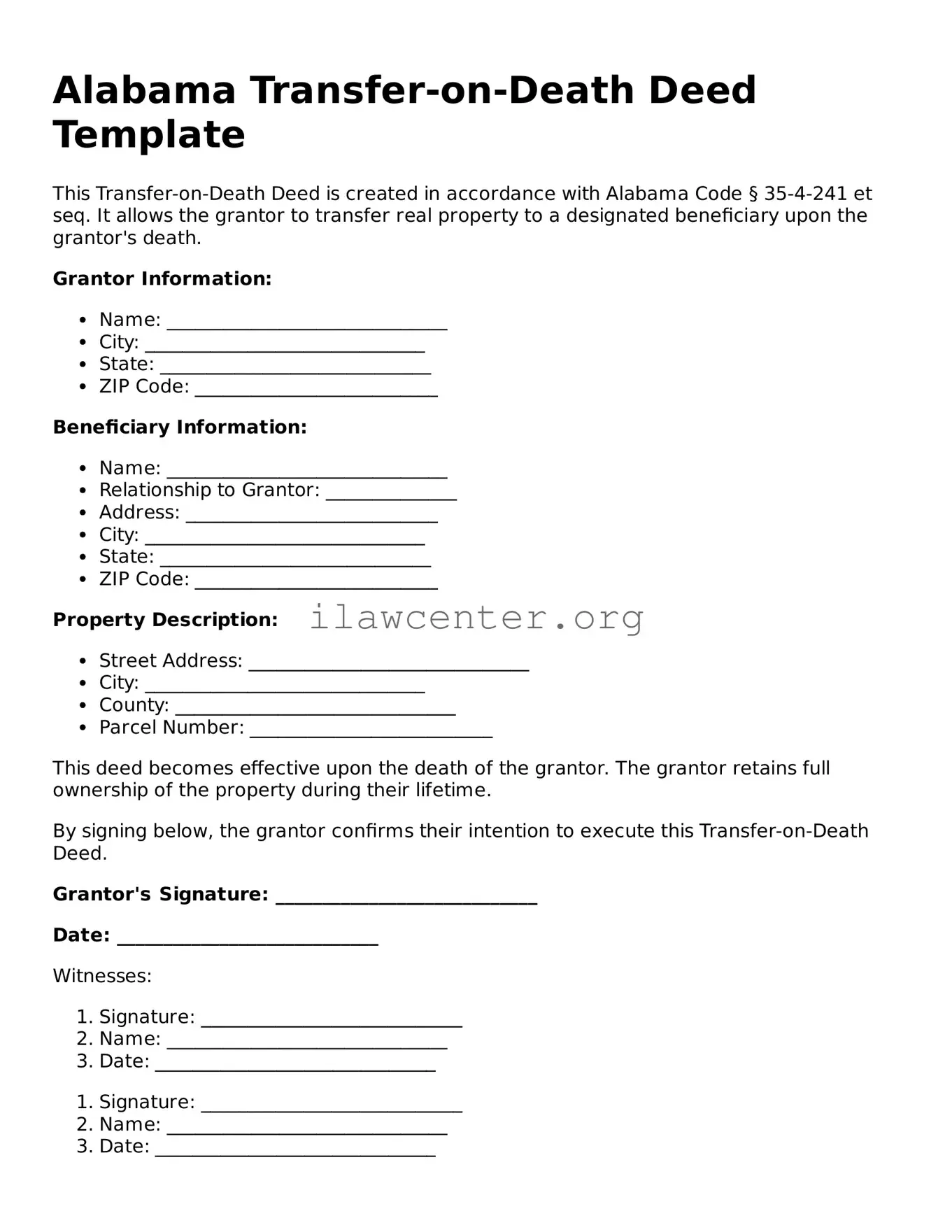

- Begin by entering the date at the top of the form in the designated area.

- Write your full name and address in the "Grantor" section. This identifies you as the property owner.

- List the names and addresses of all beneficiaries in the relevant section. Make sure to include all pertinent details for each individual you want to name.

- Clearly describe the property being transferred. Include the property address and, if applicable, the legal description to avoid any ambiguity.

- If there are multiple beneficiaries, specify how the property should be divided among them. You can indicate percentages or specific shares.

- Review the document carefully for accuracy, ensuring all names, addresses, and property descriptions are correct.

- Sign the form in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Have the notary public sign and stamp the form as required by Alabama law.

- After notarization, file the completed deed with the appropriate county office where the property is located. This formalizes the transfer arrangement.

By following these steps carefully, you can successfully complete the Transfer-on-Death Deed form and ensure that your wishes regarding property transfer are clearly communicated and legally executed.