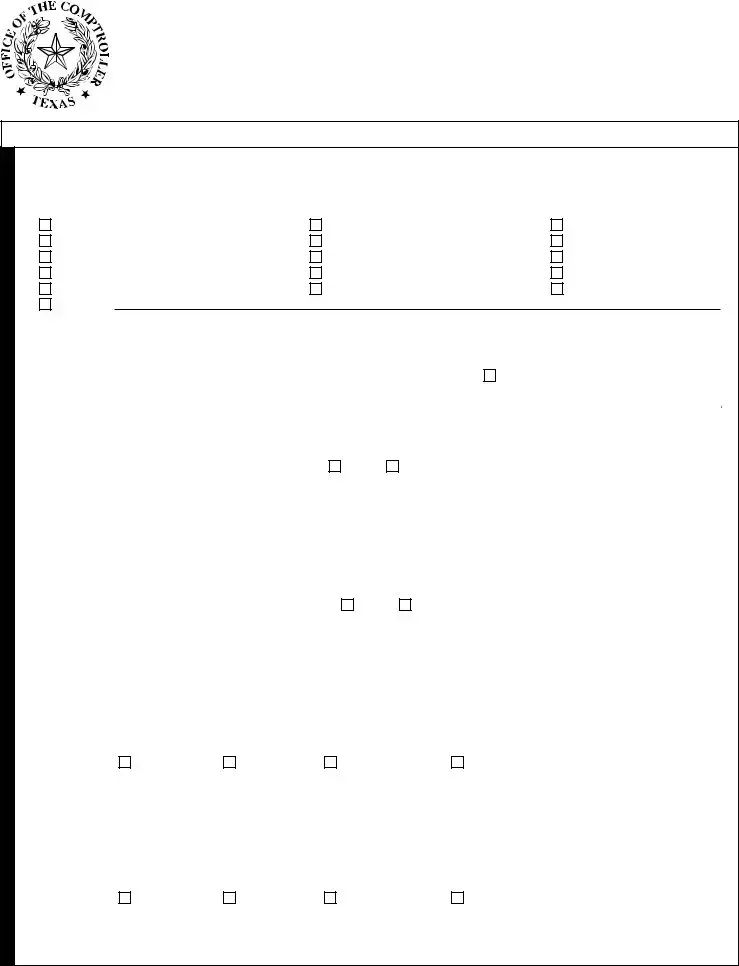

Instructions on Utilizing Ap 201 1

Filling out the AP 201 1 form is an essential step for businesses seeking various tax permits in Texas. To ensure that the process goes smoothly, it's important to follow a clear set of instructions. This will help avoid any unintentional mistakes that could lead to delays.

- Begin by carefully reading all instructions provided on the form.

- Identify your business organization type and check the appropriate box (e.g., Profit Corporation, General Partnership, etc.).

- Enter the legal name of your business in the designated field.

- If applicable, provide your Federal Employer Identification Number (FEIN).

- If you do not have an FEIN, check the appropriate box.

- List any past or current Texas Taxpayer Number you've received.

- Indicate if you have ever received a Texas vendor or payee number and provide that number if you have.

- State the home state or country of formation along with the formation date, if applicable.

- Select ‘Yes’ or ‘No’ to indicate if your corporation has been involved in a merger within the last seven years; attach details if applicable.

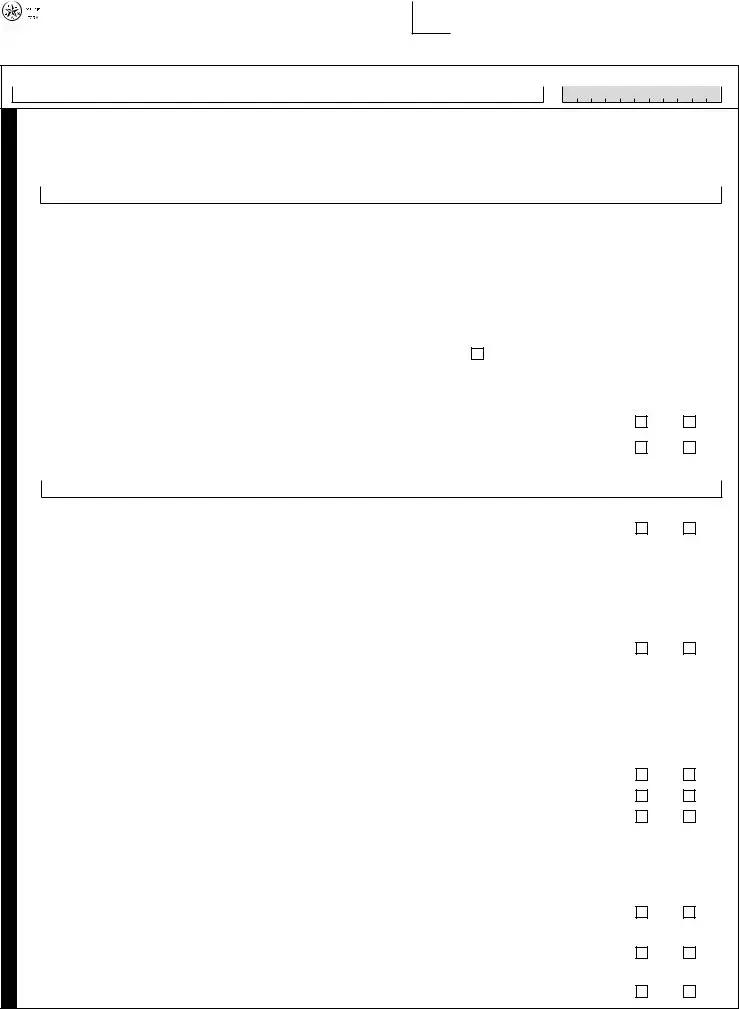

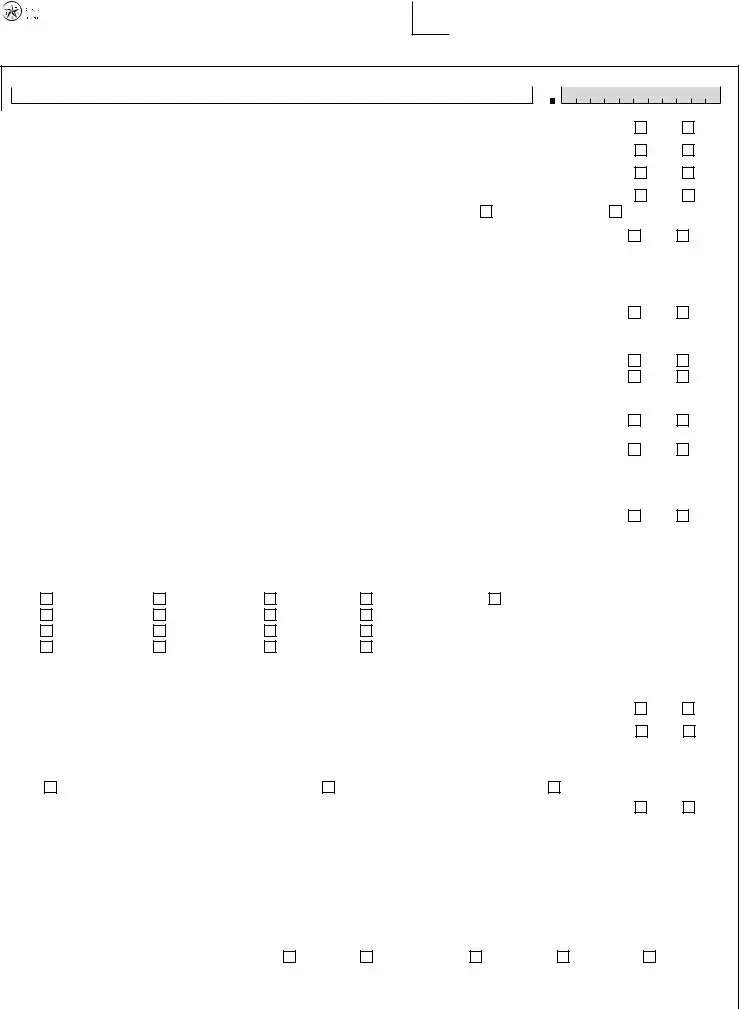

- List all general partners, officers, or managing members, along with their contact details and ownership percentages.

- For sole proprietors, enter your full legal name and Social Security number, if you have one.

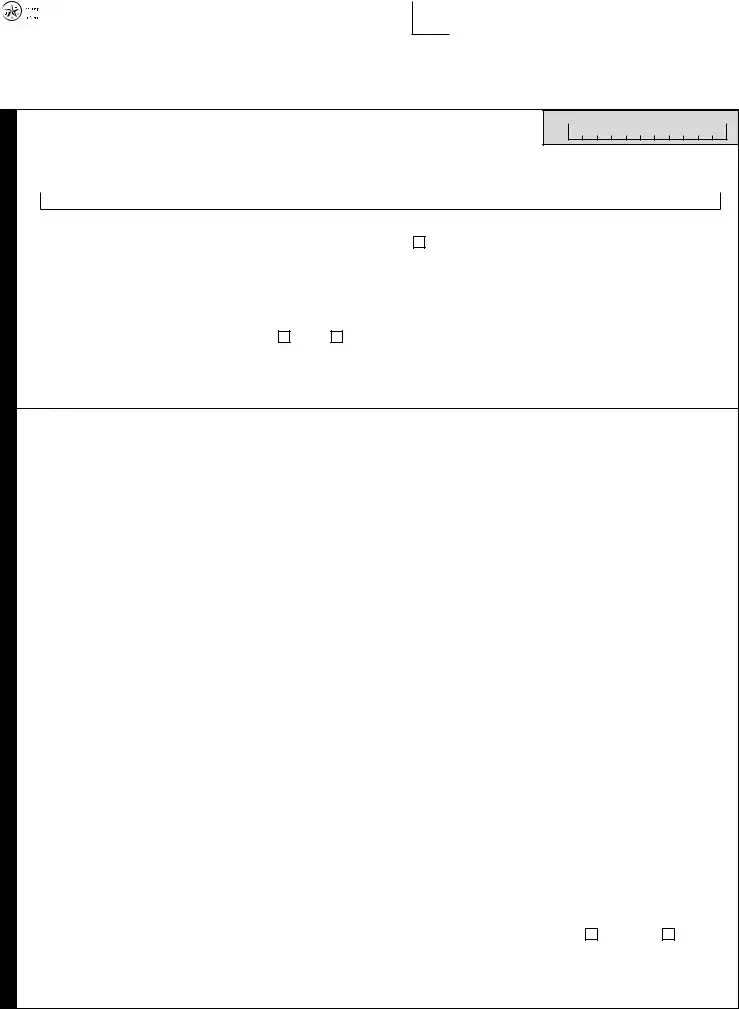

- Provide your mailing address, ensuring all details are complete.

- List daytime phone numbers, fax numbers, mobile numbers, and email addresses as needed.

- Fill out the place of business information, including the business name and physical address.

- Answer all questions regarding your business operations in Texas, including if you have representatives operating under your authority.

- If applicable, disclose details about any temporary business locations or events.

- Complete all applicable sections regarding sales tax obligations and any additional permits required.

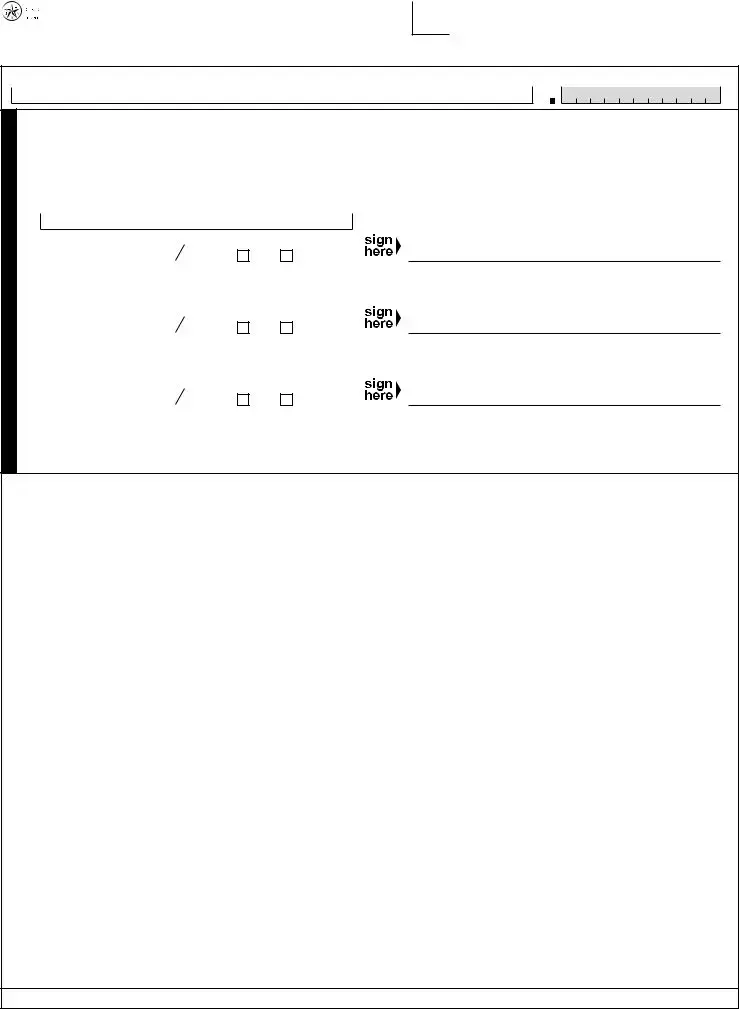

- Lastly, ensure that all required signatures are provided and that you are at least 18 years old.

The completion of this form allows your business to comply with local tax laws. Make sure all information is accurate and submit it through the designated channels as indicated on the form. Double-check for any attachments you may need to include with your application.