What is a Bill of Sale in Arizona?

A Bill of Sale is a legal document that records the transfer of ownership of personal property from one individual to another. In Arizona, this form is particularly useful for tracking the sale of items such as vehicles, boats, and firearms. It serves as proof of the transaction and can be important for future references, like tax purposes or avoiding disputes.

Is a Bill of Sale required in Arizona?

No, a Bill of Sale is not legally required in Arizona for all transactions. However, it is highly recommended, especially for significant purchases. Having this document protects both the buyer and seller by providing a clear record of the agreement, including details about the item sold, the transaction date, and the parties involved.

What information should be included in an Arizona Bill of Sale?

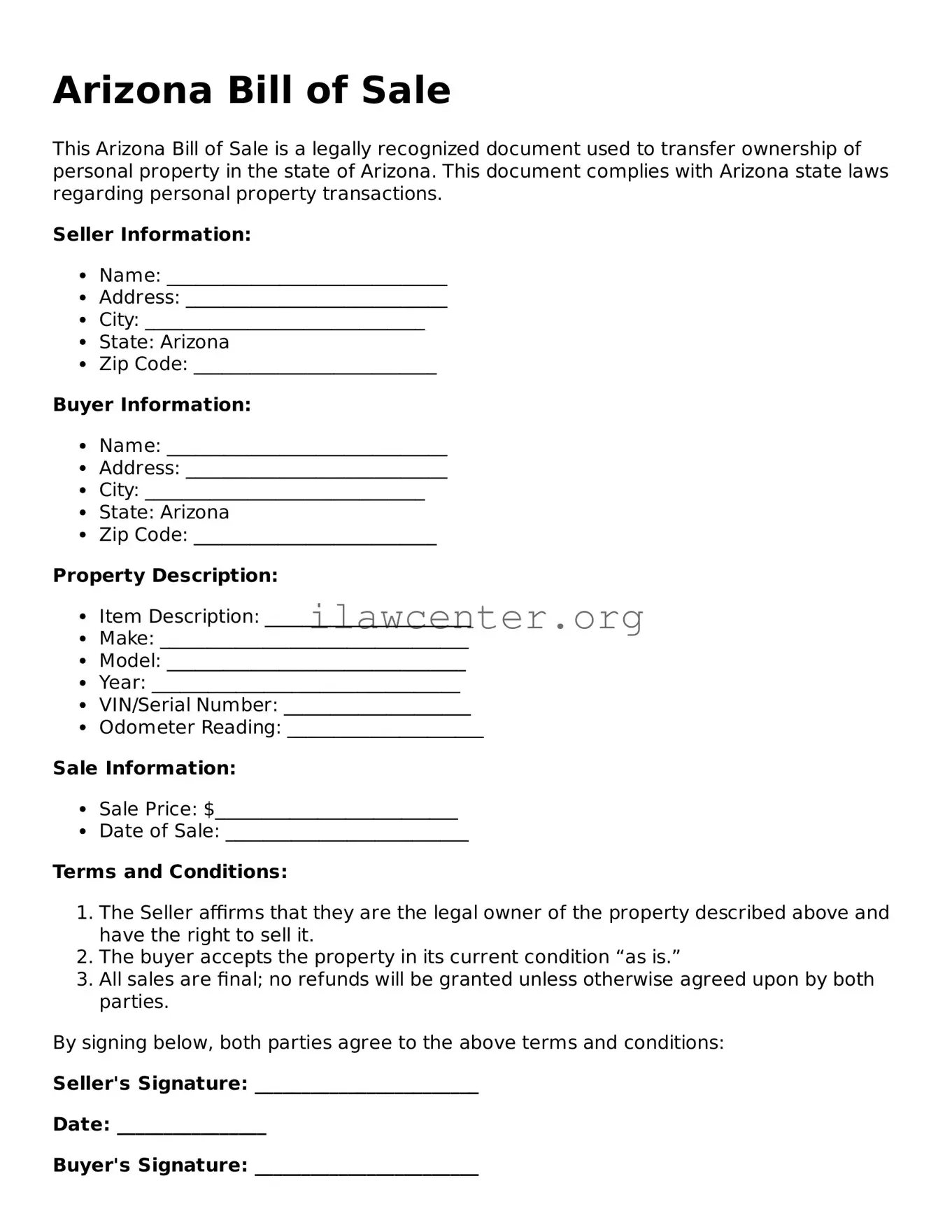

An Arizona Bill of Sale should include several key pieces of information: the names and addresses of the buyer and seller, a detailed description of the property being sold (including VIN for vehicles or serial numbers for firearms), the sale price, and the date of the transaction. It may also be helpful to include any warranties or guarantees associated with the sale.

Do I need to have the Bill of Sale notarized?

Notarization is not typically required for a Bill of Sale in Arizona. However, if you are selling a vehicle, the Arizona Department of Transportation recommends having the Bill of Sale notarized to add an extra layer of protection. This can help verify the identities of the parties involved, lending credibility to the document.

How does a Bill of Sale affect sales tax in Arizona?

In Arizona, the seller is generally responsible for reporting the sale to the appropriate tax authorities. While the Bill of Sale itself does not determine tax obligations, it provides the necessary documentation that may be needed during tax filing. It can also serve as proof of the amount paid, which is relevant if taxes are owed on the transaction.

Can I create my own Bill of Sale in Arizona?

Yes, individuals can create their own Bill of Sale in Arizona. It’s important to ensure that all necessary information is included and that it is signed by both the buyer and seller. There are also many templates available online which can simplify this process, ensuring that the document complies with state requirements.

What should I do with the Bill of Sale after the transaction?

After the transaction is complete, both parties should keep a copy of the Bill of Sale for their records. Buyers may need it when registering their new property (especially for vehicles or boats). Sellers should keep their copy to document the sale in case of any future disputes or questions regarding the transaction.