What is an Arizona Deed form?

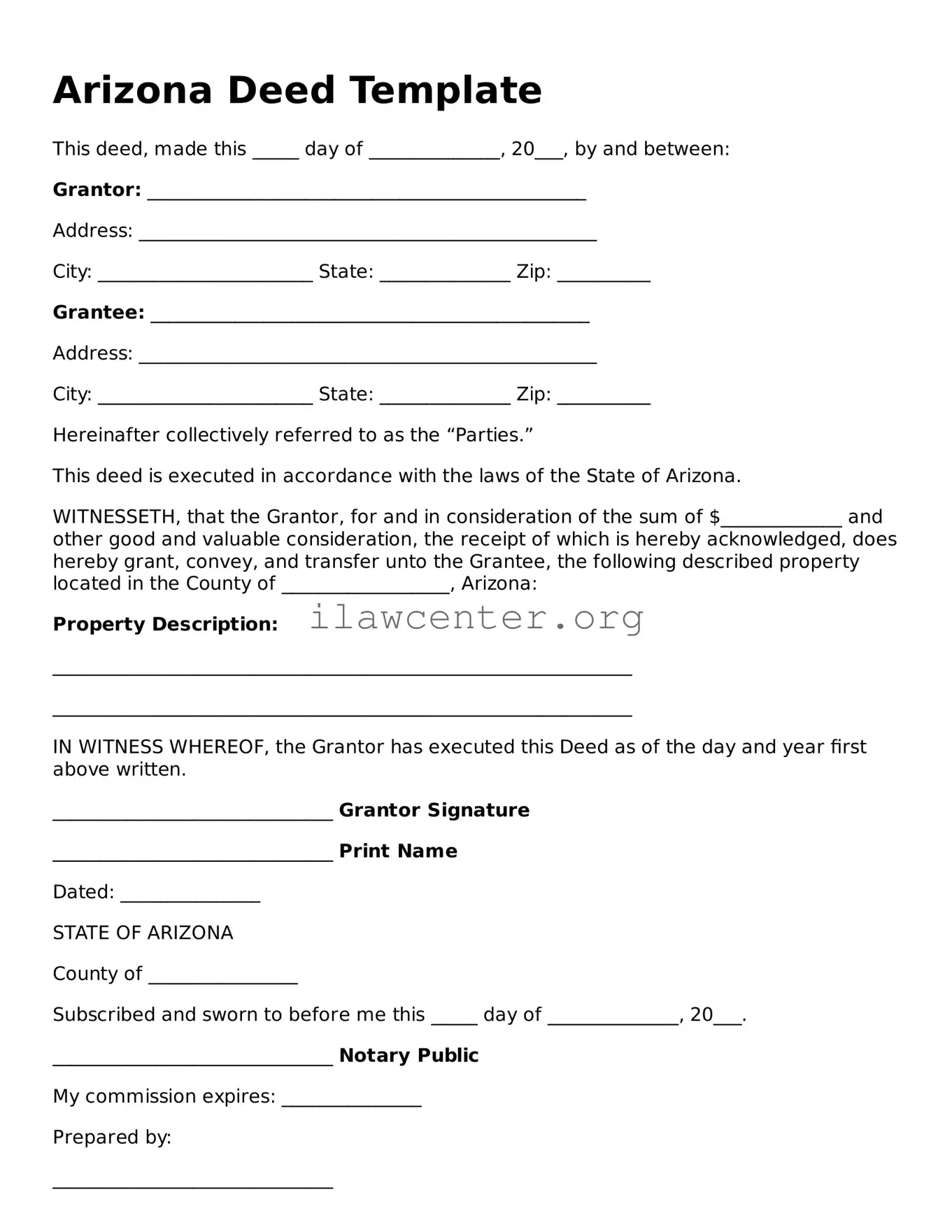

An Arizona Deed form is a legal document used to transfer ownership of real property in the state of Arizona. It serves as evidence of a person's title to the property and outlines the details of the transfer, including the names of the parties involved, a description of the property, and any special conditions pertaining to the transfer.

What are the different types of deeds available in Arizona?

Arizona recognizes several types of deeds including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. Warranty Deeds provide the highest level of protection to the buyer as they guarantee that the seller holds a clear title. Quitclaim Deeds, on the other hand, transfer whatever interest the seller has, without any guarantees. Special Warranty Deeds offer a middle ground, ensuring that no issues arose during the seller's ownership.

Is it necessary to have the Deed form notarized?

Yes, in Arizona, a Deed must be notarized to be considered valid. This step serves to authenticate the signatures of the parties involved in the transaction. Notarization helps prevent fraud and ensures that all parties are aware of the implications of the deed.

Do I need a lawyer to prepare an Arizona Deed?

While it's not mandatory to hire a lawyer, you may benefit from their expertise, particularly if the transaction is complex. Many people opt to prepare the deed on their own or use professional services. It's essential that the deed complies with state requirements to ensure a smooth transfer of property.

What information is required on the Arizona Deed form?

The required information typically includes the names of the grantor (seller) and grantee (buyer), a legal description of the property, the consideration (or purchase price), and any specific conditions related to the transfer. Additionally, the date of execution must be included, as well as the notary’s signature and seal.

Where do I file the Arizona Deed after it's completed?

Once the deed is properly executed and notarized, it must be filed with the county recorder’s office in the county where the property is located. Filing the deed officially puts the public on notice of the ownership transfer and helps protect the new owner's rights to the property.

Are there any fees associated with filing an Arizona Deed?

Yes, there are typically fees for filing an Arizona Deed. These fees can vary by county and are usually based on the length of the document. It's important to check with the local county recorder's office for the specific fee structure applicable to your situation.

How should I handle a Deed if I am transferring property as a gift?

If you are gifting property, you can still use a Quitclaim Deed or a Warranty Deed. However, it’s crucial to indicate that the transfer is a gift in the deed’s language. This may have implications for taxes—both gift tax and property tax—so consulting a tax professional may be wise to understand any potential obligations.

Can I revoke or change an Arizona Deed after it has been executed?

Generally, once a deed has been executed and recorded, it cannot be unilaterally revoked or changed. However, under certain circumstances, you may create a new deed to reverse or modify an earlier transaction. If you wish to reverse a property transfer, it’s advisable to seek legal guidance to ensure the proper steps are taken.

How long is the Arizona Deed valid?

Once a deed is properly executed and recorded, it remains valid indefinitely, unless it is revoked or modified by a subsequent legal action. The validity of the deed is tied to the ownership interest it conveys, which remains in effect until further transactions occur.