Instructions on Utilizing Arizona Last Will and Testament

Filling out the Arizona Last Will and Testament form is an important step in outlining your wishes for the distribution of your assets after your passing. Once you complete the form, it is essential to review it thoroughly for accuracy. After verifying all information, you can proceed to have it signed and witnessed according to Arizona law.

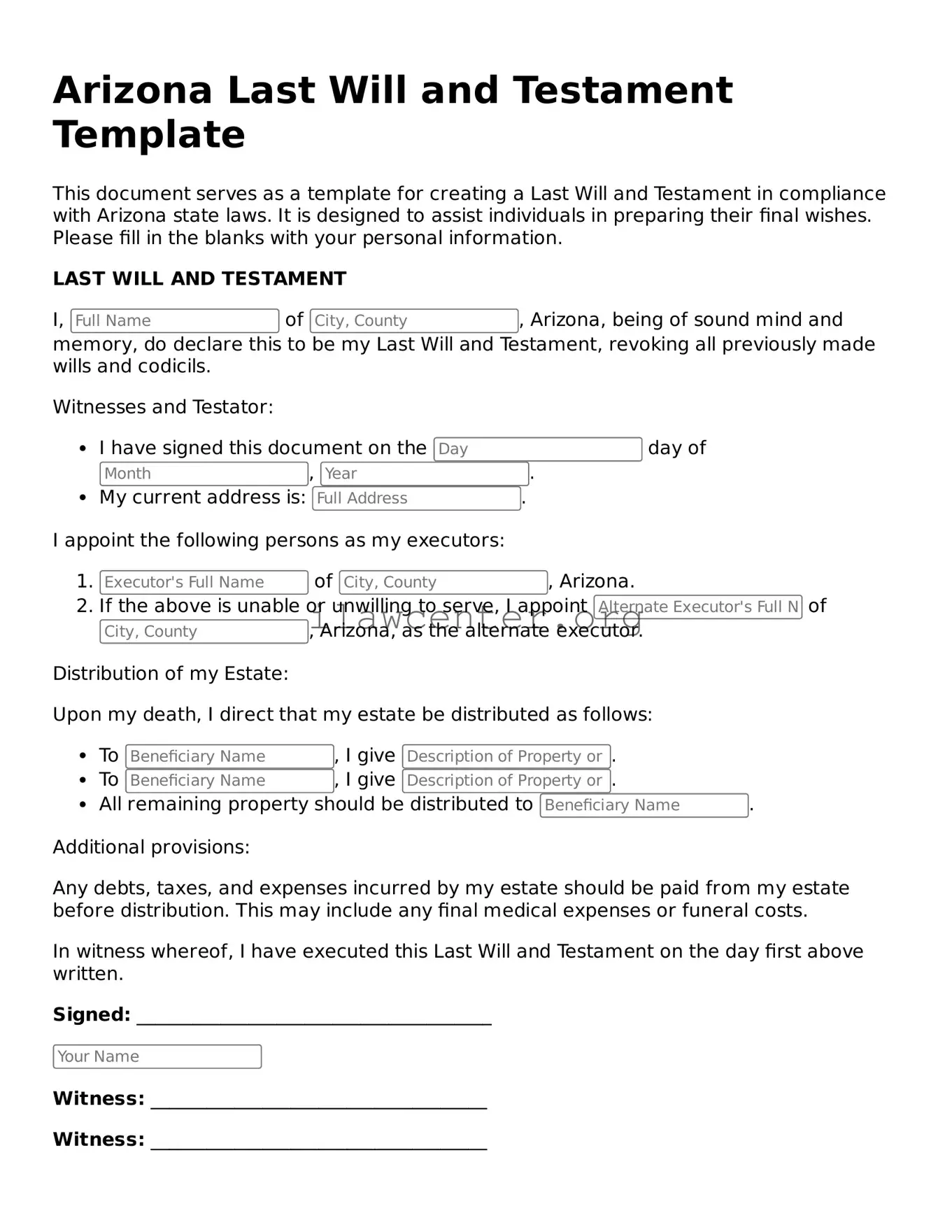

- Begin by obtaining the Arizona Last Will and Testament form from a reliable source, such as an attorney’s office or a reputable online legal service.

- Fill in your full name and address at the top of the form.

- Designate an executor by providing their full name and contact information. This person will be responsible for ensuring that your wishes are carried out.

- List your beneficiaries, including their names and relationships to you. Clearly indicate what each beneficiary will receive from your estate.

- Specify any particular assets you wish to bequeath to specific individuals, if applicable.

- Include provisions for any debts or taxes that your estate may need to pay before distribution of assets.

- If you have children, name a guardian for their care in case you are no longer able to do so.

- Review the completed form to ensure that all entries are accurate and complete.

- Sign the document in the presence of at least two witnesses who are over the age of 18. They must also sign the form as witnesses.

- Keep the original signed document in a safe place, and provide copies to your executor and family members if necessary.