What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TOD) allows an individual to transfer ownership of real estate to a beneficiary upon the owner's death without going through probate. This deed is revocable, enabling the owner to change the beneficiary or cancel the deed at any time prior to their death.

Who can use a Transfer-on-Death Deed in Arizona?

Any property owner in Arizona can utilize a Transfer-on-Death Deed. It is essential that the property is titled solely in the name of the owner or in joint tenancy with right of survivorship, as this form cannot be used for property co-owned with a spouse or another individual unless specific conditions are met.

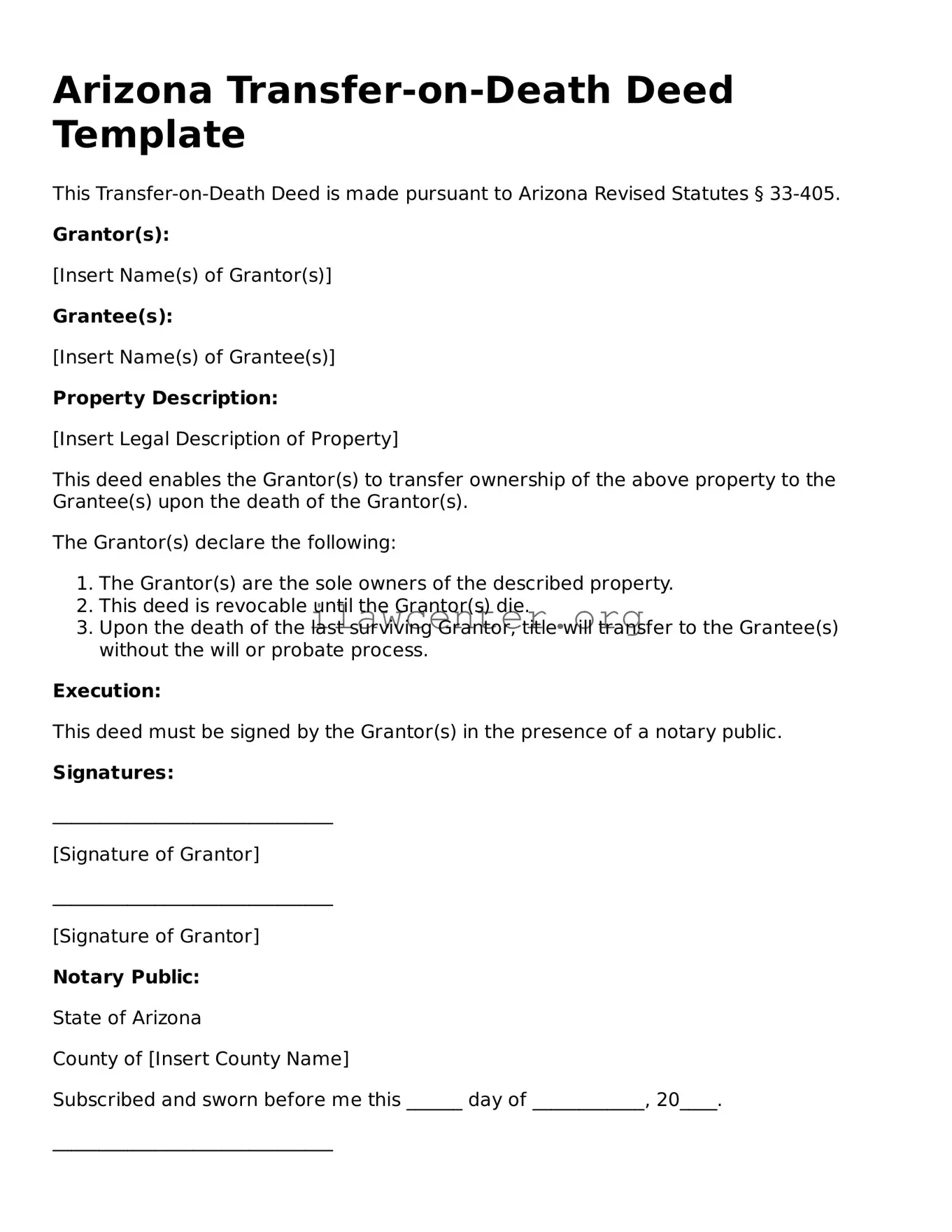

How do I complete a Transfer-on-Death Deed?

To complete a TOD Deed, the property owner must fill out the appropriate form, which includes information such as the property’s legal description, the name of the beneficiary, and the owner’s signature. It must be signed in front of a notary public and then recorded with the county recorder's office to be effective.

Can I name multiple beneficiaries on a Transfer-on-Death Deed?

Yes, an individual can name multiple beneficiaries on a TOD Deed. When multiple beneficiaries are designated, the property will be divided according to the ownership percentages stated in the deed upon the owner's death. It’s advisable to clarify these percentages within the document.

Does a Transfer-on-Death Deed affect my property taxes?

A Transfer-on-Death Deed does not affect property taxes during the owner's lifetime. However, once the property is transferred to the beneficiary after the owner’s death, the beneficiary will assume responsibility for any property taxes due. The county assessor may reassess the property, which could impact tax rates.

Is a Transfer-on-Death Deed revocable?

Yes, a Transfer-on-Death Deed is revocable. The property owner can revoke the deed at any time while they are alive by executing a new deed that explicitly states the revocation or by simply executing a later deed that provides different instructions regarding the property.

What happens if the designated beneficiary predeceases me?

If the designated beneficiary predeceases the property owner, the TOD Deed will not be effective. The property will be transferred according to the owner’s will or, if there is no will, according to Arizona’s intestacy laws. It is recommended to regularly review and update beneficiaries as needed.

Are there any fees associated with filing a Transfer-on-Death Deed?

Yes, there may be fees involved when recording the Transfer-on-Death Deed with the county recorder’s office. The fee structure varies from one county to another. Additionally, individuals may incur costs related to obtaining legal advice or notary services.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can be used for residential real estate; however, it cannot be used for personal property, bank accounts, vehicles, or other types of assets. This deed is specific to real estate transactions and should be considered accordingly during estate planning.

Do I need legal assistance to create a Transfer-on-Death Deed?

While it is not mandatory to seek legal assistance when creating a Transfer-on-Death Deed, it is advisable. Consulting with a legal professional can help ensure that the deed is properly drafted, executed, and recorded, thus minimizing potential disputes or complications in the future.