What is an Arkansas Durable Power of Attorney?

An Arkansas Durable Power of Attorney is a legal document that allows you to appoint someone, known as your agent or attorney-in-fact, to manage your financial and legal affairs on your behalf. This document remains effective even if you become incapacitated, giving your agent the authority to act in your best interest when you can’t make decisions for yourself.

Why would I need a Durable Power of Attorney?

Having a Durable Power of Attorney is beneficial for many reasons. It allows you to choose a trustworthy person to handle your financial matters if you become unable to do so. Whether due to illness, accident, or aging, this document ensures that your wishes are respected, and your affairs are properly managed during difficult times.

Who can be my agent in an Arkansas Durable Power of Attorney?

Any competent adult can serve as your agent, including a family member, friend, or professional advisor. It’s important to choose someone you trust deeply, as they will have significant authority over your financial and legal matters. Selecting the right person is crucial, as this person will act in your best interest and follow your wishes.

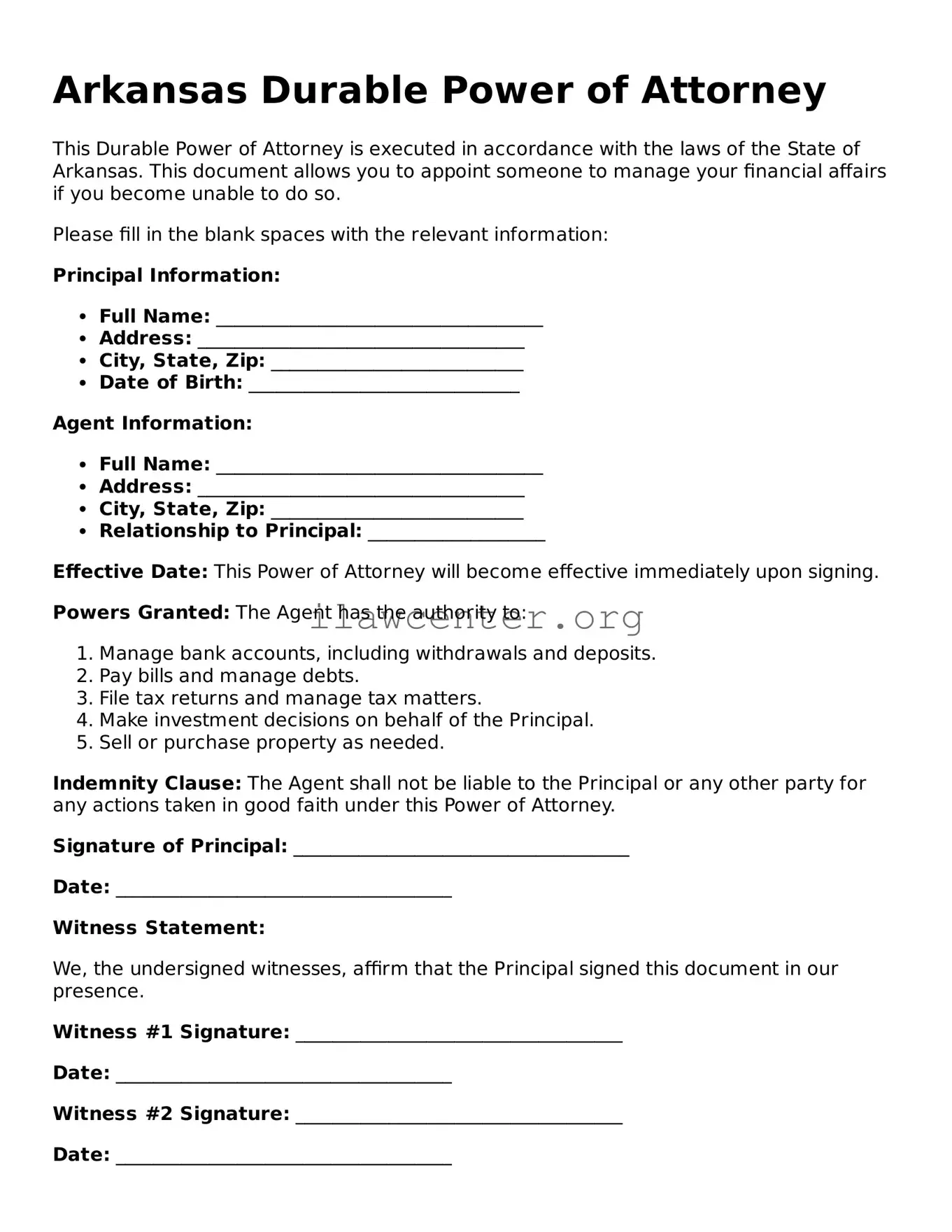

How do I create a Durable Power of Attorney in Arkansas?

Creating a Durable Power of Attorney in Arkansas involves filling out a specific form that outlines your wishes. You can find templates online or seek assistance from legal professionals. You must sign the document in front of a notary public to ensure its validity. This notarization process helps confirm your identity and intent.

Can I revoke a Durable Power of Attorney once it is created?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To revoke the document, simply create a written notice indicating your desire to cancel it. Notify your agent and any institutions that may have a copy of the original document to avoid confusion. It’s good practice to destroy copies of the old document to ensure no one can use it.

What powers can I grant to my agent?

You have the flexibility to grant your agent a range of powers. These can include making financial decisions, accessing your bank accounts, managing properties, and handling taxes. However, you may want to specify any limitations or conditions in your Durable Power of Attorney to ensure your preferences are clearly communicated.

Is a Durable Power of Attorney different from a regular Power of Attorney?

Yes, a Durable Power of Attorney is specifically designed to remain effective even if you become incapacitated. A regular Power of Attorney, on the other hand, usually becomes void if you are unable to make decisions for yourself. The durable nature of this document provides peace of mind, knowing that your choices and management of affairs will continue even when you cannot advocate for yourself.

Do I need an attorney to create a Durable Power of Attorney in Arkansas?

You do not necessarily need an attorney to create a Durable Power of Attorney, as many forms and templates are available online. However, consulting with an attorney is advisable if your situation is complex or if you have specific concerns. Professional guidance can help ensure that your document complies with Arkansas laws and that your intentions are clearly stated.