What is a Motor Vehicle Bill of Sale in Arkansas?

A Motor Vehicle Bill of Sale is a document that serves as a record of the sale or transfer of ownership of a motor vehicle from one party to another in Arkansas. It details essential information about the vehicle and the parties involved in the transaction, helping to establish an official record for both the buyer and the seller.

Why is a Bill of Sale necessary?

The Bill of Sale acts as proof of ownership transfer and provides security for both the buyer and the seller. It can help prevent disputes by documenting the transaction details, including the vehicle's condition, agreed purchase price, and the date of sale. Additionally, it may be required when registering the vehicle with the Department of Finance and Administration in Arkansas.

What information is typically included in the Bill of Sale?

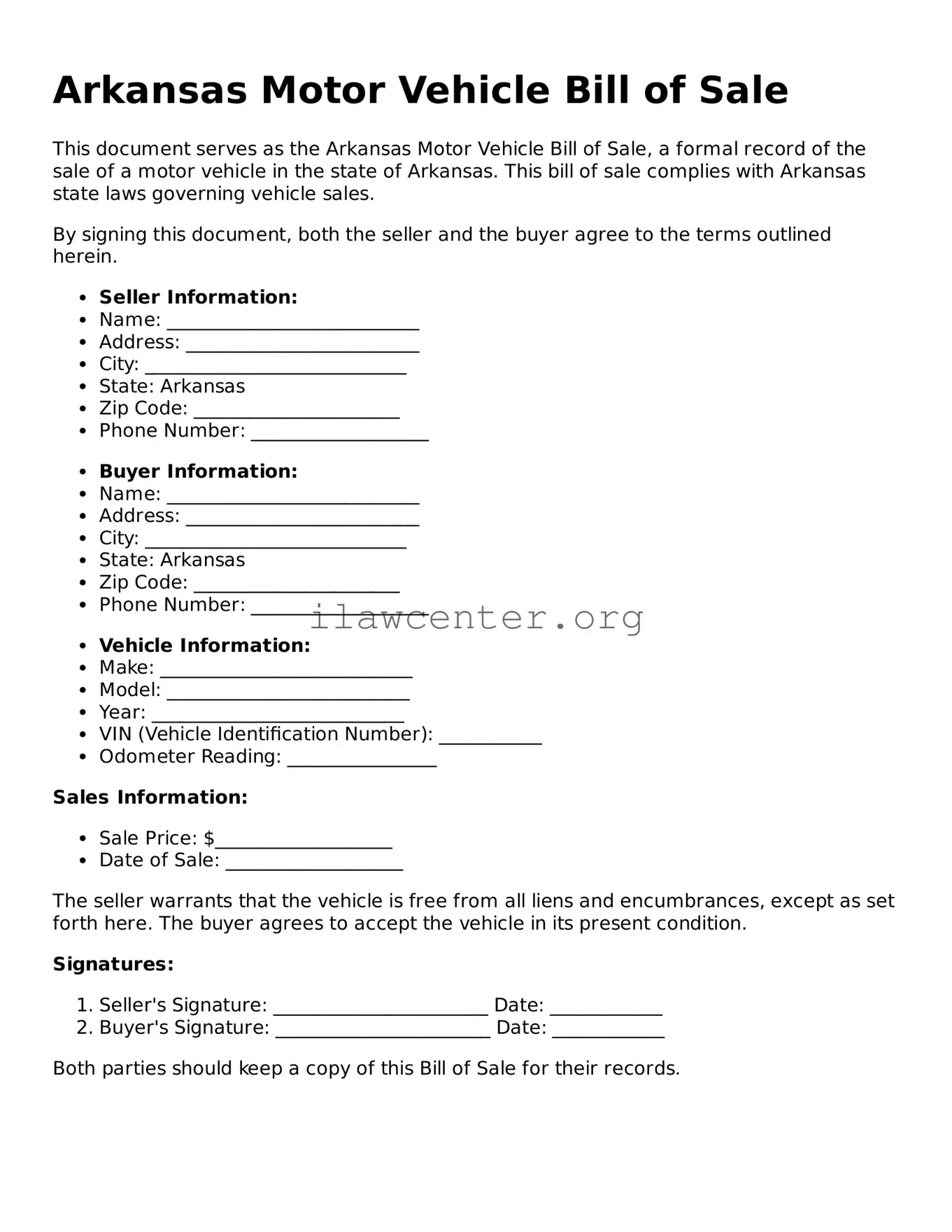

Key elements often included in a Bill of Sale are the vehicle's make, model, year, Vehicle Identification Number (VIN), odometer reading, purchase price, the names and addresses of both the buyer and seller, and the date of the transaction. This information helps ensure clarity and confirm the legitimacy of the sale.

Is the Bill of Sale required to register a vehicle in Arkansas?

Yes, a Bill of Sale is typically required for vehicle registration in Arkansas. When you submit your registration application, you may need to present the completed Bill of Sale along with other documentation, such as proof of identification and the title, to finalize the process.

Can a Bill of Sale be handwritten?

Yes, a Bill of Sale can be handwritten, as long as it contains all necessary information and is signed by both the buyer and the seller. While a typed document is often preferred for clarity and professionalism, a handwritten Bill of Sale is legally acceptable in Arkansas as long as it meets the state's requirements.

Does a Bill of Sale need to be notarized in Arkansas?

No, notarization is not required for a Bill of Sale in Arkansas. However, having the document notarized can add an extra layer of protection by verifying the identities of the parties involved and confirming the authenticity of the signatures. It can also aid in preventing potential disputes in the future.

What should I do if the seller does not provide a Bill of Sale?

If the seller does not provide a Bill of Sale, you could request one as part of the transaction. If the seller is unwilling or unable to provide this document, it's advisable to reconsider the purchase. A lack of a Bill of Sale can complicate vehicle registration and ownership confirmation, so prioritizing this documentation is crucial for a smooth transaction.

Can I use a Bill of Sale for a vehicle that is gifted rather than bought?

Yes, you can use a Bill of Sale to document the gifting of a vehicle. In cases of gifts, the transaction generally reflects a zero-dollar sale price. Such documentation may still be required when registering the vehicle to confirm the transfer of ownership from one person to another.

Where can I find a sample or template for the Arkansas Bill of Sale?

Several online resources provide sample templates for the Arkansas Motor Vehicle Bill of Sale. Local government websites, such as the Arkansas Department of Finance and Administration, often have forms available for download. Alternatively, many legal service websites offer customizable Bill of Sale templates, which can simplify the process of creating this important document.

Is a Bill of Sale necessary when purchasing a used vehicle from a dealership?

While dealerships often handle most of the paperwork for vehicle sales, a Bill of Sale may still be provided as part of the transaction documents. It serves as an added confirmation of the sale. Always review your documentation to ensure you have all necessary information when purchasing a vehicle from a dealership.