Instructions on Utilizing Arkansas Transfer-on-Death Deed

Once you have gathered the necessary information and documentation to fill out the Arkansas Transfer-on-Death Deed form, you will be ready to follow the steps outlined below. This process ensures that your property will be transferred to your chosen beneficiaries without the need for probate.

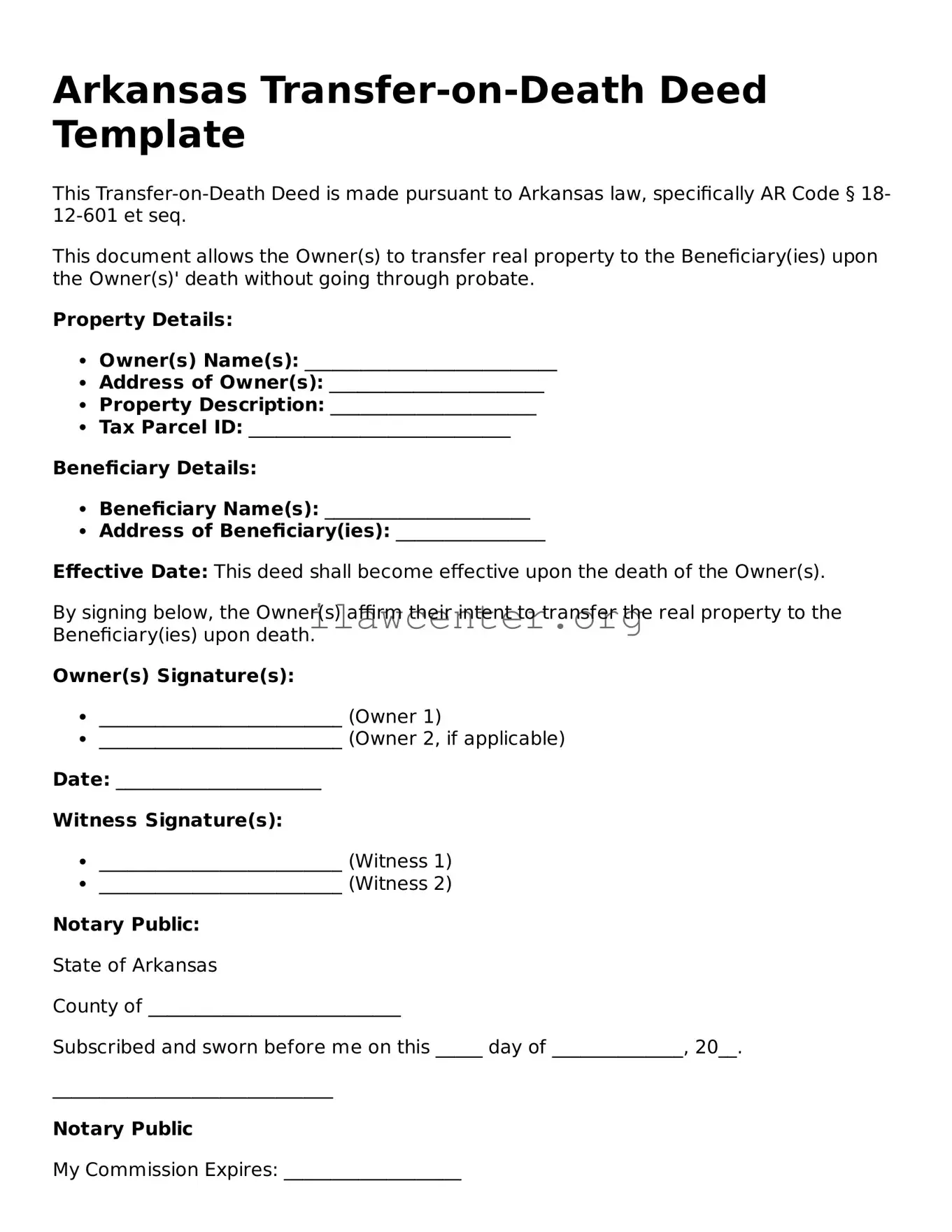

- Obtain the Form: Acquire the Arkansas Transfer-on-Death Deed form from a reliable source such as a state government website or a legal office.

- Identify Yourself: Fill in your name, address, and other contact details as the current property owner. Ensure this information is accurate.

- List the Property: Provide a detailed description of the property being transferred. Include the address, parcel number, and legal description if available.

- Specify Beneficiaries: Write the names and addresses of the individuals who will inherit the property. Make sure to clarify the relationship each beneficiary has with you.

- Include Alternate Beneficiaries: If desired, you can include alternate beneficiaries in case the primary ones are unable to inherit.

- Sign the Form: Add your signature and the date at the bottom of the form. It may need to be notarized, so be prepared to do that as well.

- File the Form: Submit the completed form to the local county clerk's office where the property is located. Be aware of any filing fees that may apply.

Once the form has been filed, it becomes a public record. Ensure that you keep a copy for your own records. This step is crucial for ensuring your wishes regarding property transfer are honored. It is advisable to inform the beneficiaries that the deed has been established and filed.