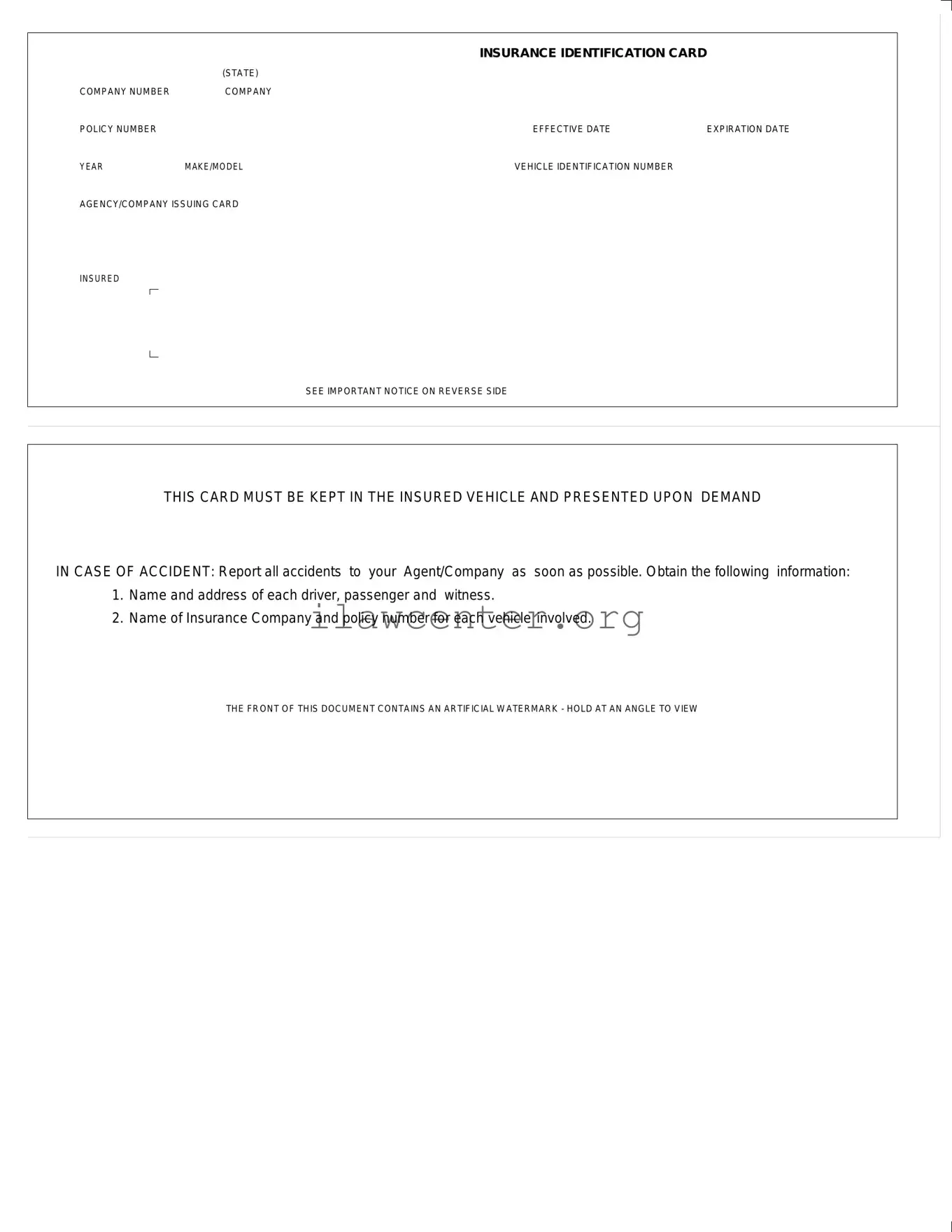

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have auto insurance coverage. It contains essential information such as your insurance company, policy details, and vehicle information. This card is usually required to be kept in your vehicle at all times.

What information is included on the Auto Insurance Card?

The card typically includes the insurance company name, policy number, effective and expiration dates, the make and model of the vehicle, and the Vehicle Identification Number (VIN). Some cards also display an identification number specific to the insurance company.

Why do I need to keep the Auto Insurance Card in my vehicle?

Keeping the Auto Insurance Card in your vehicle is important because you may need to present it to law enforcement officers or in the event of an accident. It is proof that you have the required insurance coverage while driving.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, you should contact your insurance company or agent as soon as possible. They can provide you with a replacement card or a digital version which you can keep on your smartphone.

What should I do after an accident regarding my Auto Insurance Card?

After an accident, you should report the incident to your insurance company immediately. Make sure to gather all necessary information from the other parties involved, including names, addresses, and insurance details. Having your Auto Insurance Card on hand when making this report can be helpful.

Is the Auto Insurance Card valid in all states?

The Auto Insurance Card is valid within the state where your policy is issued. Some states may have specific requirements or formats for insurance cards. It is advisable to check your state's regulations to ensure compliance.

What is the importance of the watermark on the Auto Insurance Card?

The watermark is included to deter fraud and ensure authenticity. By holding the card at an angle, the watermark will become visible. This feature can help law enforcement and others verify that the card is legitimate.

Can I use a digital version of my Auto Insurance Card?

Many states allow the use of digital versions of Auto Insurance Cards. Check with your state’s Department of Motor Vehicles (DMV) or your insurance provider to find out if this is an option for you. If digital cards are accepted, ensure you have it easily accessible on your mobile device.

What happens if I don’t carry my Auto Insurance Card?

Failure to carry your Auto Insurance Card may result in penalties, including fines. Additionally, if you are involved in an accident and cannot provide proof of insurance, you may face more severe legal consequences. It is important to keep the card with you at all times while driving.