Instructions on Utilizing Blumberg 120

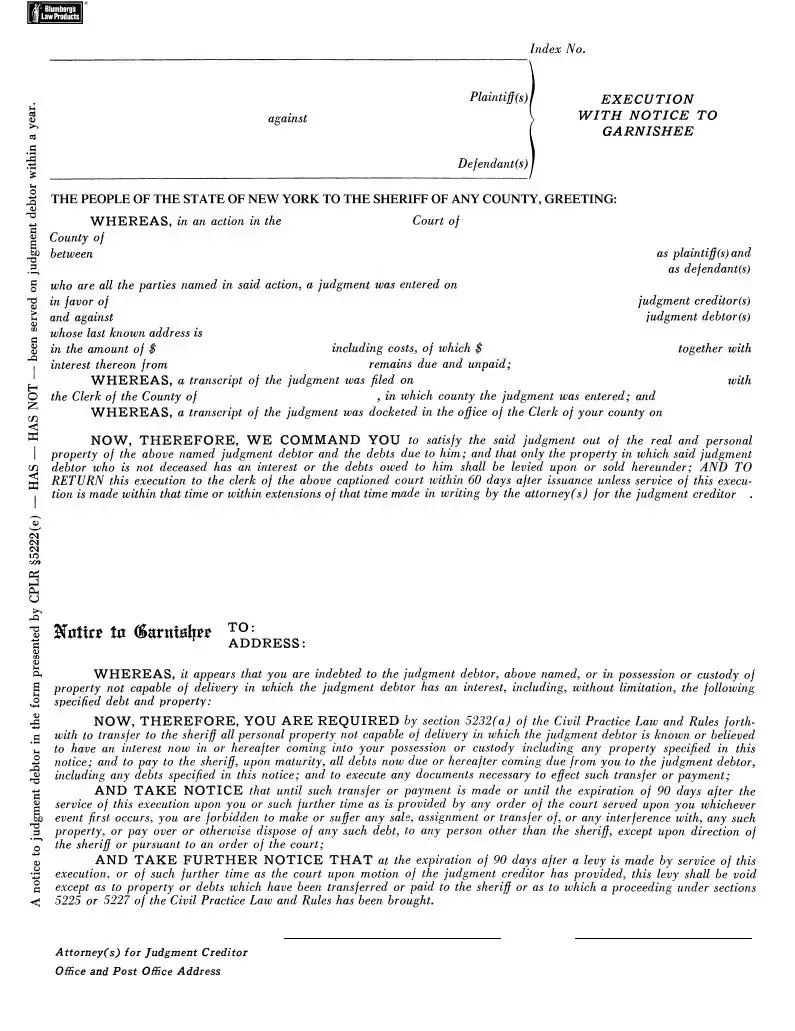

Filling out the Blumberg 120 form requires careful attention to detail. This form is essential for executing against a property in a legal context. Ensure all information is accurate to avoid delays in processing.

- Obtain the Form: Download the Blumberg 120 form from the official Blumberg website or acquire a physical copy.

- Fill Out the Heading: Provide the court name, the index number, and the county where the action is filed. Write "Execution Against Property" at the top of the form.

- Identify the Parties: Enter the names of the plaintiff(s) and defendant(s). Make sure to include the judgment debtor's full name and address.

- Garnishee Information: Include the name and address of the garnishee—the third party who may hold the debtor's property or assets.

- Location of the Property: Indicate the specific location of the property being executed against.

- Signature and Date: Sign the form and print your name below the signature. Include the date of signing.

- Endorsement Section: Note any defendants who have not been served with a summons. Clearly indicate the execution limitations for these individuals.

- Review the Form: Check all entries for accuracy. Ensure there are no missing details or mistakes.

- Make Copies: Create sufficient copies of the completed form as instructed, including an original and an office copy, plus two copies for both the debtor and garnishee.

- Submit the Form: File the completed form with the sheriff's office in the relevant county.