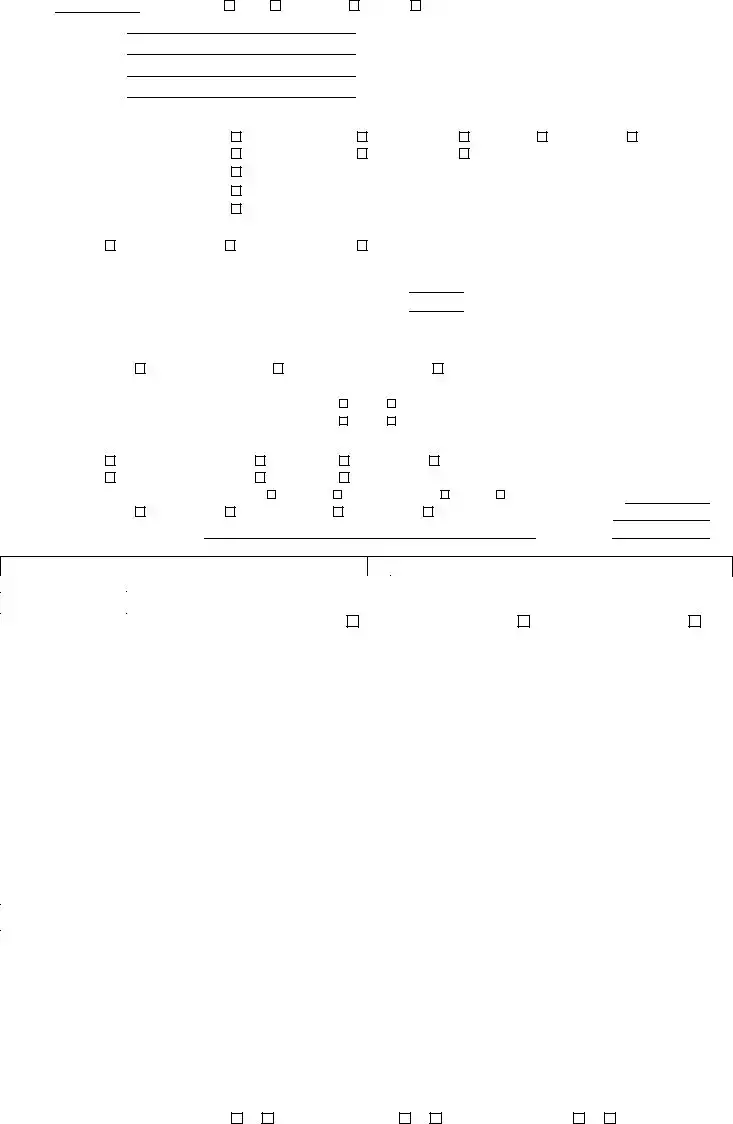

Instructions on Utilizing Broker Price Opinion

Filling out the Broker Price Opinion (BPO) form requires careful attention to detail. This form helps assess the current value of a property based on market conditions and comparable sales. You may want to gather any necessary documents and information before starting to ensure a smooth process.

- Begin with the top section of the form. Fill in the Loan # and REO # if applicable.

- Enter the PROPERTY ADDRESS, FIRM NAME, and your PHONE NO..

- Indicate if this is the Initial, 2nd Opinion, or Updated BPO and if it’s Exterior Only.

- Write today's DATE and your SALES REPRESENTATIVE name.

- Add the BORROWER’S NAME and fill in FAX NO. as needed.

- Under I. GENERAL MARKET CONDITIONS, assess the current market condition and check the appropriate box: Depressed, Slow, Stable, or Improving.

- Evaluate employment conditions and indicate whether they are Declining, Stable, or Increasing.

- Estimate the market price change of the property and indicate whether it has Decreased or Increased, specifying the percentage.

- Provide the estimated percentages of owner vs. tenants in the neighborhood, noting the % owner occupant.

- Identify if there is a normal supply, oversupply, or shortage of comparable listings.

- Report the approximate number of comparable units for sale in the neighborhood.

- Note the number of competing listings that are REO or corporate owned, and the number of boarded or blocked-up homes.

- In section II. SUBJECT MARKETABILITY, establish the range of values in the neighborhood.

- Describe the subject property condition, stating if it is an over improvement, under improvement, or has appropriate improvement.

- Determine the normal marketing time in days for the area.

- Indicate whether all types of financing are available for the property.

- If the property was on the market in the last 12 months, provide the list price.

- Identify the unit type (e.g., single family, condo, etc.) and, if applicable, provide details about the homeowner’s association fees.

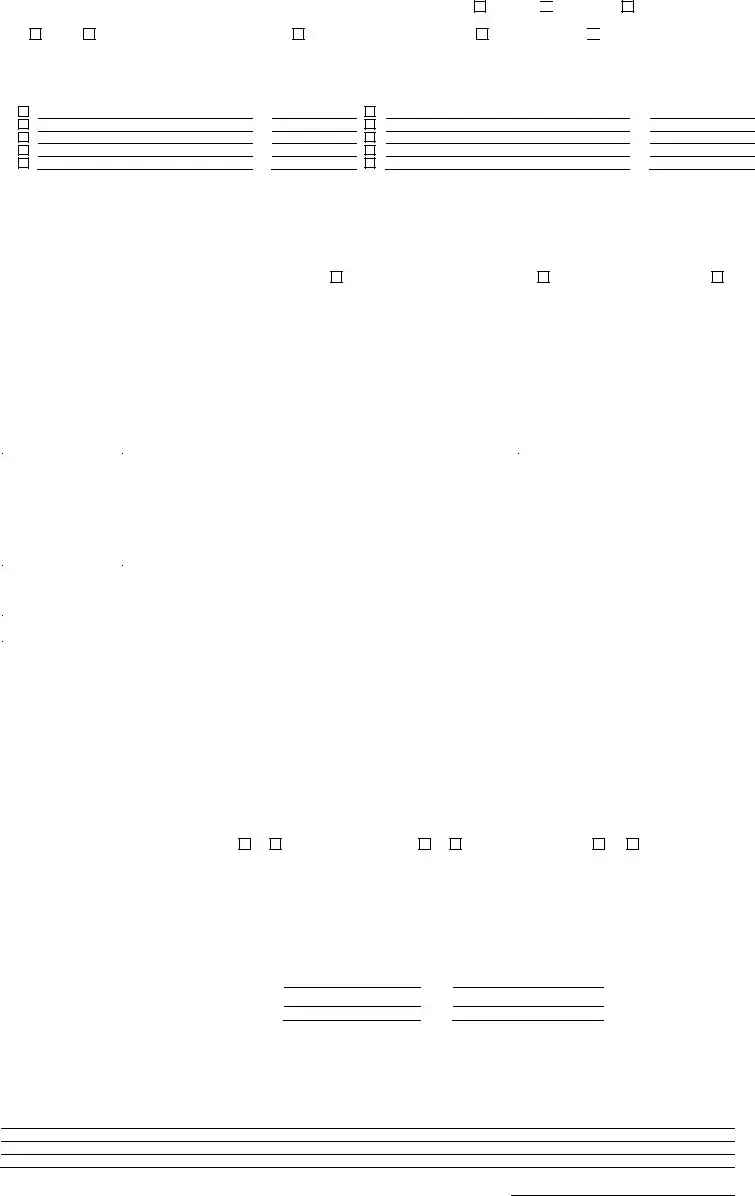

- In section III. COMPETITIVE CLOSED SALES, list comparable properties, their details, and adjust the values accordingly.

- Adjust the sales prices based on your evaluations and comments.

- Move to IV. MARKETING STRATEGY and indicate the condition of the property and the most likely buyer.

- In section V. REPAIRS, identify and itemize any necessary repairs, along with their costs.

- List comparable properties in VI. COMPETITIVE LISTINGS noting their details and adjustments.

- Finally, determine the MARKET VALUE and suggested list price, providing additional comments if needed.

- Sign and date the form at the bottom to complete the process.

Unknown

Unknown

Investor

Investor