When filling out a Business Bill of Sale form, individuals can make a variety of mistakes that may lead to complications in the future. Understanding these common pitfalls can help ensure a smoother transaction. To promote clarity and prevent misunderstandings, here are ten frequent errors to be aware of.

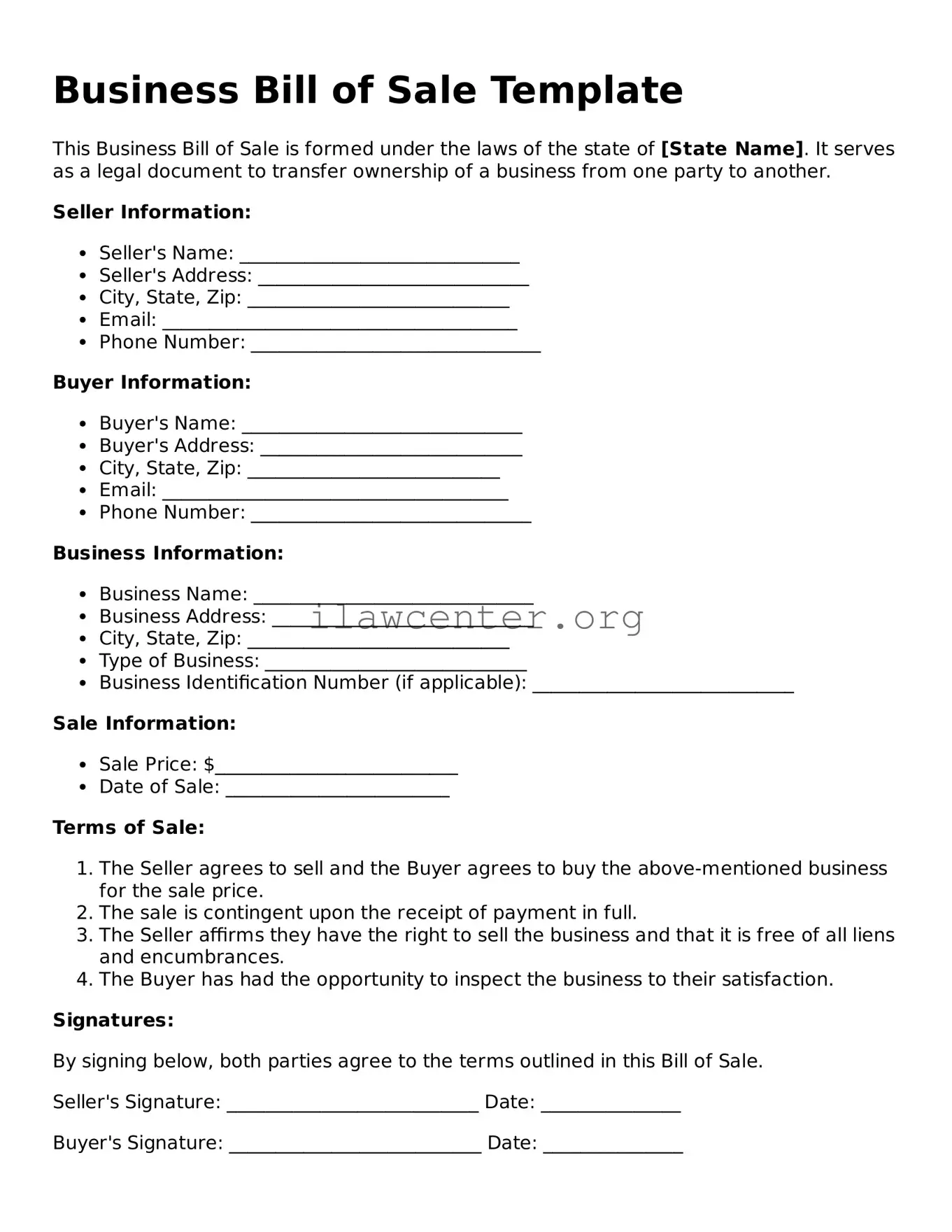

One of the most common mistakes is not including complete contact information for both the seller and the buyer. It's essential to provide accurate phone numbers, email addresses, and mailing addresses. Without this information, communication may falter, leading to delays or confusion after the sale is complete.

Another frequent error involves leaving out detailed asset descriptions. A vague description can lead to disputes down the line. Be specific about what is being sold, whether it's equipment, inventory, or property. The more detail you provide, the less room there is for misinterpretation.

People also tend to forget to double-check the purchase price. Confirm that the price accurately reflects the agreed-upon amount. Mistakes in this section can cause legal issues or financial discrepancies later. A simple error can lead to misunderstandings that could complicate the sale.

Many individuals overlook the date of the sale, which is crucial for record-keeping and legal purposes. If the date is incorrect, potential tax implications or issues with ownership could arise. Include the correct date to maintain an accurate transaction record.

Additionally, some individuals fail to provide signature lines for both parties. This mistake undermines the validity of the document. Ensure that both the seller and the buyer sign the bill of sale to authentic the transaction and provide evidence of agreement between parties.

Another area of concern is neglecting to include any warranties or guarantees. If warranties or specific terms were discussed, they should be explicitly stated in the document. Failing to do so might lead to assumptions or miscommunications about the nature of the sale.

Individuals often forget to check for applicable local or state regulations that govern the sale of business assets. Without understanding legal requirements, a sale could be rendered void or subject to penalties. Always verify relevant laws before finalizing the document.

Using poor quality or illegible handwriting can create problems as well. If the bill of sale is difficult to read, it may lead to misinterpretations or disputes. Typing the document can improve clarity and provide a professional appearance.

Many people also make the mistake of not keeping a copy of the completed bill of sale. Both parties should retain a signed copy for their records. This ensures that everyone has access to the agreed terms if questions arise in the future.

Finally, a common oversight is not consulting with a professional if unsure about the process. Seeking guidance can prevent errors and safeguard your interests. More often than not, an expert can provide insights that may seem trivial but are crucial for avoiding potential complications.

By being aware of these common mistakes, individuals can complete their Business Bill of Sale more confidently and effectively. Knowing what to watch for helps facilitate smoother transactions and enhances protection for both parties involved.