Instructions on Utilizing California Deed in Lieu of Foreclosure

After filling out the California Deed in Lieu of Foreclosure form, the next steps involve reviewing the document for accuracy and ensuring all necessary signatures are included. This form needs to be recorded with the appropriate county office, and any relevant parties should receive copies once it's finalized.

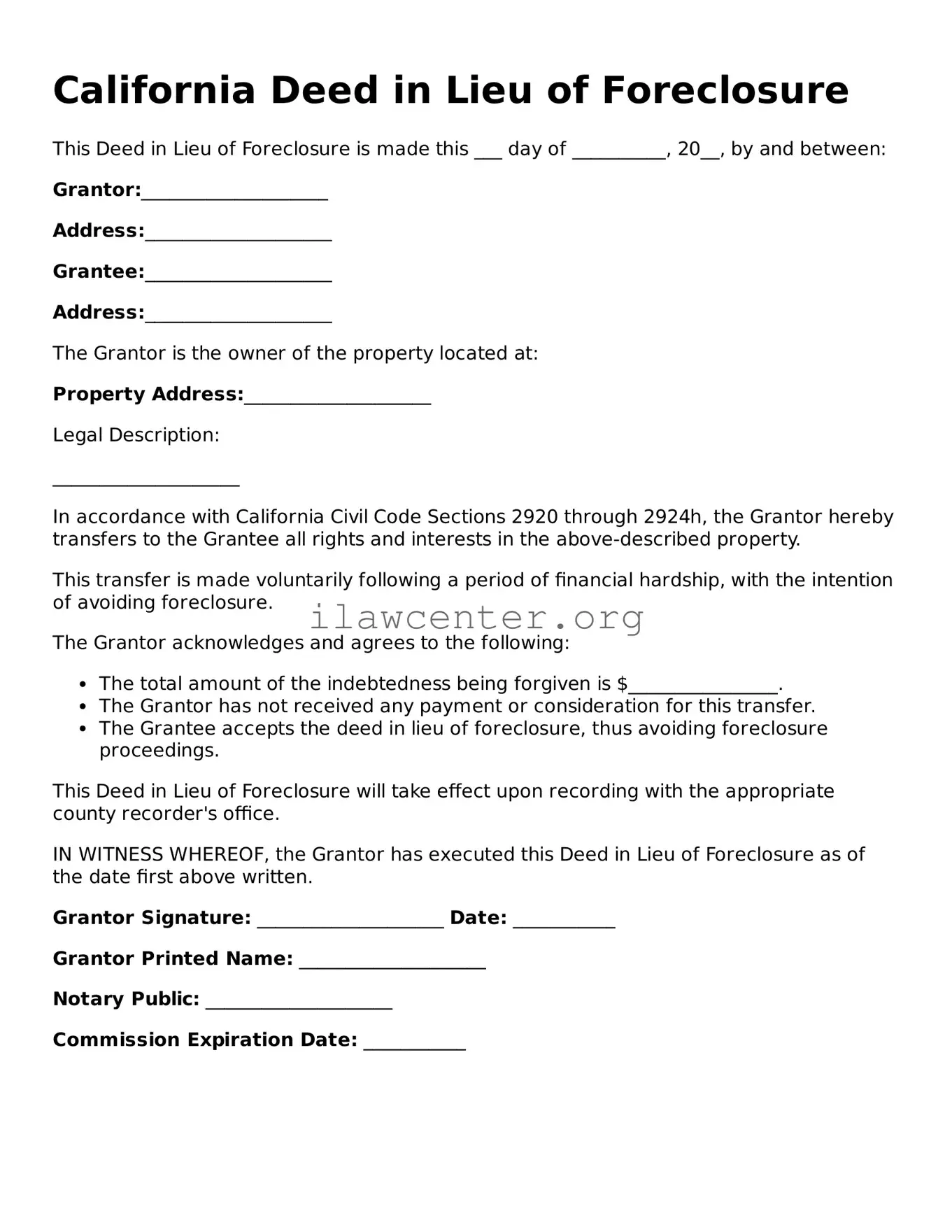

- Begin with the form header. Provide the names of the borrower and lender at the top.

- List the property address. This should be the full address of the property involved.

- Fill in the details about the borrower. Include their full legal name and address.

- Next, detail the lender's information. Ensure you provide the lender's full legal name and address too.

- State the date the deed is executed. This is when the document is signed by the borrower.

- In the section regarding the property, provide a brief description. This usually includes the type of property and its legal description if necessary.

- Include any specific terms of the deed. Note any agreements regarding any remaining obligations or conditions.

- Sign the document. The borrower must sign it in front of a notary public.

- Have the notary public sign and stamp the form. This step is crucial for the document's legal validity.

- Make copies of the completed form for your records and for the lender.

- Finally, submit the original signed deed to the county recorder's office for recording.