Instructions on Utilizing California Deed

Completing the California Deed form requires careful attention to detail and accurate information. After filling out the form, it's crucial to ensure the document is properly executed and recorded with the county to finalize the property transfer.

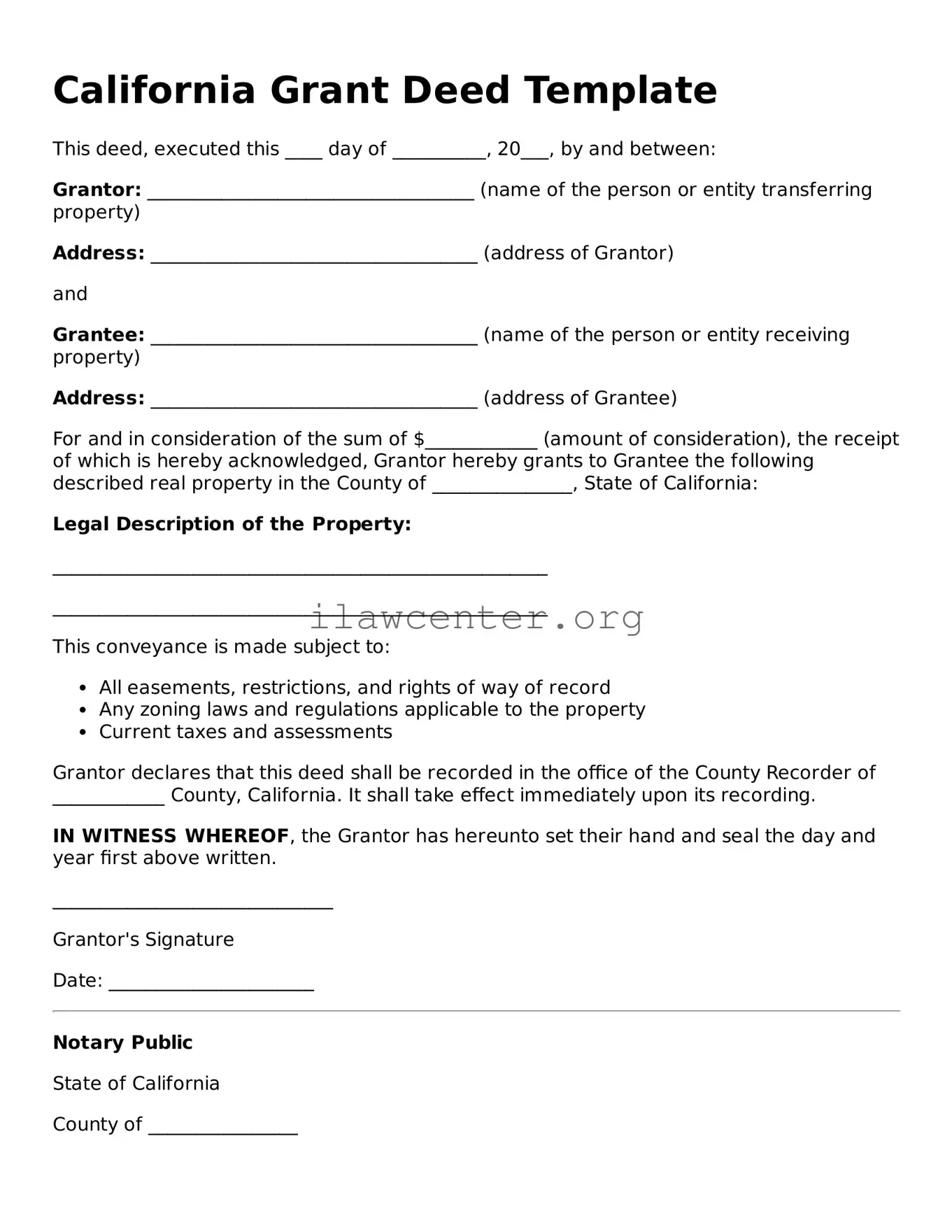

- Begin with the title of the form, which is usually located at the top. Write “Grant Deed” or the specific type of deed you are completing.

- Identify the parties involved. In the section for the "Grantor," fill in the name(s) of the person(s) transferring the property.

- Next, input the name(s) of the "Grantee," or the individual(s) receiving the property, in the respective section.

- Provide the current property address, including the city, state, and zip code. This ensures clarity regarding the property being transferred.

- Include the legal description of the property. This may require checking the property title or deed for accurate details.

- Indicate the date of transfer. Use the format of month, day, and year to avoid confusion.

- In the space for consideration, specify the amount paid for the property, if applicable, or state “for love and affection” if it’s a gift.

- Sign the document in the designated area. The Grantor’s signature is typically required, and it may need to be notarized. Check your local notary requirements.

- After the signature, write the name of the person who signed the deed clearly underneath their signature.

- Lastly, make a copy of the completed deed for your records before submitting it for recording in the appropriate county office.