What is a Durable Power of Attorney in California?

A Durable Power of Attorney is a legal document that allows you to appoint someone—known as an agent—to make decisions on your behalf if you become unable to do so yourself. The "durable" part means the document remains effective even if you become incapacitated. This is different from a regular Power of Attorney, which becomes invalid if you lose mental capacity.

Why do I need a Durable Power of Attorney?

Having a Durable Power of Attorney ensures that your financial, medical, and legal matters are handled according to your wishes if you're unable to manage them yourself. Without this document, your loved ones may have to go through a lengthy court process to gain the authority to make decisions on your behalf.

What powers can I grant my agent with this document?

You can grant your agent a wide range of powers, including managing your finances, making healthcare decisions, and handling real estate transactions. You can also limit their authority to specific tasks if you prefer. It’s important to be clear about what you want your agent to manage.

Do I need to have a lawyer to create a Durable Power of Attorney?

No, a lawyer is not required to create a Durable Power of Attorney in California. However, it’s wise to consult one if you have complex financial situations or if you need help understanding your options. Many legal services exist to aid you in filling out the form properly.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time, as long as you are still mentally capable. To do so, you must notify your agent and possibly put your revocation in writing. It's best to destroy any copies of the original document to avoid confusion.

How does the Durable Power of Attorney become effective?

The Durable Power of Attorney typically becomes effective immediately upon being signed unless you specify that it should only take effect when you become incapacitated. This flexibility allows you to choose what works best for your situation.

Can my agent be held liable for their decisions?

Generally, your agent will not be personally liable for decisions made in good faith while acting on your behalf under the Durable Power of Attorney. However, they are expected to act in your best interests and according to the powers granted to them. Misuse or neglect of their duties could lead to legal consequences.

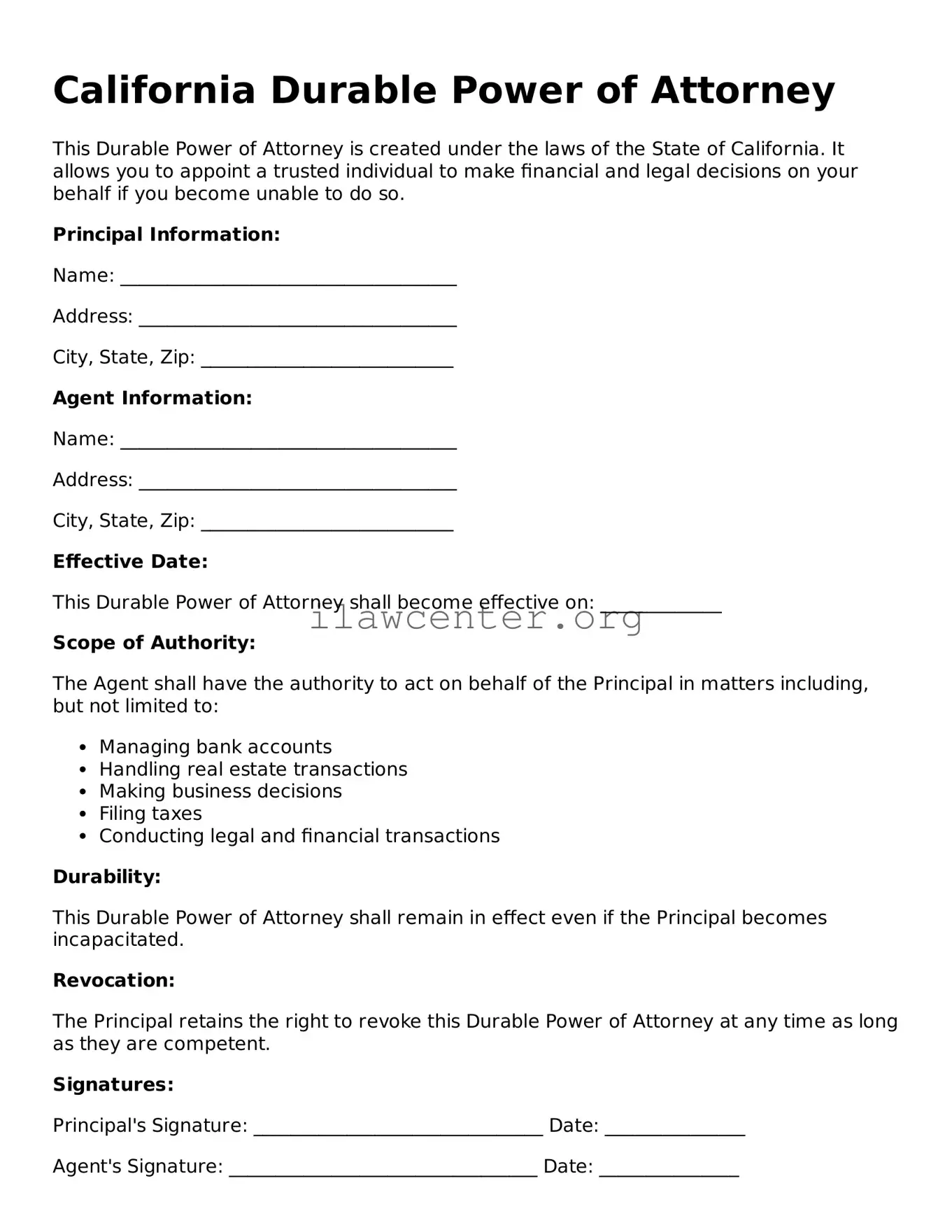

Is there a specific form I need to use?

California has a specific Durable Power of Attorney form that is recommended. While you can create your own document, using the official form is advisable to ensure it meets all legal requirements. You can find this form online or at legal stationery stores.

What happens if I don’t have a Durable Power of Attorney?

If you don't have a Durable Power of Attorney and become incapacitated, your loved ones may have to go to court to get a conservatorship, which can be a time-consuming and expensive process. This can also lead to decisions being made by someone you wouldn't have chosen. Having a Durable Power of Attorney is an important step in ensuring your wishes are respected.