Instructions on Utilizing California General Power of Attorney

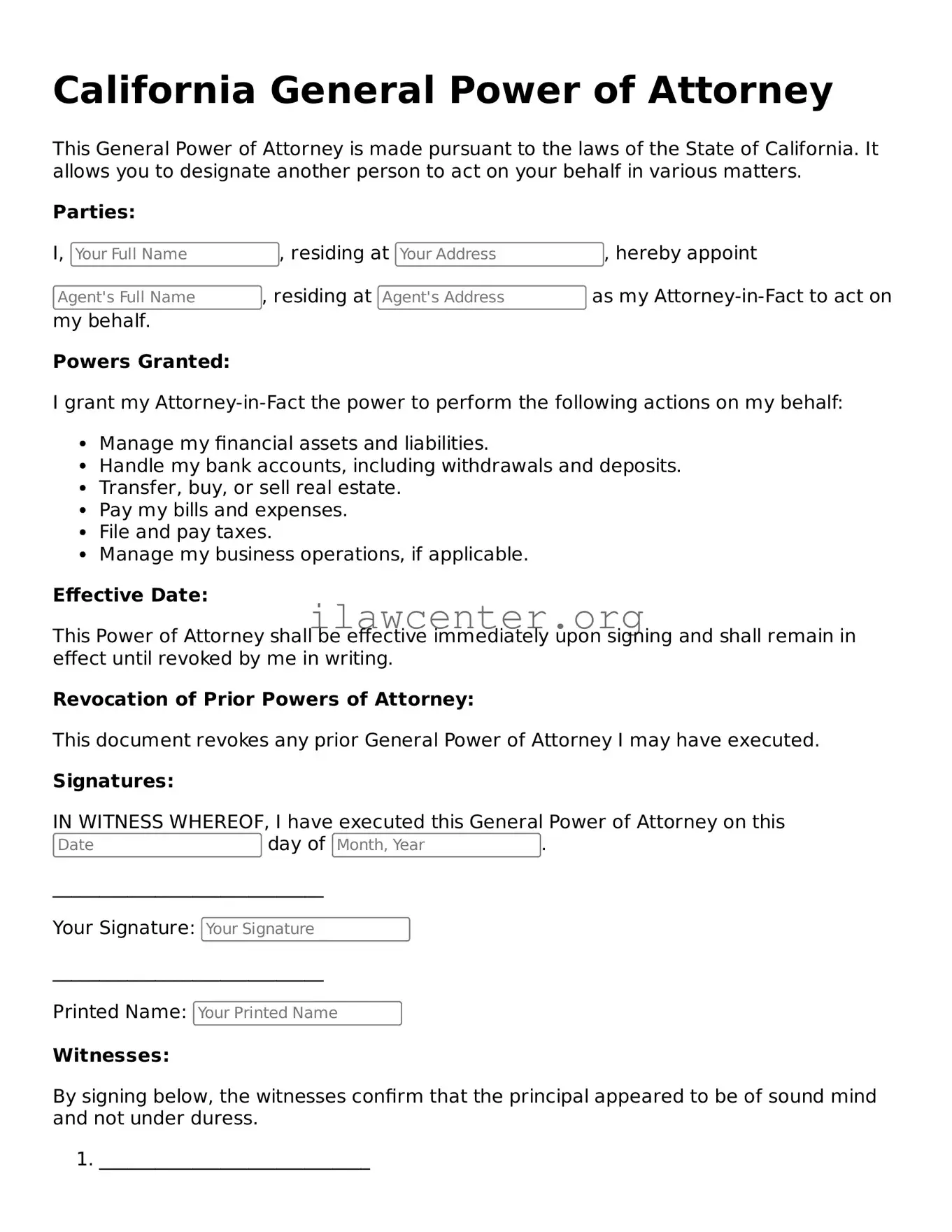

Filling out a General Power of Attorney form in California can provide you with peace of mind, allowing a trusted individual to manage your affairs when you cannot. It's essential to ensure the information is accurate and clearly stated. Once completed, the form must be signed and may need to be notarized. Follow these steps to fill out the form correctly.

- Obtain a blank California General Power of Attorney form. You can find it online or at legal supply stores.

- Begin by writing your name and address as the “Principal” at the top of the form. This is the person granting the power.

- Next, enter the name and address of the person you are appointing as your “Agent.” This individual will handle the tasks specified in the document.

- Clearly list the specific powers you wish to grant. Be as detailed as possible. This may include managing finances, handling real estate transactions, or making healthcare decisions.

- Indicate whether these powers are effective immediately or only in the event of your incapacity. You can choose the specific timeframe you prefer.

- Make sure to review the section regarding alternate agents. You may name someone else to step in if your primary agent cannot serve.

- At the bottom of the form, sign your name and date it. Witness signatures may be required, depending on your preferences.

- If necessary, go to a notary public to have the document notarized. Notarization may lend additional credibility to the document.

- Keep a copy of the completed and signed Power of Attorney form for your records. You should also provide copies to your appointed agent and any other relevant parties.