Instructions on Utilizing California Gift Deed

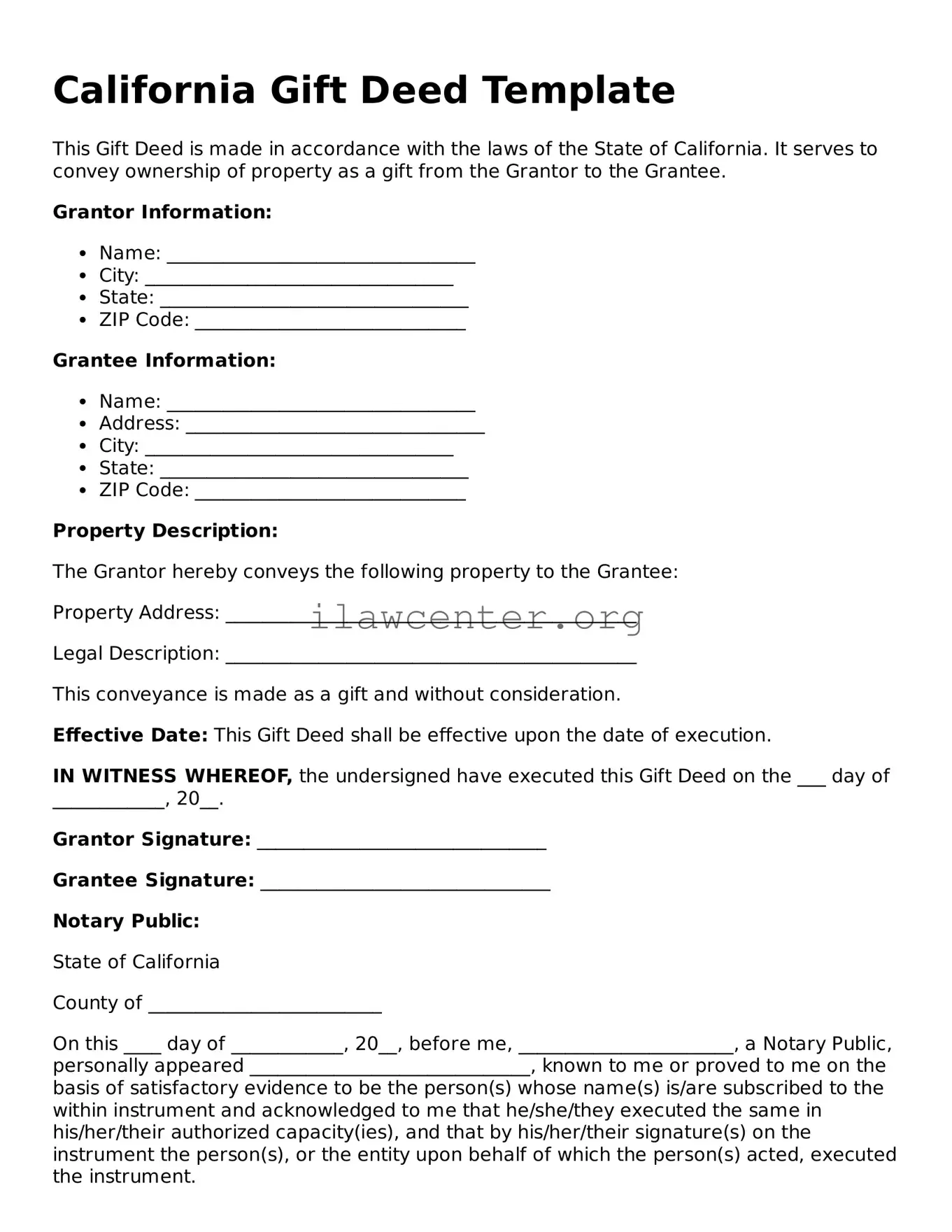

Filling out the California Gift Deed form requires attention to detail and accurate information about the property and the parties involved. After you complete the form, you will need to ensure that it is properly signed and notarized before recording it with the county recorder's office.

- Obtain the California Gift Deed form. You can download it online or request a physical copy from your local county recorder’s office.

- At the top of the form, fill in the name of the county where the property is located.

- Provide the names of the giver (donor) and the recipient (grantee). Include their address and any other required identifying information.

- Describe the property being gifted. This should include details such as the lot number, parcel number, and a brief description of the property, such as its address.

- Indicate the value of the gift in the appropriate section. This is often used for tax purposes.

- If applicable, state any conditions of the gift. This could include stipulations about property use or maintenance.

- Both parties should date and sign the document. It is important that the form is signed in front of a notary public.

- After obtaining notarization, make copies for both the giver and the recipient for their records.

- Submit the original form to your local county recorder’s office for official recording. Be aware that recording fees may apply.