What is a California Last Will and Testament?

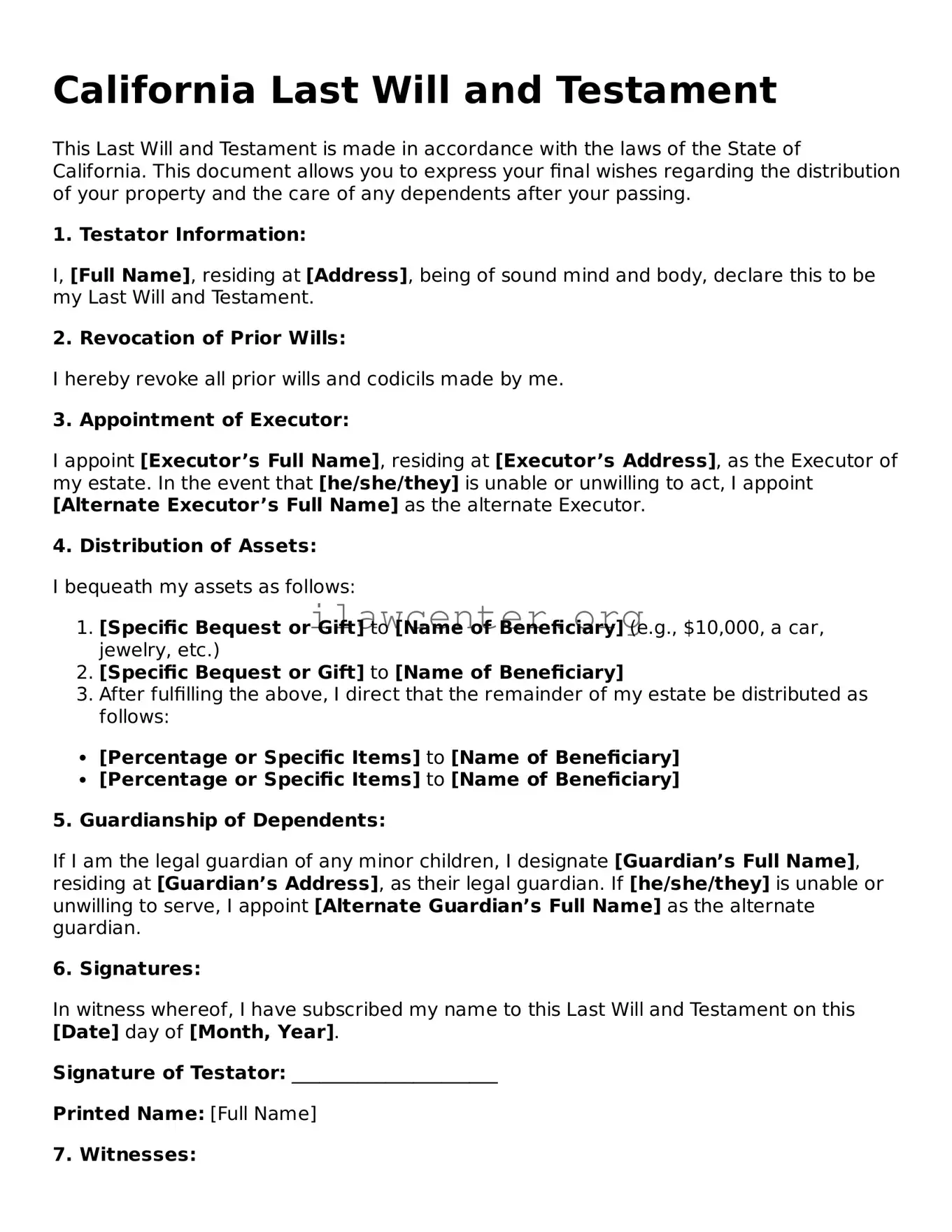

A California Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets after their death. It can specify beneficiaries, appoint guardians for minor children, and name an executor to manage the estate. Having this document helps ensure that a person's wishes are followed and can simplify the probate process.

Who can create a Last Will and Testament in California?

Any individual who is at least 18 years old and of sound mind can create a Last Will and Testament in California. This means the person must be able to understand the nature and consequences of making a will. There is no requirement for the will to be notarized, but it must be signed by the testator and witnessed by at least two individuals who are present at the same time.

What assets can be included in a California Last Will and Testament?

A will can include a range of assets such as real estate, bank accounts, personal property, investments, and other possessions. However, certain assets like jointly owned property or assets with a designated beneficiary—such as life insurance policies or retirement accounts—are typically not governed by the will.

Can I change my Last Will and Testament after I create it?

Yes, you can change your will at any time while you are of sound mind. This can be done by creating a new will or by adding a codicil, which is a document that amends your existing will. It is essential that any changes follow the legal requirements; otherwise, the changes may not be valid.

What happens if I die without a Last Will and Testament in California?

If an individual dies without a valid will, they are considered to have died "intestate." In this case, California law will determine how the deceased's assets are distributed. Generally, this means that assets will be divided among surviving relatives based on a predetermined hierarchy, which may not align with the deceased's wishes.

How do I ensure my Last Will and Testament is valid?

To ensure validity, a California Last Will and Testament must be written, signed by the testator, and witnessed by at least two people. The witnesses cannot be beneficiaries or have a financial interest in the will. It's also advisable to keep the will in a safe place and inform trusted individuals about its location.

What should I do if I want to revoke my Last Will and Testament?

To revoke a will in California, you can create a new will that explicitly states it revokes any previous wills or you can physically destroy the old will with the intent to revoke it. It is recommended to inform your executor and any relevant family members about the revocation to avoid confusion.

Can I create a California Last Will and Testament without a lawyer?

Yes, you can create a California Last Will and Testament without a lawyer. There are templates and resources available online that can aid in drafting a will. However, it is advisable to seek professional legal assistance to ensure that the will complies with state laws and accurately reflects your wishes.