Instructions on Utilizing California Power of Attorney

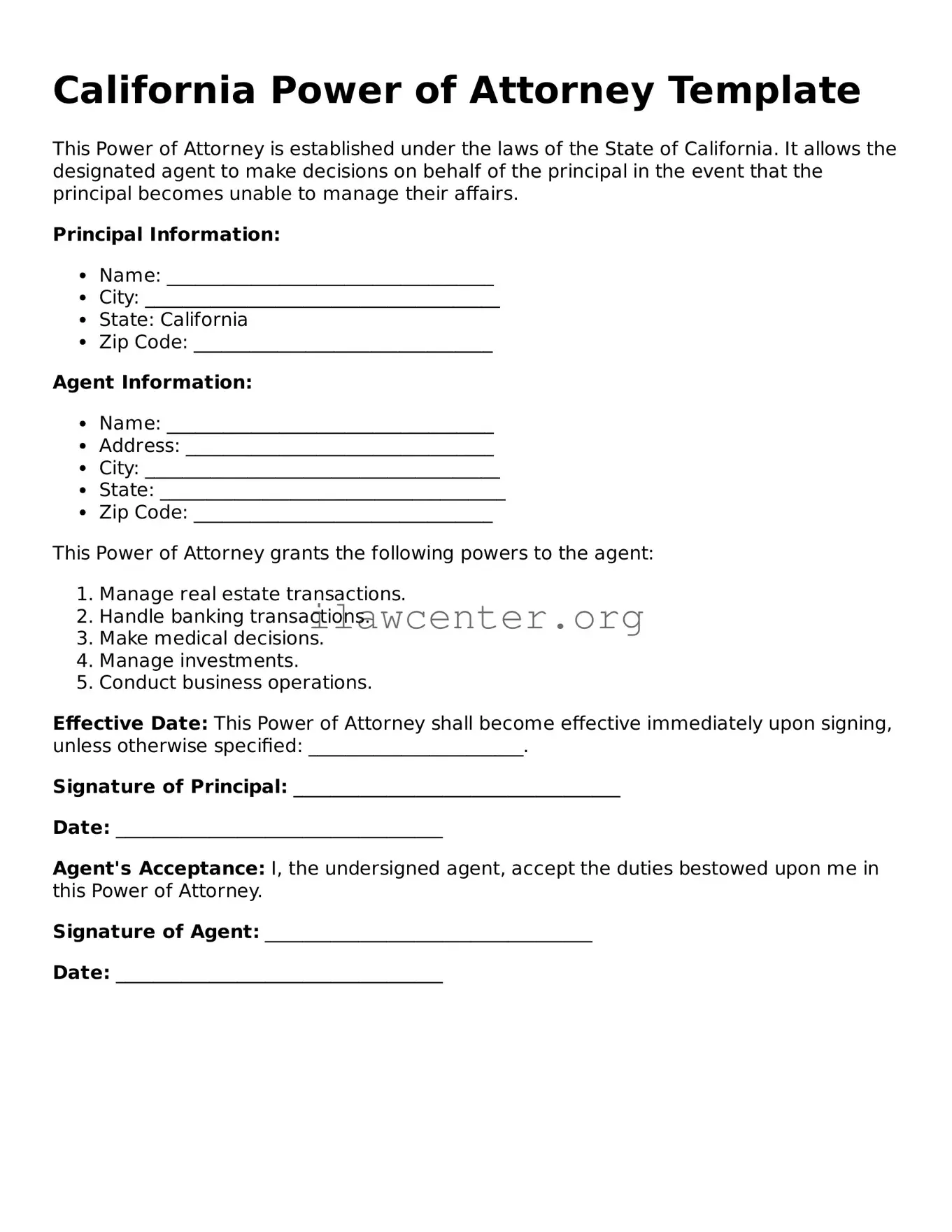

Once you have decided to create a California Power of Attorney, you will need to carefully fill out the appropriate form. This document designates someone to make decisions on your behalf in various matters, which could include financial or healthcare decisions. Completing the form accurately ensures that your choices are clearly understood and legally valid.

- Download the Form: Obtain the California Power of Attorney form from a reliable source, such as the California Department of Justice website or your local courthouse.

- Read Instructions: Familiarize yourself with the instructions provided with the form. Understanding each section will help you fill it out correctly.

- Provide Your Information: At the top of the form, enter your full name, address, and contact information. Make sure this is accurate and up-to-date.

- Designate an Agent: Clearly state the name and address of the person you are appointing as your agent. This individual will act on your behalf.

- Specify Powers: Indicate the specific powers you wish to grant to your agent. Be as detailed as possible, covering areas such as financial transactions or healthcare decisions.

- Choose Duration: Decide whether the powers granted will start immediately or upon a specific event, like your incapacitation. Note your choice clearly on the form.

- Sign and Date: Sign the form in the designated space, ensuring your signature is clear. Then, date the document to validate it.

- Witnesses and Notary: California requires the form to be signed in front of either a notary public or two witnesses. Follow state guidelines to ensure this step is completed correctly.

- Distribute Copies: Make copies of the completed document. Provide copies to your agent, your attorney, and any relevant institutions, such as banks or healthcare providers.