What is a prenuptial agreement in California?

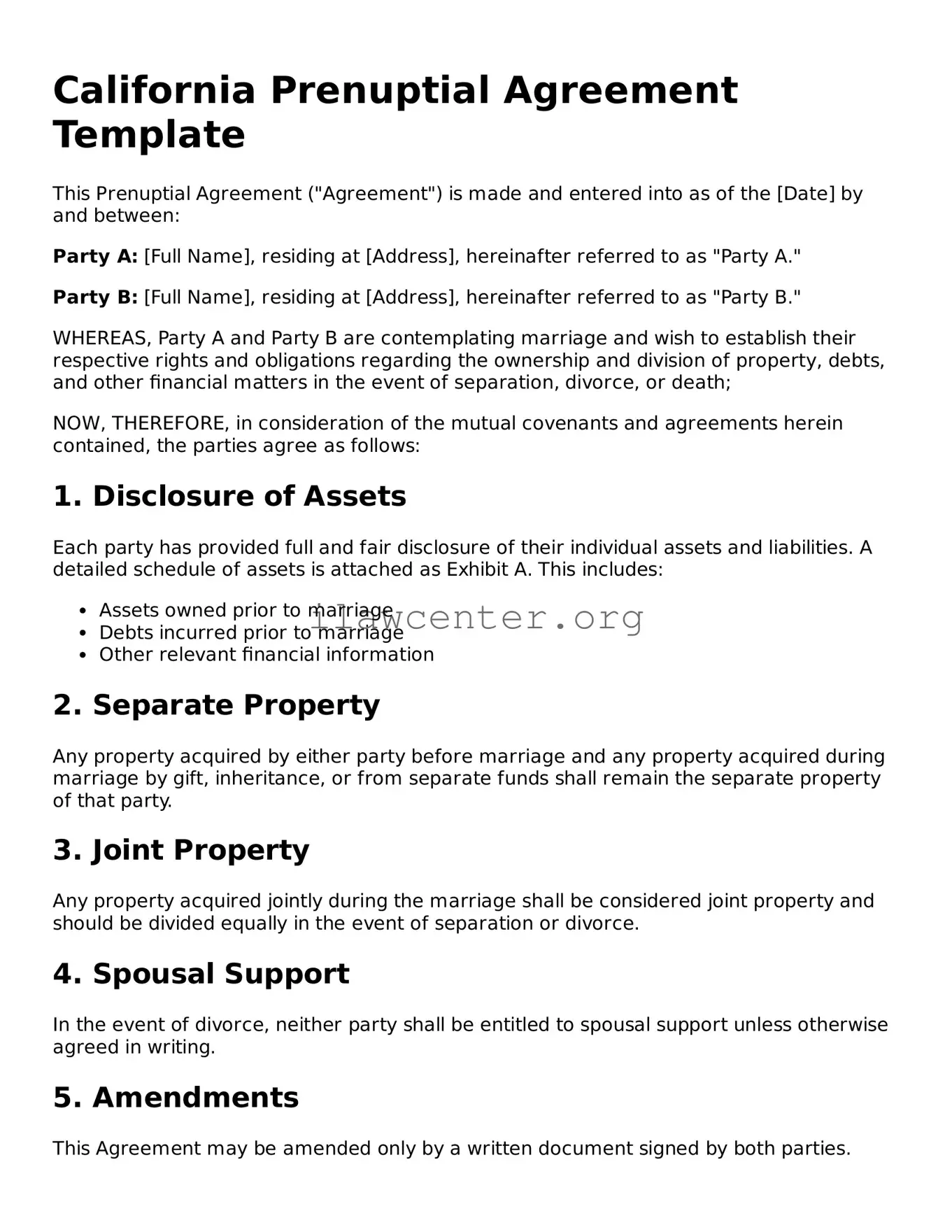

A prenuptial agreement, often called a prenup, is a legal document created by two individuals before they marry. This agreement details the management and division of assets and debts, should the marriage end in divorce or separation. It can offer protection and clarity for both parties regarding their financial rights and responsibilities.

Why should I consider a prenuptial agreement?

Considering a prenuptial agreement can be wise for several reasons. It helps to establish financial expectations and responsibilities, protects personal assets, and may simplify divorce proceedings. Additionally, it can be particularly important if one or both individuals have significant assets, businesses, children from previous relationships, or unique financial situations.

What should be included in a prenuptial agreement?

A prenuptial agreement can include various elements, such as the division of property acquired during the marriage, how debts will be handled, and alimony or spousal support arrangements. It can also address how individual assets maintained before marriage will be treated during and after marriage. Each agreement is unique and should reflect the couple's specific needs and circumstances.

Is a prenuptial agreement enforceable in California?

Yes, a prenuptial agreement is generally enforceable in California, provided it meets certain legal requirements. Both parties must fully disclose their financial situations, and the agreement must be signed voluntarily without coercion. It should also be in writing to be considered valid. Courts typically uphold these agreements unless they are proven to be unconscionable or were signed under duress.

When should I create a prenuptial agreement?

The best time to create a prenuptial agreement is well before the wedding. Engaging in this process several months prior can give both parties adequate time to negotiate terms and seek legal advice. It ensures that there is no appearance of coercion or pressure as the wedding date approaches.

Do I need a lawyer for my prenuptial agreement?

While it is not legally required to have a lawyer, hiring one is highly advisable. An experienced attorney can help draft the document to ensure it complies with California laws and reflects your intentions clearly. A lawyer can also help each party to understand their rights and responsibilities, making the overall process smoother and more informed.

Can I modify a prenuptial agreement after marriage?

Yes, it is possible to modify a prenuptial agreement after marriage. Both parties must agree to the changes, and any amendments should be documented in writing and signed by both spouses. This can help maintain clarity and address any new circumstances in the couple’s lives.

What happens if my spouse refuses to sign a prenuptial agreement?

If one spouse refuses to sign a prenuptial agreement, the other party must decide how to proceed. It is essential to communicate openly about the reasons for wanting a prenup and to consider mediation if necessary. Ultimately, if a prenup cannot be reached, the couple must rely on California's community property laws in the event of a divorce.

Are there any limitations on what a prenuptial agreement can cover?

Yes, prenuptial agreements in California cannot include provisions that are illegal or against public policy. For instance, they cannot dictate child custody arrangements or child support terms, as these issues must be determined based on the best interests of the child at the time of a divorce. Additionally, agreements cannot include any terms that would promote divorce or violate the law.