Instructions on Utilizing California Quitclaim Deed

Filling out the California Quitclaim Deed form is a straightforward process that plays a crucial role in transferring property ownership. Proper completion of this form is essential for ensuring a smooth transition of property rights.

- Begin by obtaining the Quitclaim Deed form. You can find it online or at your local county recorder's office.

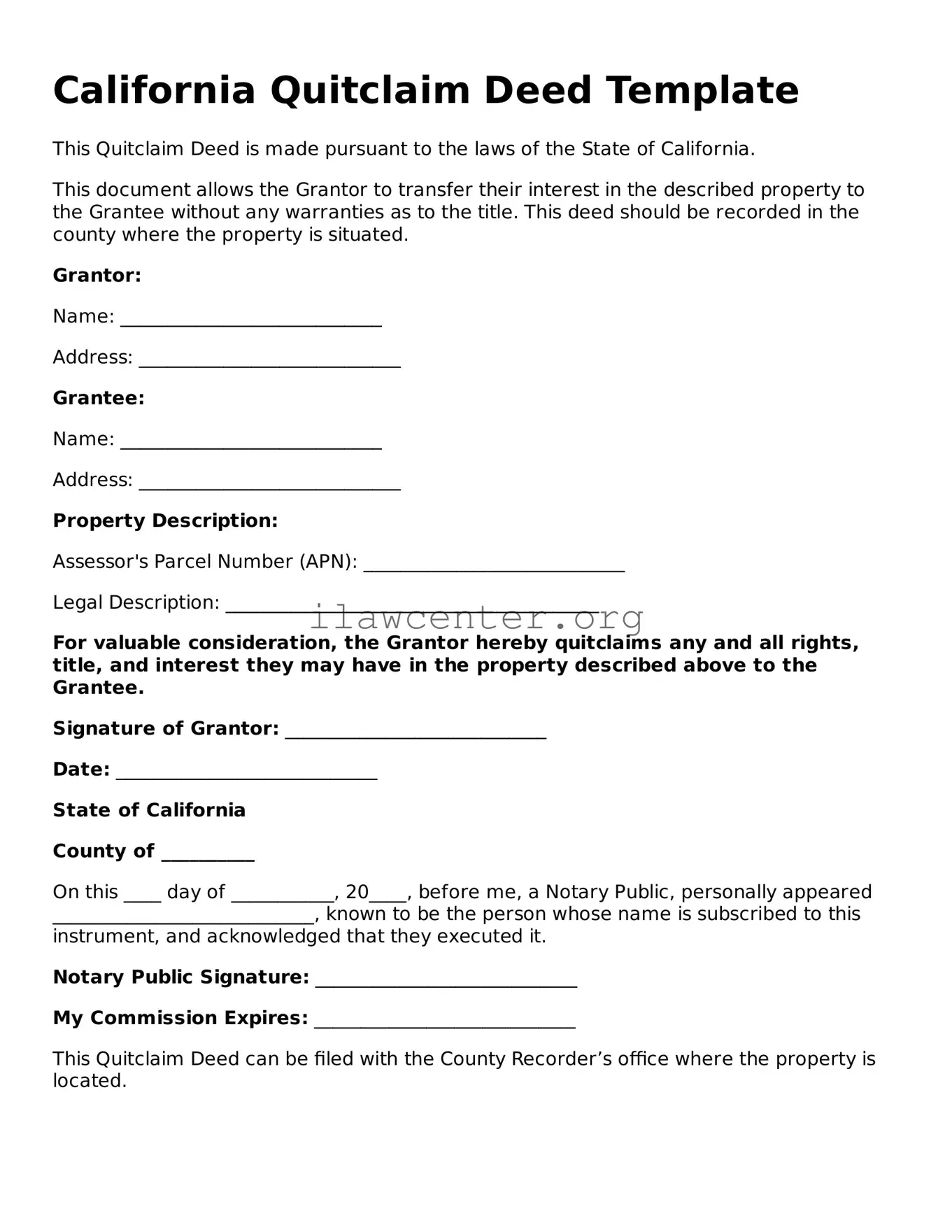

- In the top section, enter the names of the current property owner(s) as the grantor. This is the person or people transferring the property.

- Next, identify the new property owner(s) by writing their names as the grantee. Make sure this is accurate as they will receive the ownership rights.

- Provide a description of the property being transferred. This usually includes the address and may require the legal description found in previous deeds.

- Specify the county where the property is located in the designated area of the form.

- Count any additional considerations, such as money paid for the property, if applicable, and note this amount in the appropriate box.

- Ensure that all involved parties sign the document in front of a notary public. This verification is crucial for the deed to be valid.

- Once signed and notarized, make copies for your records.

- Finally, submit the original Quitclaim Deed to the county recorder's office in the county where the property is located. There may be a fee for recording the document.

After completing these steps, retain any copies for your personal records. It is also wise to confirm that the deed has been recorded properly by checking with the county recorder's office.