What is a Transfer-on-Death Deed in California?

A Transfer-on-Death Deed (TOD Deed) allows property owners in California to designate a beneficiary who will receive the property upon their death. This type of deed facilitates the transfer of real estate outside of probate, simplifying the process for those left behind.

How do I create a Transfer-on-Death Deed?

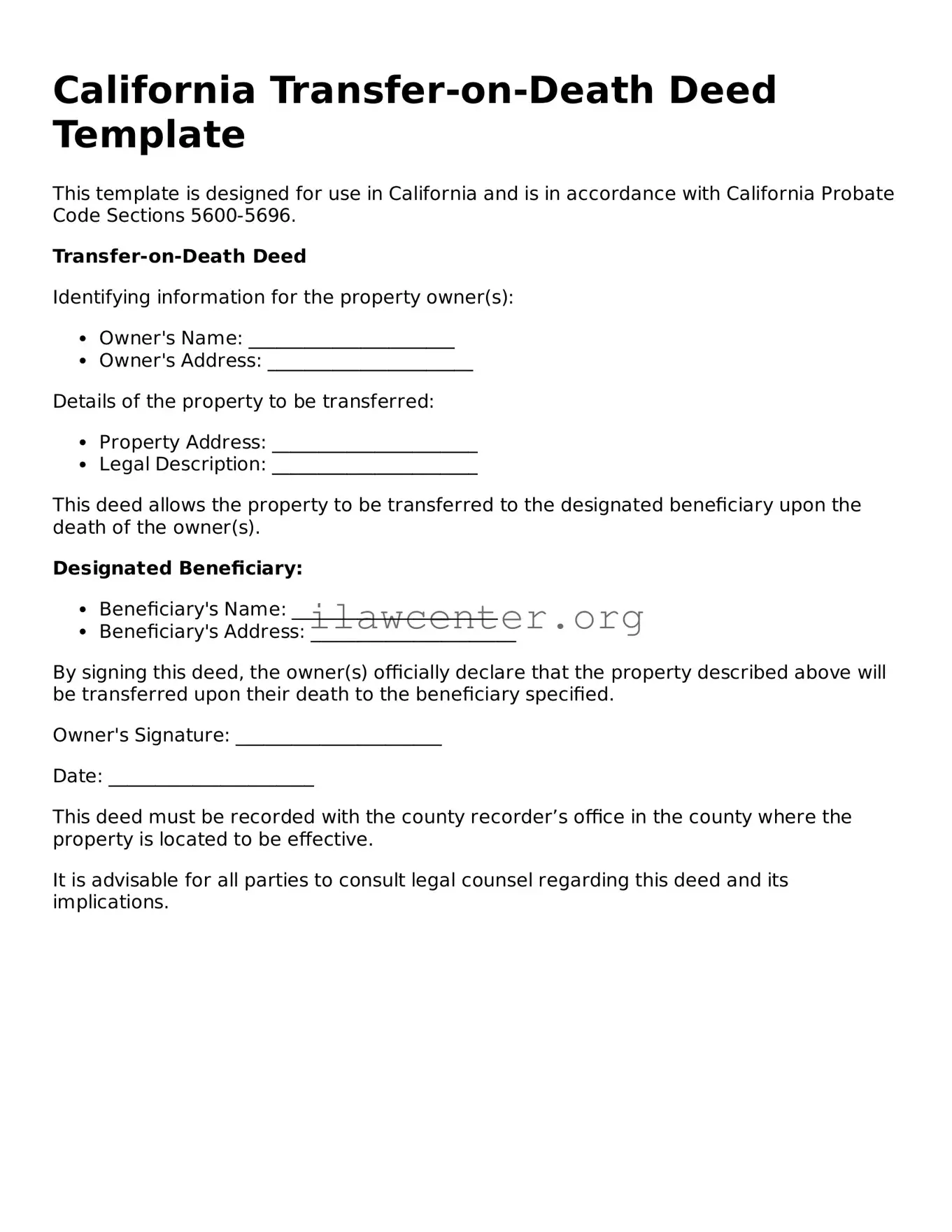

To create a Transfer-on-Death Deed, you must fill out the specific form provided by the California government. You’ll need to include details about the property and the beneficiary. It’s vital to have the deed signed, dated, and notarized. After that, you must file the deed with the county recorder's office in the county where the property is located.

Can I revoke a Transfer-on-Death Deed?

Yes, you can revoke a Transfer-on-Death Deed. To do this, you must complete a revocation form and record it with the county recorder’s office. Alternatively, you could create a new TOD Deed that explicitly revokes any previous deeds.

Is a Transfer-on-Death Deed suitable for all types of property?

A Transfer-on-Death Deed can be used for residential real estate, including houses and condominiums. However, it does not apply to commercial property or certain types of interests, like timeshares. Always consider your specific situation to ensure this option is right for you.

Do I need to notify my beneficiary when I create a Transfer-on-Death Deed?

While it’s not legally required to notify your beneficiary, doing so is advisable. Discussing your intentions with them can help prevent potential disputes and clarify your wishes for the future.

What happens if I don’t name a beneficiary in my Transfer-on-Death Deed?

If no beneficiary is named, the property will not transfer as intended after your death. Instead, the property will become part of your estate and will go through probate. Naming a beneficiary ensures your wishes are adhered to and can prevent complications for your loved ones.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, property transferred via a Transfer-on-Death Deed receives a stepped-up basis for tax purposes upon your death. This means the beneficiary's tax basis will be the property's fair market value at the time of transfer. However, estate tax considerations may apply depending on your overall estate size. Consult with a tax professional for tailored advice.

Can I use a Transfer-on-Death Deed if I have a mortgage?

Yes, you can still use a Transfer-on-Death Deed if your property has a mortgage. However, it’s essential to note that the mortgage must still be paid after your death. The beneficiary will inherit the property along with any obligations associated with it, including the mortgage payments.

How does a Transfer-on-Death Deed affect my estate planning?

A Transfer-on-Death Deed can be a valuable tool in your estate planning strategy. It allows you to bypass probate, ensuring a smoother transfer of your property to your chosen beneficiary. Incorporating this deed into your overall plan can provide financial security and peace of mind for your loved ones.

Where can I find the Transfer-on-Death Deed form?

The Transfer-on-Death Deed form can be found on the California Secretary of State's website or your local county recorder's office. It's also advisable to check for any updates or specific requirements that may vary by county.