What is the CBP 6059B form?

The CBP 6059B form, also known as the Customs Declaration for Free Entry of Informal Entries, is a document required by U.S. Customs and Border Protection (CBP). This form must be completed by travelers entering the United States to declare any items that will not be subject to duties or taxes. It helps facilitate the customs process for certain categories of goods being imported for personal use or as gifts.

Who is required to complete the CBP 6059B form?

All travelers entering the U.S. who bring in items valued at $800 or less must complete the CBP 6059B form. This includes U.S. citizens, residents, and foreign visitors. It’s essential to declare any items in your possession that exceed this value or fall outside the limits to avoid penalties.

Where can I obtain the CBP 6059B form?

The CBP 6059B form is usually provided during your travel, either on the airplane or at customs checkpoints. Additionally, travelers can access the form online through the official CBP website. It’s advisable to fill out the form before arriving at customs to expedite the process.

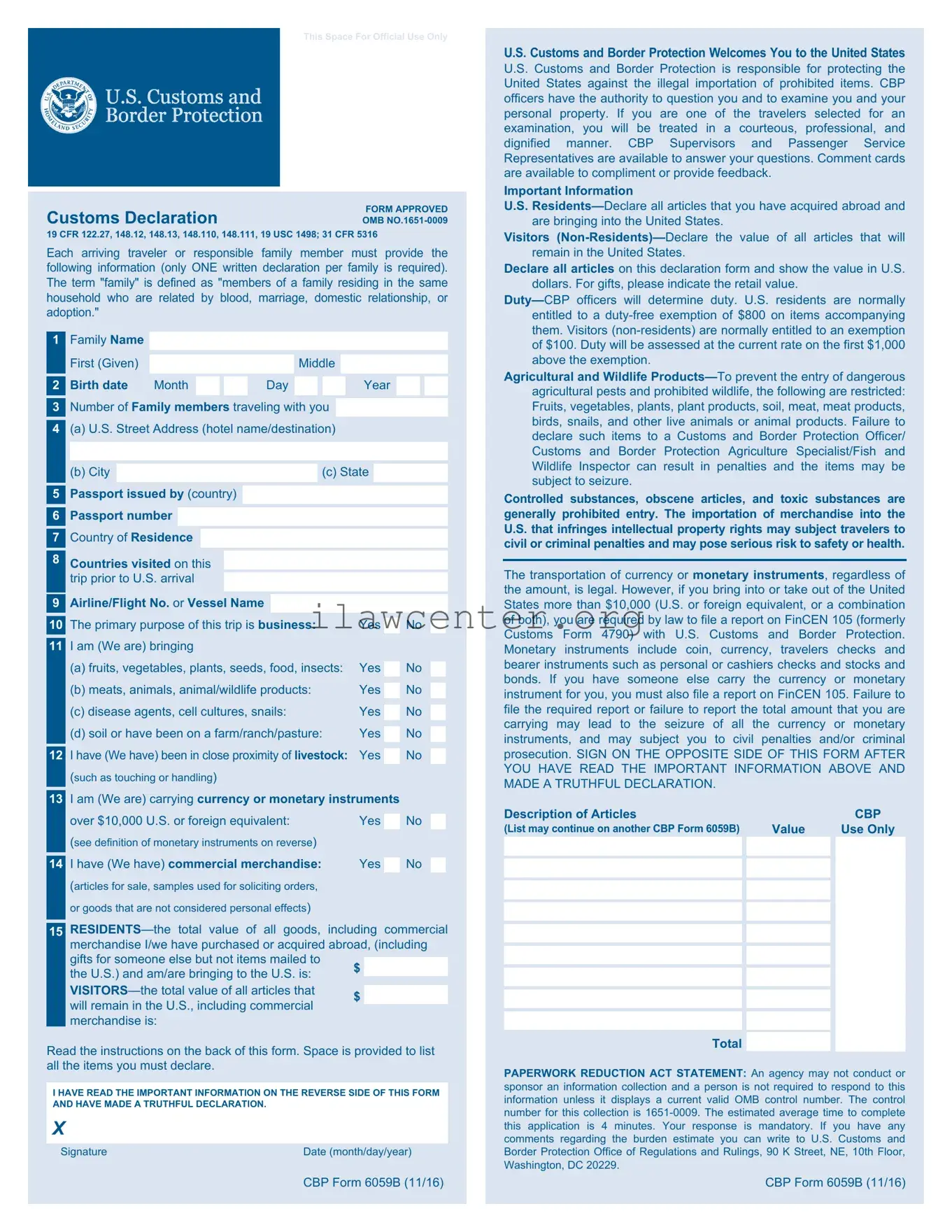

What information do I need to provide on the CBP 6059B form?

When filling out the CBP 6059B form, you need to provide personal information, including your name, citizenship, and contact details. Additionally, you must list all items you are bringing into the U.S., specifying their quantity and value. Be honest and accurate to prevent issues during border crossing.

What happens if I fail to submit the CBP 6059B form?

If you neglect to submit the CBP 6059B form when required, you may face penalties. The customs officers can confiscate undeclared items or impose fines. In severe cases, failing to declare items may lead to delays or denial of entry into the United States.

Can I change my declaration after submitting the CBP 6059B form?

It is advisable to be accurate when completing the CBP 6059B form. If you realize you need to amend your declaration after submission, inform a customs officer immediately. They are equipped to assist you and may allow changes before the processing of your entry is finalized.

Is the CBP 6059B form applicable to both goods and gifts?

Yes, the CBP 6059B form applies to both goods for personal use and gifts. However, gifts may have specific value limitations, and it is important to provide correct information to customs officials regarding the nature and value of the items. Accurate declarations ensure compliance with customs regulations.

How does the CBP 6059B form affect duty exemptions?

Completing the CBP 6059B form allows travelers to claim duty exemptions on items valued at $800 or less. This exemption applies to personal items brought into the country and certain gifts. Proper submission of the form can help streamline the customs process without incurring additional charges.

(c) State

(c) State

No

No