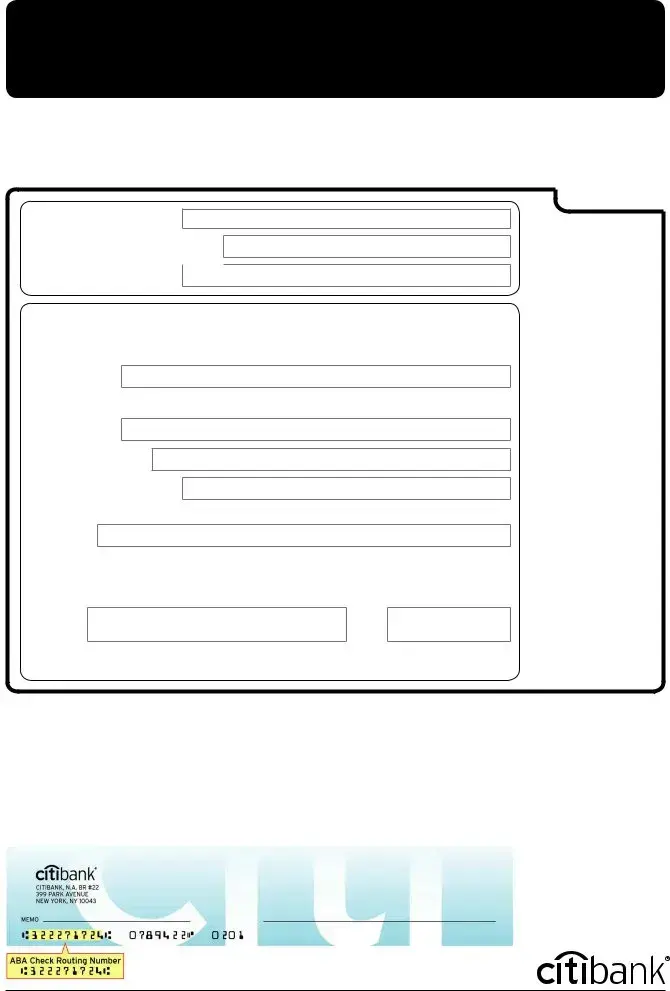

Instructions on Utilizing Citibank Direct Deposit

Completing the Citibank Direct Deposit form is an important step for ensuring that your payments are deposited directly into your bank account. By providing accurate information, you can help streamline your transactions and avoid delays. Follow these steps carefully to fill out the form correctly.

- Start by obtaining the Citibank Direct Deposit form from your employer or the Citibank website.

- At the top of the form, enter your name as it appears on your bank account.

- Provide your Social Security number in the designated space. Make sure to enter it accurately.

- Fill in your address, including street, city, state, and ZIP code. This should match your bank account records.

- Next, write your telephone number. This can be used if there are questions regarding your application.

- Locate the section for bank account information. Here, you will need to enter your bank's routing number. This number identifies your bank in the transaction process.

- Directly below the routing number, enter your account number. Double-check this number to prevent errors.

- Indicate whether you would like your funds deposited into a checking or savings account by selecting the appropriate box.

- Sign and date the form at the bottom. Your signature authorizes the direct deposit setup.

- Submit the completed form to your employer or the appropriate department as directed.

SIGNATURE:

SIGNATURE: