Instructions on Utilizing Corrective Deed

Filling out the Corrective Deed form is an important step in ensuring that property records accurately reflect ownership. Completing this form enables corrections to be made formally, which helps to prevent future disputes regarding property rights. Below are the detailed steps to assist in accurately completing the form.

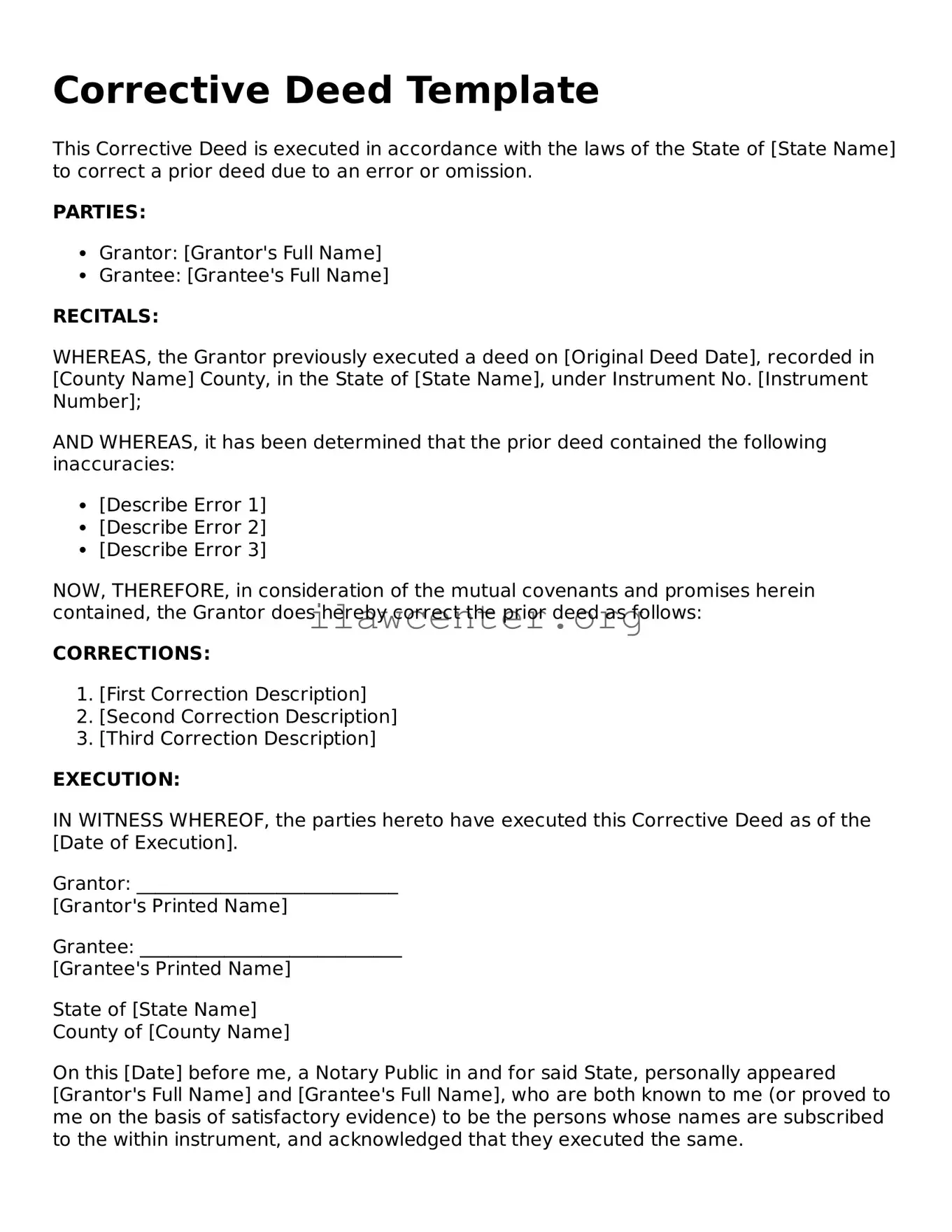

- Obtain a copy of the Corrective Deed form. Ensure you have the most recent version of the form, which can typically be found on your local government’s website or at their office.

- Fill out your name and address. In the designated areas, provide your full name and mailing address, so it’s clear who is making the correction.

- Identify the property in question. Clearly write down the property address, including the city, state, and zip code. This information is crucial for identifying the specific property being corrected.

- Describe the nature of the error. Clearly articulate what the error is that you are seeking to correct. Use straightforward language to convey the mistake.

- Provide the correct information. Next to the description of the error, provide the correct details that should be documented. Make sure this information is accurate and complete.

- Sign and date the form. At the bottom of the form, sign your name and indicate the date on which you are submitting the correction. This legally affirms that the information provided is accurate.

- Submit the form. Follow the instructions for submission, whether electronically or by mail. Be mindful of any associated fees that may need to be paid at this time.

Once the form is filled out and submitted, it will be reviewed by the relevant authority. If approved, the corrections will be recorded in the property records, ensuring clear and accurate documentation moving forward.