Fillable Deed in Lieu of Foreclosure Document

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid the lengthy foreclosure process. This option can help both parties, as it often provides a more efficient resolution to the homeowner's financial challenges. For those considering this alternative, filling out the form is a crucial step in the process.

To proceed, please click the button below to fill out the form.

When facing financial difficulties and the threat of foreclosure, homeowners may seek alternatives to preserve their dignity and avoid the lengthy foreclosure process. One option available is a deed in lieu of foreclosure, a legal document that allows a borrower to transfer ownership of their property back to the lender voluntarily. This solution can help both parties: homeowners can relieve themselves from the burdens of an unaffordable mortgage, while lenders can save time and resources associated with foreclosure proceedings. Signing a deed in lieu not only simplifies the transition but may also lead to a more favorable outcome regarding any remaining debt after the property is sold. It is important to understand the components of this form, including the transfer of title, waiver of claim, and any potential impact on credit ratings. By grasping the nature and implications of a deed in lieu of foreclosure, homeowners can make informed decisions during challenging times.

Deed in Lieu of Foreclosure Preview

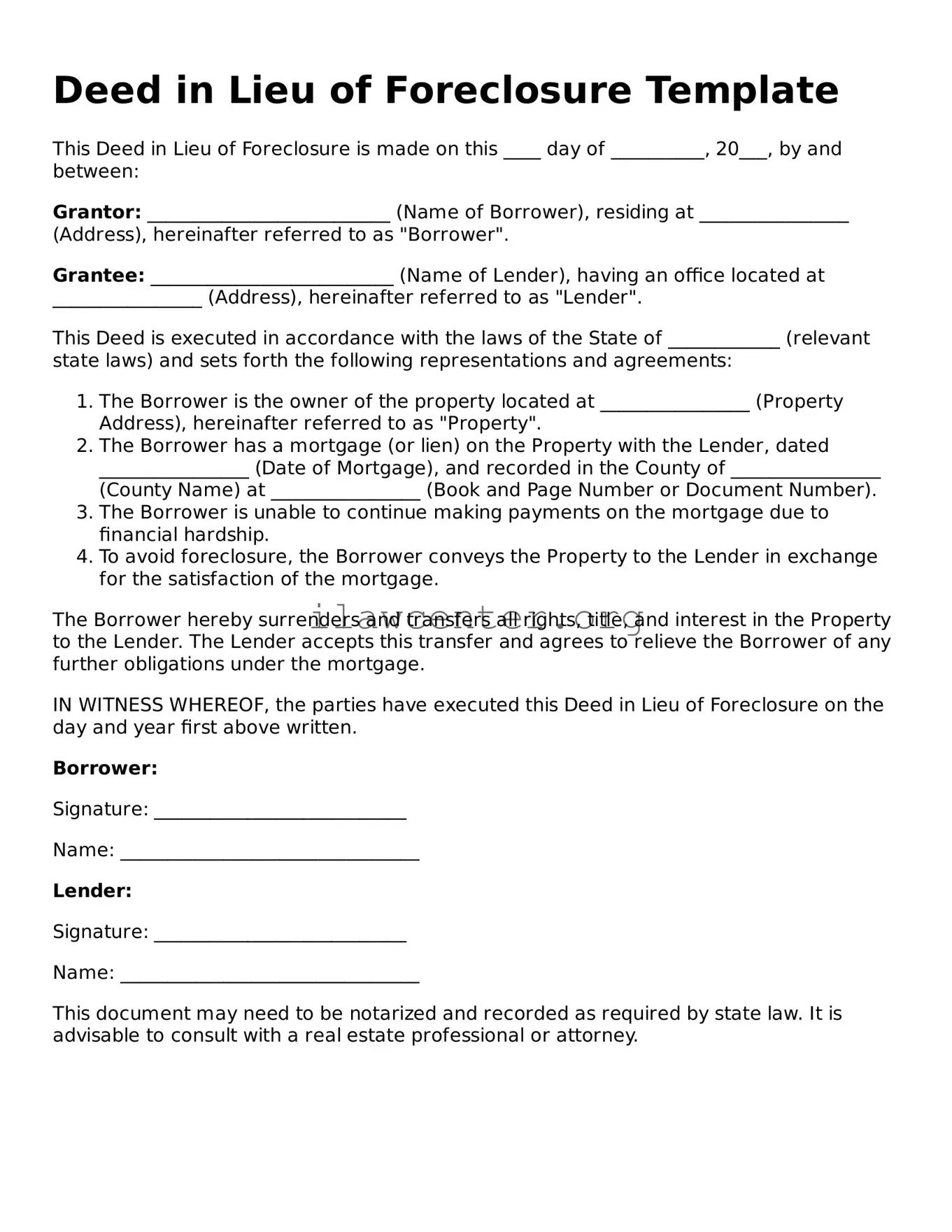

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on this ____ day of __________, 20___, by and between:

Grantor: __________________________ (Name of Borrower), residing at ________________ (Address), hereinafter referred to as "Borrower".

Grantee: __________________________ (Name of Lender), having an office located at ________________ (Address), hereinafter referred to as "Lender".

This Deed is executed in accordance with the laws of the State of ____________ (relevant state laws) and sets forth the following representations and agreements:

- The Borrower is the owner of the property located at ________________ (Property Address), hereinafter referred to as "Property".

- The Borrower has a mortgage (or lien) on the Property with the Lender, dated ________________ (Date of Mortgage), and recorded in the County of ________________ (County Name) at ________________ (Book and Page Number or Document Number).

- The Borrower is unable to continue making payments on the mortgage due to financial hardship.

- To avoid foreclosure, the Borrower conveys the Property to the Lender in exchange for the satisfaction of the mortgage.

The Borrower hereby surrenders and transfers all rights, title, and interest in the Property to the Lender. The Lender accepts this transfer and agrees to relieve the Borrower of any further obligations under the mortgage.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure on the day and year first above written.

Borrower:

Signature: ___________________________

Name: ________________________________

Lender:

Signature: ___________________________

Name: ________________________________

This document may need to be notarized and recorded as required by state law. It is advisable to consult with a real estate professional or attorney.

PDF Form Characteristics

| Fact | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal process where a borrower voluntarily conveys their property to the lender to avoid foreclosure. |

| Purpose | This process helps both parties. The borrower avoids foreclosure, and the lender takes possession of the property without incurring the costs of foreclosure proceedings. |

| State-Specific Regulations | The laws governing deeds in lieu of foreclosure can vary by state. For example, in California, Civil Code Section 2929.5 outlines the procedures and requirements. |

| Loan Types | This option is often available for various loan types, including conventional and government-backed loans, provided the lender agrees. |

| Impact on Credit Score | A deed in lieu of foreclosure can negatively impact a borrower's credit score, although typically less than a foreclosure. |

| Potential Tax Implications | Borrowers may face tax implications on any forgiven debt, so consulting a tax professional is advisable prior to proceeding. |

| Legal Consultation Recommended | Before signing any documents, seek legal advice to understand rights, obligations, and ramifications associated with a deed in lieu of foreclosure. |

Instructions on Utilizing Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. They will review it and determine the next steps based on your agreement. Gather any required documentation that may support your submission.

- Obtain the form for the Deed in Lieu of Foreclosure. You can get this from your lender's website or office.

- Fill in your name and contact information at the top of the form.

- Provide the property address, ensuring all details are accurate.

- Indicate the type of ownership you hold in the property (e.g., sole ownership, joint ownership).

- Fill in the date of the transaction.

- Provide details regarding any existing liens or mortgages on the property.

- Sign and date the form in the appropriate section.

- Have your signature notarized. This is often required to validate the document.

- Make copies of the completed form for your records.

- Submit the completed form to your lender, along with any additional documents they may need.

Important Facts about Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender. This option typically comes into play when a homeowner is facing financial difficulties and wants to avoid the lengthy and often stressful process of foreclosure. By voluntarily transferring the property, the homeowner can potentially reduce the impact on their credit and might be able to negotiate terms that prevent further liabilities, such as a deficiency judgment.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

This approach can offer several benefits to homeowners. First, it generally allows for a quicker resolution than foreclosure proceedings. The homeowner can put an end to the financial strain caused by mortgage payments they can no longer afford. Additionally, it tends to be less damaging to one's credit score than a foreclosure, which can stay on a credit report for up to seven years. Lastly, homeowners may be able to negotiate with the lender for a move-out date, giving them more control over their transition to new living arrangements.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While this option can be advantageous, it is not without its drawbacks. One significant concern is the risk of potential tax implications. The transfer of property may be considered a sale, and any difference between the mortgage owed and the actual value of the property may be treated as taxable income. Homeowners should consult a tax advisor to fully understand these risks. Furthermore, lenders may not always agree to a Deed in Lieu of Foreclosure, especially if there are junior liens on the property. In such cases, pursuing a different strategy may be necessary.

How can a homeowner initiate a Deed in Lieu of Foreclosure?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. It is important for homeowners to present their financial situation clearly and provide any necessary documentation. The lender will then review the request and may require an evaluation of the property. Once the lender agrees to the arrangement, both parties will need to sign the document, which should be recorded with the local government to finalize the transfer of ownership. Legal advice is recommended throughout this process to ensure that all actions taken are in the homeowner's best interest.

Common mistakes

Filling out a Deed in Lieu of Foreclosure form can seem straightforward, but mistakes can lead to complications. One common error is failing to provide accurate property information. Missing the correct address or details about the property can create legal issues later. Ensure that all descriptions match public records accurately.

Another frequent mistake is neglecting to consult with a legal professional. Many individuals assume they understand the entire process on their own. However, the complexities of foreclosure law can lead to unforeseen consequences. Seeking guidance from an attorney can help clarify any ambiguities and ensure compliance with local laws.

Additionally, people often overlook the importance of notifying all lienholders. If there are outstanding mortgages or liens, failing to include them in the process may lead to disputes. All creditors should be informed to avoid future claims against the property.

Not properly documenting the transaction presents another potential pitfall. It's essential to keep copies of the signed Deed in Lieu of Foreclosure and any correspondence related to the transaction. Lack of documentation could create challenges in proving that the deed was accepted, particularly if a dispute arises later.

Finally, some individuals may sign the form without fully understanding the implications. The deed transfers ownership of the property to the lender, which might have lasting effects on one's credit and financial situation. Understanding these repercussions is crucial before proceeding.

Documents used along the form

A Deed in Lieu of Foreclosure is an important document that can help homeowners avoid the lengthy and stressful process of foreclosure. However, several other forms and documents are often needed alongside this deed to ensure a smooth transition. Each piece plays a specific role in protecting the rights of the homeowner and the lender while facilitating the transfer of property ownership.

- Mortgage Satisfaction Document: This document confirms that the mortgage debt has been fully satisfied. It is essential for releasing the homeowner from any further financial liability related to the property.

- Property Title Transfer Form: This form officially transfers ownership of the property from the homeowner to the lender. It is a legal requirement for updating public records regarding property ownership.

- Release of Liability Agreement: This agreement absolves the homeowner from future claims related to the mortgage debt. It gives peace of mind by ensuring that no further obligations exist after the deed is executed.

- Notice of Default: This document is typically sent by the lender to notify the homeowner that they are behind on mortgage payments. It serves as an official record of the borrower’s default status.

- Financial Disclosure Statement: This statement provides the lender with a clear picture of the homeowner's financial situation. It may include income, debt, and asset information that can influence the lender's decision during negotiations.

- Release of Claim: This document is signed by the lender, allowing the homeowner to release any claims against the lender once the deed is executed. It ensures that both parties understand the terms of the agreement.

- Settlement Statement: This statement outlines all the costs associated with the transaction, ensuring that both parties are aware of all financial terms before the transition takes place.

Each of these documents plays a crucial role in the process surrounding a Deed in Lieu of Foreclosure. By understanding their importance, homeowners can approach the situation with confidence, knowing that they have the necessary tools for a successful resolution.

Similar forms

- Loan Modification Agreement: This document alters the terms of an existing loan, making it more manageable for the borrower. It is often used to avoid foreclosure by providing new payment arrangements.

- Short Sale Agreement: In this situation, the lender agrees to accept a sale price that is less than the total owed on the mortgage. It allows the borrower to sell the property and avoid foreclosure while limiting the lender’s loss.

- Mortgage Release or Satisfaction: This document formally acknowledges that a mortgage has been paid off. It releases the borrower from obligations and clears the title to the property.

- Foreclosure Settlement Agreement: This is a mutual agreement between the lender and borrower to settle outstanding debts and avoid foreclosure proceedings, often with terms favorable to both parties.

- Rent-Back Agreement: After a deed in lieu, this document allows the borrower to remain in the property as a tenant. It provides them time to transition while ensuring the lender has a tenant in place.

- Forbearance Agreement: This document provides temporary relief by allowing the borrower to pause or reduce payments for a specified period. It is used to avoid default and provide the borrower with time to stabilize their finances.

- Release of Lien Agreement: This document removes the lender’s security interest from the property, ensuring that the borrower can freely transfer or sell the property, often used after settling debts.

Dos and Don'ts

When navigating the Deed in Lieu of Foreclosure form, there are important dos and don'ts to consider. Here's a list to guide you through the process:

- Do: Read the form thoroughly before filling it out.

- Do: Ensure all information is accurate and complete.

- Do: Consult with a legal professional if you have questions.

- Do: Keep copies of all documents for your records.

- Do: Notify your lender of your intention to submit the deed.

- Don’t: Rush through the form or make assumptions.

- Don’t: Leave any sections blank unless directed.

- Don’t: Sign the form without understanding its implications.

- Don’t: Disregard the timeline set by your lender for submission.

- Don’t: Ignore any potential tax consequences associated with the deed.

Misconceptions

A Deed in Lieu of Foreclosure can be a viable option for homeowners facing financial difficulties. However, several misconceptions exist regarding this process. Here are six common misconceptions explained:

- It eliminates all debt entirely. Many believe that a deed in lieu completely wipes out their mortgage debt. In reality, while it may relieve homeowners of their mortgage obligation, other liens against the property could still remain.

- It guarantees that the lender will accept it. Homeowners often assume that their lender will automatically accept a deed in lieu. Lenders have specific criteria for approval, and not all applications will be accepted, especially if there are other options available.

- It has no impact on credit scores. Some people think that a deed in lieu does not affect their credit. This is incorrect; it can still have a negative impact, though typically less severe than a foreclosure.

- It is a quick and easy process. There is a perception that a deed in lieu can be executed swiftly. The truth is that the process can take time, requiring documentation and negotiation with the lender before reaching an agreement.

- It only benefits the homeowner. Some believe that only the homeowner gains advantages from a deed in lieu. However, lenders can also benefit, as it allows them to avoid the lengthy and costly foreclosure process.

- It eliminates the need for legal advice. While homeowners may feel confident navigating the process, legal guidance can be beneficial. Understanding the implications and ensuring that all rights are protected is essential before proceeding.

Key takeaways

Filling out a Deed in Lieu of Foreclosure form can seem overwhelming, but understanding its key aspects can simplify the process. Here are ten essential takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer their property to the lender to avoid foreclosure.

- Review the Mortgage Agreement: Before filling out the form, review your mortgage terms to confirm eligibility and understand any specific requirements.

- Document Everything: Keep copies of all correspondence and documentation related to the deed. This will be helpful in case of disputes.

- Consult a Professional: Consider seeking advice from a lawyer or real estate professional to ensure you fully understand the implications.

- Be Honest About Your Financial Situation: Clearly disclose your current financial condition to the lender. This includes income, expenses, and reasons for default.

- Complete the Form Accurately: Fill out all sections of the Deed in Lieu of Foreclosure form completely and accurately to avoid delays.

- Check State Laws: Laws regarding deeds in lieu of foreclosure vary by state. Ensure you are following local regulations.

- Assess Tax Implications: Be aware that transferring property in this manner may have tax consequences. Consult a tax professional if needed.

- Communicate with the Lender: Maintain open lines of communication with your lender throughout the process to ensure a smoother transaction.

- Consider Alternatives: Before committing, weigh other options such as loan modification or short sale that may be more advantageous.

Fill out Common Types of Deed in Lieu of Foreclosure Templates

Iowa Quit Claim Deed Requirements - In real estate, a quitclaim deed is favored for its simplicity and speed.

California Corrective Deed - This document strengthens the protection of property rights.

Tod in California - Some states require specific wording for a Transfer-on-Death Deed to be valid.