Fillable Durable Power of Attorney Document

A Durable Power of Attorney is a legal document that allows one individual to appoint another to make decisions on their behalf, even if they become incapacitated. This form is crucial for ensuring that personal, financial, and healthcare decisions can be handled in accordance with the principal's wishes. Understanding its importance can empower individuals to take control of their future. For assistance with filling out the form, click the button below.

The Durable Power of Attorney (DPOA) form is a vital document that allows an individual, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf when they are unable to do so. This instrument remains effective even if the principal becomes incapacitated, thereby ensuring that their wishes and interests are protected during times of vulnerability. Key aspects of the DPOA include the authority granted to the agent, which can range from managing financial matters, handling real estate transactions, to making healthcare decisions, depending on how the document is drafted. Typically, the principal must sign the DPOA in the presence of a notary public or witnesses to ensure its legality. Moreover, the principal has the flexibility to specify limitations or define the scope of powers entrusted to the agent. A well-prepared Durable Power of Attorney not only safeguards an individual's preferences but also alleviates potential conflicts among family members during difficult circumstances, ultimately streamlining decision-making processes in times of need.

Durable Power of Attorney Preview

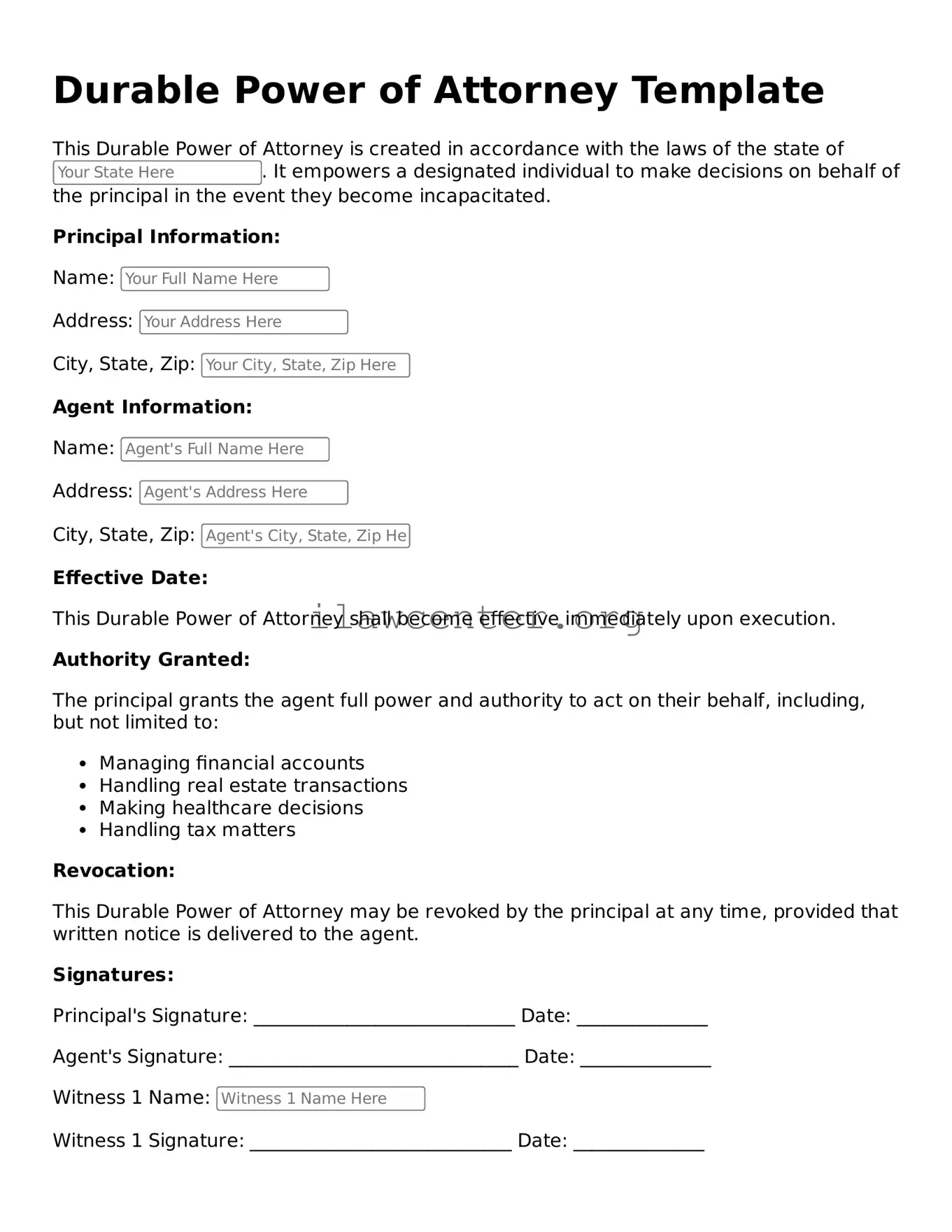

Durable Power of Attorney Template

This Durable Power of Attorney is created in accordance with the laws of the state of . It empowers a designated individual to make decisions on behalf of the principal in the event they become incapacitated.

Principal Information:

Name:

Address:

City, State, Zip:

Agent Information:

Name:

Address:

City, State, Zip:

Effective Date:

This Durable Power of Attorney shall become effective immediately upon execution.

Authority Granted:

The principal grants the agent full power and authority to act on their behalf, including, but not limited to:

- Managing financial accounts

- Handling real estate transactions

- Making healthcare decisions

- Handling tax matters

Revocation:

This Durable Power of Attorney may be revoked by the principal at any time, provided that written notice is delivered to the agent.

Signatures:

Principal's Signature: ____________________________ Date: ______________

Agent's Signature: _______________________________ Date: ______________

Witness 1 Name:

Witness 1 Signature: ____________________________ Date: ______________

Witness 2 Name:

Witness 2 Signature: ____________________________ Date: ______________

This document reflects the principal's wishes and serves as an official record of the agent's authority to act on their behalf.

PDF Form Characteristics

| Fact Name | Detail |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) is a legal document that grants another person the authority to act on your behalf in financial or legal matters. |

| Durability | This document remains effective even if the principal becomes incapacitated, unlike a standard power of attorney. |

| Principal | The individual who creates the DPOA is known as the principal. This person authorizes another to act for them. |

| Agent | The person appointed to act on behalf of the principal is known as the agent or attorney-in-fact. |

| Scope of Authority | The DPOA can be tailored to grant broad or limited powers. Specific powers may include managing finances, real estate transactions, and health care decisions. |

| Revocation | A DPOA can be revoked at any time, as long as the principal is mentally competent. This is done through a formal written statement. |

| State-Specific Laws | The creation of a DPOA is governed by state laws. For example, in California, it is governed by the California Probate Code Section 4400-4501. |

| Notarization | Most states require that a DPOA be signed in the presence of a notary public to ensure its validity. |

| Importance | A DPOA is crucial for planning ahead, especially for individuals who may face unforeseen health challenges or need assistance with financial affairs. |

Instructions on Utilizing Durable Power of Attorney

Filling out a Durable Power of Attorney form is a crucial step in ensuring that your financial and legal matters are handled according to your wishes in the event you cannot manage them yourself. Follow these steps carefully to complete the form accurately.

- Title the Document: Clearly label the document as a "Durable Power of Attorney." This indicates its purpose from the start.

- Identify Yourself: Write your full name and address at the beginning of the form. It is important to provide accurate information.

- Choose Your Agent: Select the individual you trust to act on your behalf. Include their full name and address.

- Specify Powers: Clearly list the specific powers you are granting to your agent. This may include financial matters, property decisions, or other legal authorities.

- Set Conditions (if necessary): If there are any specific conditions or limitations to the powers you are granting, include them here.

- Sign and Date: You must sign and date the document at the designated area. This typically takes place at the bottom of the form.

- Witness or Notarization: Depending on your state’s requirements, have your signature witnessed or notarized. Ensure you follow your state's specific guidelines.

- Distribute Copies: Provide copies of the completed form to your agent, your family, and any relevant financial institutions or legal advisors.

After completing this process, ensure that all parties involved are aware of the arrangement. Keep the original form in a safe but accessible place. You may wish to revisit the form and its provisions periodically to ensure it continues to reflect your current wishes.

Important Facts about Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to make decisions on their behalf regarding financial or healthcare matters. Unlike a standard Power of Attorney, a Durable Power of Attorney remains in effect even if the principal becomes incapacitated.

Why is a Durable Power of Attorney important?

This document is crucial for ensuring that someone you trust can manage your affairs if you are unable to do so due to illness, injury, or other incapacitating conditions. It provides peace of mind, knowing that your financial and healthcare decisions will be handled according to your wishes.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are still competent to do so. To revoke the document, you must typically provide written notice to the agent and any institutions or individuals who may have relied on it.

Who can be appointed as an agent in a Durable Power of Attorney?

Any competent adult can be designated as your agent. It is generally advisable to choose someone who is trustworthy and who has a good understanding of your values and wishes. Some people choose family members, close friends, or financial advisors.

What powers can I grant to my agent?

You have the ability to grant a wide variety of powers to your agent, including the authority to manage your bank accounts, pay bills, and make healthcare decisions. You can tailor the powers granted in the document to suit your specific needs and preferences.

Does a Durable Power of Attorney need to be notarized?

In most states, a Durable Power of Attorney must be signed in the presence of a notary public to be legally valid. Additionally, some states may require witnesses to be present during the signing. Always check your state’s specific requirements to ensure compliance.

What happens if I do not have a Durable Power of Attorney in place?

If you become incapacitated without a Durable Power of Attorney in place, your loved ones may need to go through a lengthy court process to gain the authority to manage your affairs. This can create stress and may not align with your wishes.

Can I have multiple agents in a Durable Power of Attorney?

Yes, you can appoint multiple agents in your Durable Power of Attorney. You can specify whether they are to act jointly or independently in decision-making. Choose this option carefully, as it requires clear communication among the agents.

Is my Durable Power of Attorney effective immediately?

This can depend on how you structure the document. A Durable Power of Attorney can be set to take effect immediately or upon a specific event, such as your incapacitation. Make sure to clearly outline your intentions in the document.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form can be straightforward, yet mistakes are common. One frequent error occurs during the selection of the agent. Choosing someone who does not fully understand their responsibilities or lacks trustworthiness can lead to issues down the line. It's crucial to appoint an individual who will act in your best interest and manage your affairs appropriately.

Another mistake involves failing to specify the powers granted to the agent. Leaving this section vague can create confusion. Be clear about the extent of authority the agent will have regarding financial matters or health care decisions. Providing explicit instructions helps ensure that your wishes are honored.

Many individuals do not consider the potential future changes in circumstances. Assigning a single agent without naming alternates is a common oversight. If the primary agent becomes unable or unwilling to serve, having a backup can prevent delays and complications.

Additionally, not having the form properly witnessed or notarized contributes to legal challenges. Each state has different requirements regarding witnessing. It is essential to follow your state’s guidelines to ensure the document is valid. Execute the form in the presence of required witnesses or a notary as needed.

People often forget to review and update their DPOA after significant life changes. Events such as marriage, divorce, or the birth of children can alter your priorities. Regularly reviewing and adjusting your DPOA ensures that it reflects your current wishes and needs.

Not discussing the DPOA with the selected agent can lead to misunderstandings. Transparency is key; the agent should be aware of their responsibilities and your expectations. This conversation can also help them feel comfortable with the role, reducing stress when the time comes for them to act.

Another common error is neglecting to keep a copy of the DPOA in a secure yet accessible location. Important documents should be easily found by both you and your agent. Failure to provide copies can hinder the agent’s ability to act promptly, particularly in emergencies.

Lastly, individuals may underestimate the importance of understanding the implications of granting authority to an agent. This form can significantly affect one's financial and medical decisions. Take the time to comprehend what this authority entails so that you can make informed choices.

Documents used along the form

A Durable Power of Attorney (DPOA) is a crucial document that allows you to designate someone to manage your affairs when you are unable to do so. When creating a DPOA, you may also find it beneficial to consider other related legal documents. Each of these documents serves a specific purpose and can work together to ensure your wishes and needs are met if you face a medical or financial crisis.

- Health Care Proxy: This document designates a person to make medical decisions on your behalf if you are unable to communicate your wishes. It ensures that your healthcare preferences are respected.

- Living Will: A living will specifies your preferences regarding medical treatment in situations where you cannot express your wishes, especially concerning end-of-life care.

- Will: A will outlines how your assets will be distributed after your death. It allows you to specify beneficiaries and appoint guardians for dependents.

- Revocable Living Trust: This legal arrangement holds your assets during your lifetime and allows for an easier transfer of those assets upon your death, helping to avoid probate.

- Financial Power of Attorney: This document allows you to appoint someone to manage your financial matters. It can be structured to begin immediately or only when you become incapacitated, similar to a DPOA.

- Advance Directive: This comprehensive document combines elements of a living will and health care proxy, allowing you to specify medical treatment preferences and appoint someone to make decisions for you.

- Organ Donation Form: If you wish to donate your organs after death, this form communicates your wishes and can relieve your family of making that difficult decision.

- Beneficiary Designation Forms: These forms are used to name individuals who will receive proceeds from financial accounts or insurance policies upon your death, ensuring that assets are distributed according to your wishes.

Having the appropriate documents in place alongside a Durable Power of Attorney can provide peace of mind and clarity during uncertain times. These forms can work together to create a comprehensive plan that addresses both medical and financial needs.

Similar forms

Health Care Proxy: This document allows an individual to designate another person to make medical decisions on their behalf if they become incapacitated. Similar to a Durable Power of Attorney, it grants authority to act in specified situations, focusing specifically on health care matters.

Living Will: A living will outlines a person's preferences regarding medical treatment in the event they become unable to communicate their wishes. While a Durable Power of Attorney establishes a person to act on behalf, a living will directly communicates an individual’s specific medical choices.

Revocable Trust: A revocable trust is used to manage an individual's assets during their lifetime and after death. Like a Durable Power of Attorney, it allows for control over one’s financial affairs, but with a focus on asset distribution rather than decision-making authority during incapacity.

Joint Bank Account: This arrangement allows multiple individuals to manage a shared account. Similar to a Durable Power of Attorney, it permits access to financial resources but does not provide the comprehensive decision-making abilities granted under a Durable Power of Attorney.

Will: A will specifies how someone's assets will be distributed after death. While a Durable Power of Attorney manages decisions during a person’s lifetime, a will comes into effect upon death, ensuring that the individual's wishes regarding their estate are honored.

Guardian Appointment: In cases of incapacity, a guardian can be appointed to manage personal and financial matters. Both documents serve to protect an individual’s interests when they can no longer advocate for themselves, but a guardian is typically appointed through court proceedings.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it's essential to follow certain guidelines to ensure the document is accurate and effective. Below is a list of things you should and shouldn't do during this process.

Things You Should Do:

- Consult with a legal professional to understand the implications of granting power of attorney.

- Clearly identify the person you are appointing as your agent or attorney-in-fact.

- Include specific powers that you wish to grant, making sure they align with your needs.

- Sign the form in the presence of a notary public or witnesses if required by your state law.

- Keep a copy of the signed document in a safe place and share copies with your agent and relevant family members.

Things You Shouldn't Do:

- Don't rush through the form; take your time to ensure all information is accurately completed.

- Avoid vague language when stating the powers you are giving; be as clear and specific as possible.

- Do not appoint someone who may not act in your best interest or is potentially untrustworthy.

- Don’t forget to review and update the document periodically, especially if your situation changes.

Following these guidelines can assist in navigating the process of creating a Durable Power of Attorney. Ensuring clarity and understanding in this important matter can provide peace of mind for you and your loved ones.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is essential for making informed decisions about your financial and medical matters. There are several misconceptions that often lead to confusion. Here are five common myths about the DPOA:

- Myth 1: A Durable Power of Attorney is only for the elderly.

- Myth 2: A DPOA gives away control of my finances and decisions.

- Myth 3: A Durable Power of Attorney is the same as a regular Power of Attorney.

- Myth 4: I can’t change my DPOA once it's been signed.

- Myth 5: A DPOA is only for financial matters.

This is not true. Anyone at any age can create a DPOA. It’s a useful tool for all adults, especially those facing potential health issues or who want to ensure their affairs are managed if they become incapacitated.

Incorrect. A DPOA allows you to designate someone to act on your behalf if you are unable to do so. You maintain control until you become incapacitated, at which point the person you trust can step in to help.

This is a misconception. While both documents allow someone to act on your behalf, a "durable" one remains effective even if you become incapacitated, whereas a regular Power of Attorney typically ends if you lose the ability to make decisions.

That’s not accurate. You can revoke or modify your DPOA at any time, as long as you are mentally competent. It’s recommended to review this document regularly to ensure it meets your current needs.

This is misleading. While many people use it for financial decisions, a DPOA can also cover medical and healthcare decisions. You can specify what powers you want to grant, including those related to medical care.

By debunking these myths, individuals can better understand how a Durable Power of Attorney can serve their needs and provide peace of mind for the future.

Key takeaways

Filling out and using a Durable Power of Attorney (DPOA) is an important step in planning for your future and ensuring that your wishes are respected in case you become unable to make decisions for yourself. Here are some key takeaways:

- Understand the Purpose: A DPOA allows you to appoint someone you trust to make decisions on your behalf, covering financial and legal matters when you cannot do so yourself.

- Choose Your Agent Wisely: It's crucial to select a responsible and trustworthy individual to act as your agent. Consider their ability to handle financial matters competently and their willingness to respect your wishes.

- Specify Authority: Clearly outline the powers you wish to grant your agent. This can range from managing bank accounts to making healthcare decisions, depending on your needs.

- Discuss Your Wishes: Have an open conversation with your designated agent about your preferences and values. This ensures they are prepared to act in your best interests.

- Review and Revise: Regularly review your DPOA, especially after major life changes such as marriage, divorce, or relocation. Ensure it still reflects your current wishes and circumstances.

Fill out Common Types of Durable Power of Attorney Templates

What Does a Power of Attorney Form Look Like - Allows for proactive management of real estate investments by appointed agents.