Instructions on Utilizing Florida Deed in Lieu of Foreclosure

When preparing to fill out the Florida Deed in Lieu of Foreclosure form, it is essential to have all the relevant details organized. Once completed, the form must be submitted to the appropriate authority, potentially impacting the future of the property and debt involved. Below are the steps to guide you through the process of filling out the form accurately.

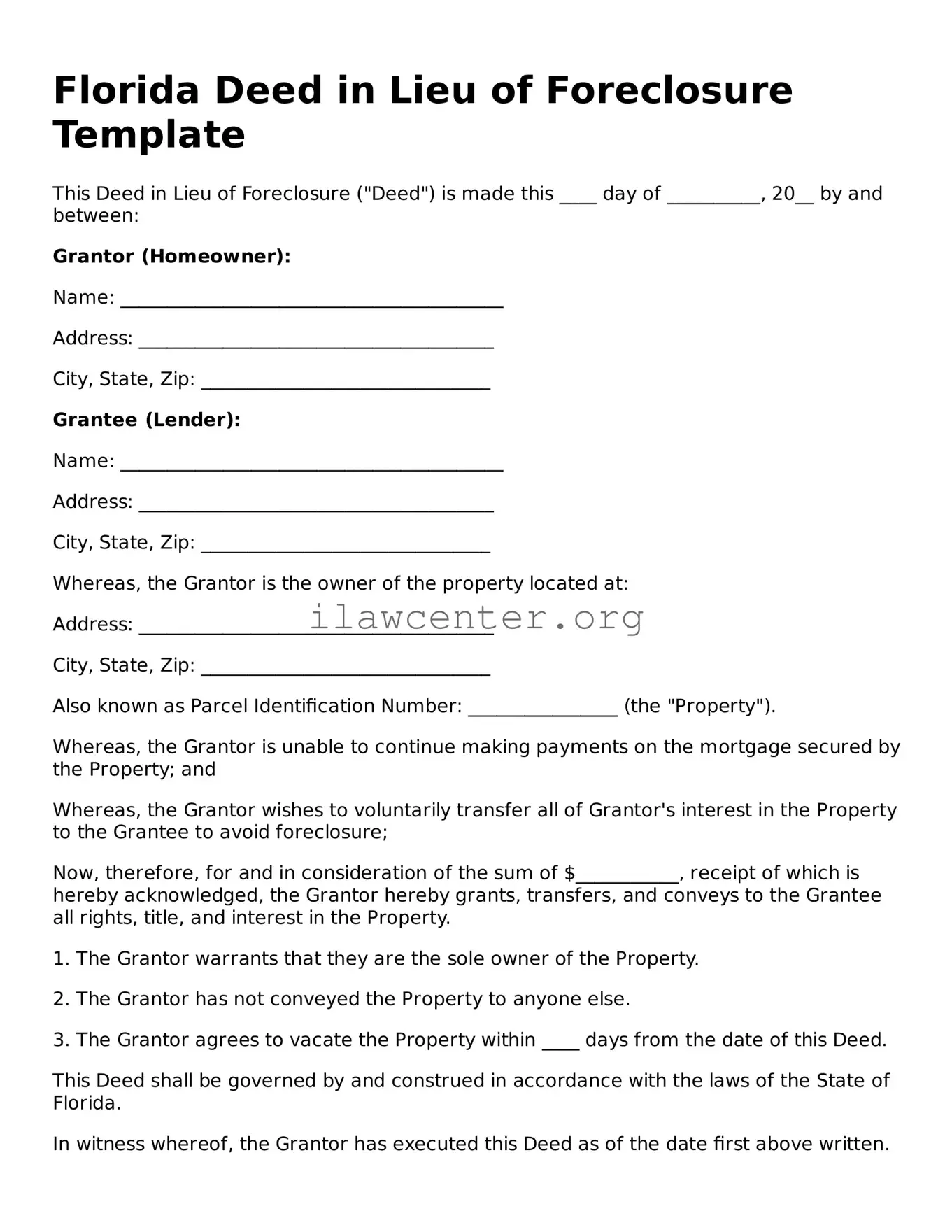

- Obtain the Form: Download or request the Florida Deed in Lieu of Foreclosure form from a reliable source, such as the county clerk’s office or a legal website.

- Read the Instructions: Review any accompanying instructions with the form to understand the information required.

- Identify the Parties: Clearly fill in the names of the grantor (the borrower) and the grantee (the lender) at the top of the form.

- Provide Property Information: Accurately enter the address and legal description of the property being transferred.

- Include Loan Information: Document the details of the mortgage, including the loan number and date of the original loan agreement.

- State Consideration: Indicate the consideration given, which is typically stated as "zero" if no money is exchanged in the deed transfer.

- Sign the Document: Ensure that the grantor signs the form in the designated area. If there are multiple grantors, each must sign.

- Notarize the Document: Have the signatures notarized to add legal validity to the form. A notary public must witness the signing.

- Submit the Form: File the completed and notarized form with the appropriate county office to finalize the deed transfer.

- Keep Copies: Make copies of the filled-out form and any related documents for personal records.