Instructions on Utilizing Florida Deed

Once you have gathered all necessary information and documents related to the property and the parties involved, you will be ready to fill out the Florida Deed form. Completing this form accurately is essential to ensure the proper transfer of property ownership and to avoid potential issues in the future.

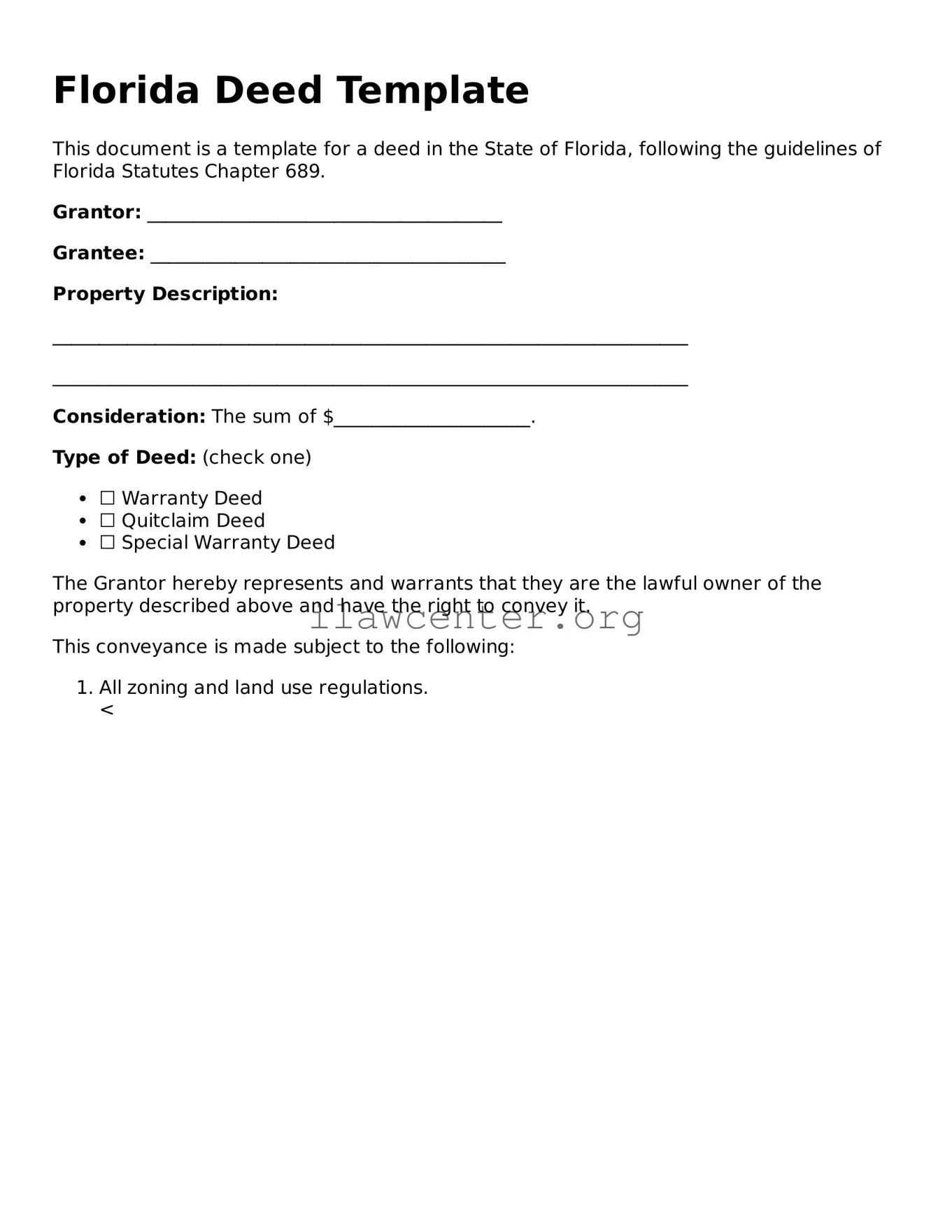

- Identify the Grantor and Grantee: Begin by filling in the names of the current owner(s) of the property (grantor) and the new owner(s) (grantee). Make sure to include any applicable titles, such as Mr., Mrs., or Ms.

- Provide Addresses: Enter the addresses of both the grantor and grantee. This helps ensure that all parties can be reached if necessary.

- Describe the Property: Detail the property being transferred. Include the legal description, which can usually be found on the most recent property tax bill or in previous deed documents.

- Include the Consideration: State the amount being exchanged for the property. This could be money, services, or other forms of consideration, depending on the nature of the transaction.

- Signatures: Ensure that the grantor signs the form in the designated area. If multiple grantors are involved, all must sign the document.

- Notarization: Locate a notary public to witness the signing of the document. The notary’s signature and seal will validate the deed.

- Review the Document: Take a moment to review the completed form for accuracy. Double-check names, addresses, the property description, and signatures.

- Record the Deed: Visit the local county office to record the deed. This step is important to make the transfer official and to protect your ownership rights.