Instructions on Utilizing Florida Durable Power of Attorney

Once you have the Florida Durable Power of Attorney form in front of you, it’s time to complete it accurately. This will help ensure that your intentions and decisions regarding financial and health-related matters are clear. Follow these steps to fill out the form properly.

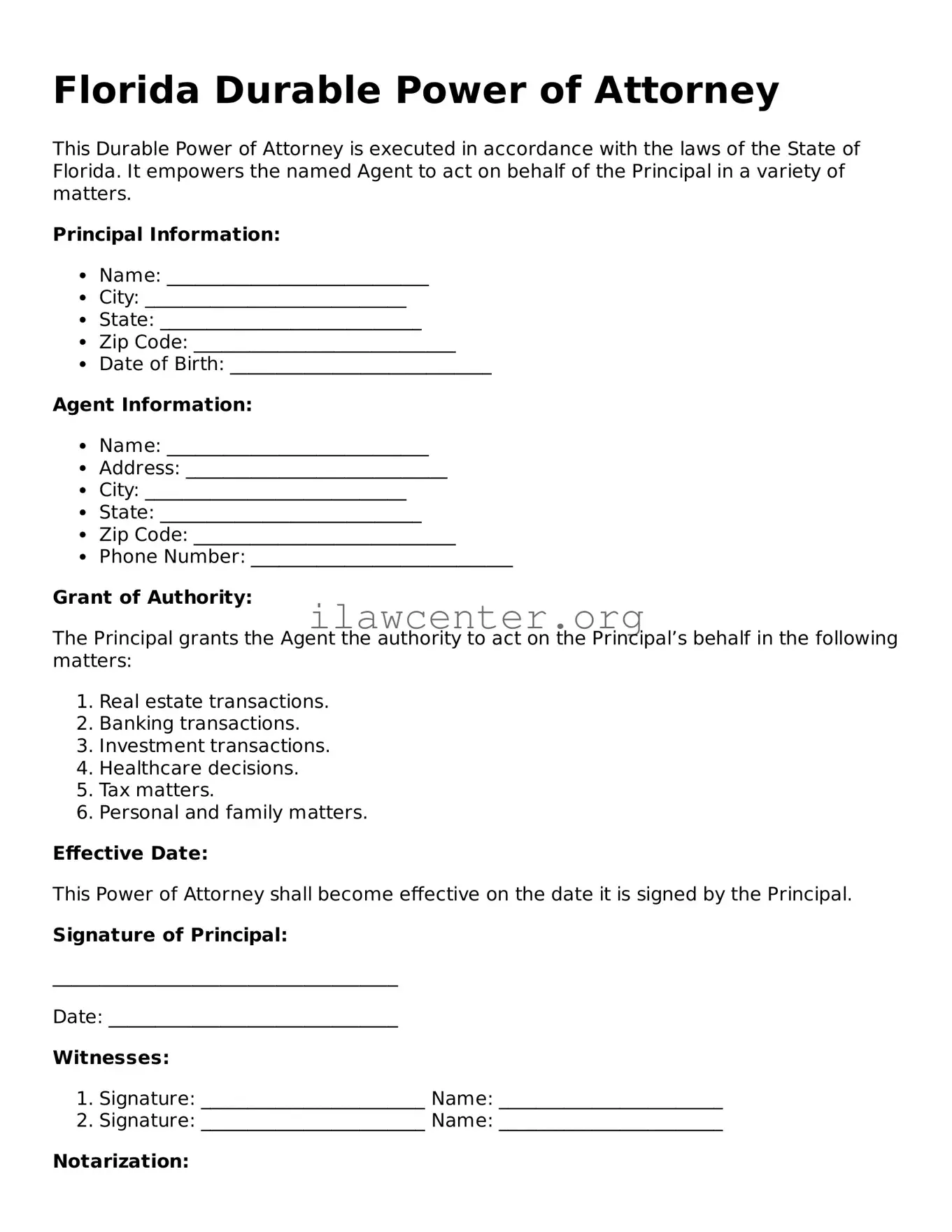

- Begin with your personal information. Write your name, address, and date of birth at the top of the form. Ensure this information is accurate.

- Identify your agent. Name the person you are appointing as your durable power of attorney. Include their full name, address, and relationship to you.

- Designate any alternate agents. If you wish to appoint one or more alternate agents, list their names and addresses in the appropriate section.

- Specify the powers granted. This section allows you to outline the specific powers your agent will have. You can choose general powers or limit them to specific tasks.

- Sign and date the form. Print your name clearly, sign it, and indicate the date of your signature.

- Have the form witnessed and notarized. In Florida, you need two witnesses who can confirm your signature, as well as a notary public. Make sure they sign the document where indicated.

After completing these steps, you will have a valid Durable Power of Attorney form ready for use. Keep a copy for your records and provide copies to your agent and any relevant parties, such as financial institutions or healthcare providers.