What is a Florida General Power of Attorney?

A Florida General Power of Attorney is a legal document that allows one person, known as the principal, to grant another person, known as the agent or attorney-in-fact, the authority to act on their behalf. The powers granted can cover a wide range of financial and legal matters, including managing bank accounts, paying bills, and making investments. It is important for the principal to clearly outline the scope of authority given to the agent in the document.

Why should I consider creating a General Power of Attorney?

Creating a General Power of Attorney can provide peace of mind. Life can be unpredictable; if a person becomes incapacitated or unable to manage their financial affairs, having this document in place ensures that someone they trust can take care of those responsibilities. It can also prevent delays and complications in managing necessary transactions during a challenging time.

Can the powers granted under a General Power of Attorney be limited?

Yes, the principal can specify which powers the agent has. While some may choose to provide broad authority, others may prefer to limit the powers to certain activities, such as managing a specific bank account or handling a particular real estate transaction. Clarity in the document is essential to avoid misunderstandings about the agent’s authority.

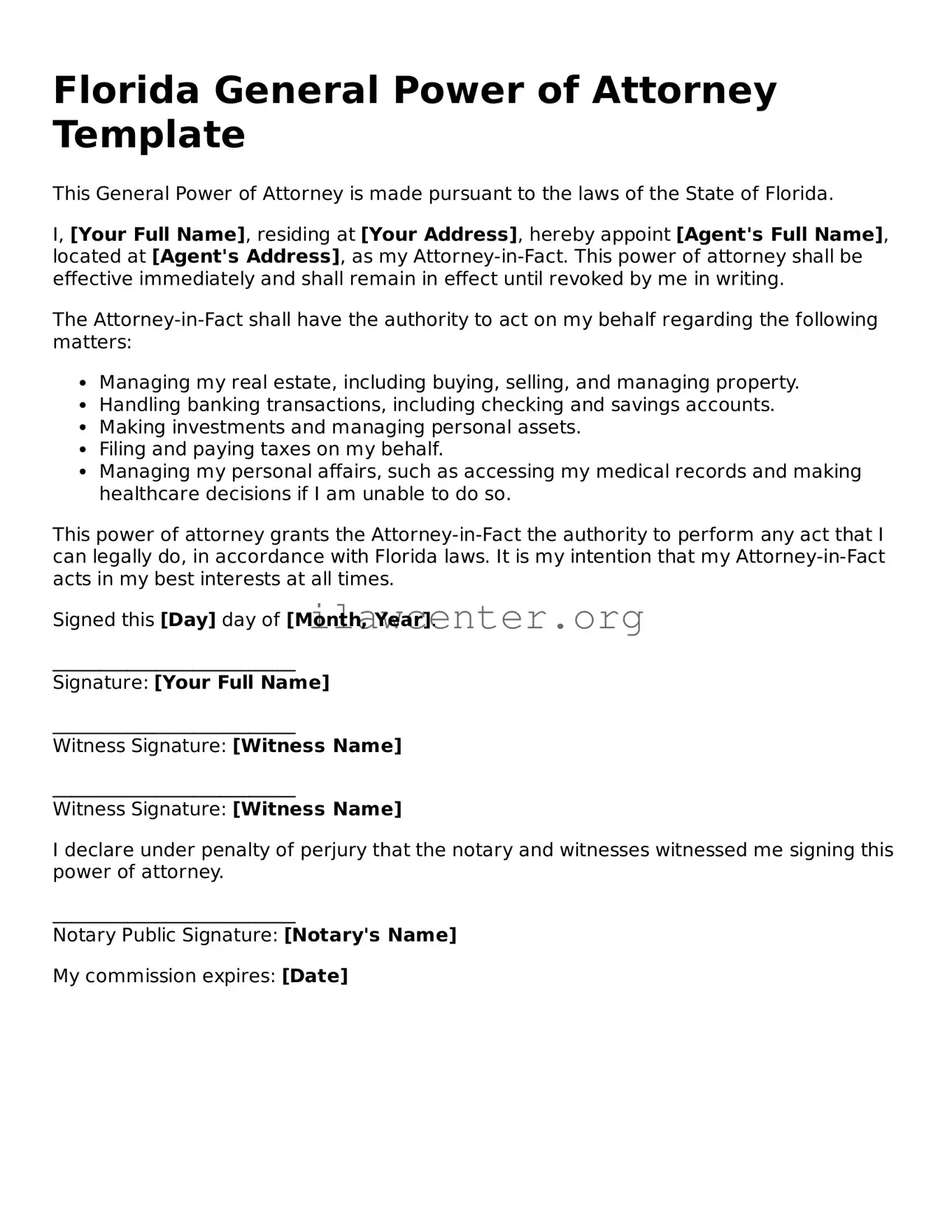

Do I need a witness or notary to create a General Power of Attorney in Florida?

Yes, in Florida, a General Power of Attorney must be signed in the presence of a notary public and two witnesses. This ensures that the document is legally valid and that the principal's intentions are clear. The witnesses cannot be the agent or the principal’s spouse or children, as this could create conflicts of interest.

What happens if I become incapacitated and do not have a General Power of Attorney in place?

If a person becomes incapacitated without having a General Power of Attorney, their loved ones may need to go through the court system to secure guardianship or conservatorship. This process can be lengthy, costly, and emotionally taxing for everyone involved. A General Power of Attorney helps streamline decision-making during critical times, avoiding potential legal challenges.

How long does a General Power of Attorney remain effective?

A General Power of Attorney remains in effect until the principal revokes it, the principal passes away, or the powers are terminated. It is important to review this document periodically, especially after major life events such as marriage, divorce, or the birth of children. Revoking or updating the document can help ensure that it still aligns with the principal's current wishes.

Can a General Power of Attorney be revoked?

Yes, a principal can revoke a General Power of Attorney at any time, as long as they are mentally competent. This can be done through a written notice to the agent and, if possible, notifying relevant financial institutions or entities that were relying on the previous document. It’s crucial to provide communication to avoid confusion and ensure that only the current wishes of the principal are honored.

What should I do once I have completed my General Power of Attorney?

After completing a General Power of Attorney, it's advisable to keep the original document in a safe place and provide copies to the agent and any relevant financial institutions. Communicating with the agent about the powers granted and discussing the principal’s expectations can also promote transparency and understanding, ensuring the agent can act effectively on behalf of the principal when needed.