What is a Lady Bird Deed in Florida?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer real estate upon death while maintaining control over the property during their lifetime. In Florida, this form is popular because it avoids probate, meaning that the property can pass directly to the beneficiaries without going through the often lengthy and costly probate process.

Who can use a Lady Bird Deed?

Any property owner in Florida can utilize a Lady Bird Deed to transfer real estate. It can be beneficial for those who want to ensure that their property goes to specific individuals upon their passing without the complexity of probate. This deed is often used by homeowners looking to pass on their home to children or other family members.

What are the advantages of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed. First, it allows the property owner to retain full control over the property while alive, including the ability to sell or modify the property without needing the consent of the beneficiaries. Additionally, since the property can pass outside of probate, it can save time and money for the heirs. Finally, this deed can protect the property from creditors if the owner requires long-term care.

Are there any disadvantages to a Lady Bird Deed?

While there are many benefits, some disadvantages should be considered. A Lady Bird Deed may not protect the property from Medicaid claims if the owner requires nursing home care. Furthermore, if the owner wishes to change beneficiaries, this requires executing a new deed. It's also worth noting that certain circumstances can complicate the validity of the deed, such as existing liens or claims against the property.

How do I create a Lady Bird Deed?

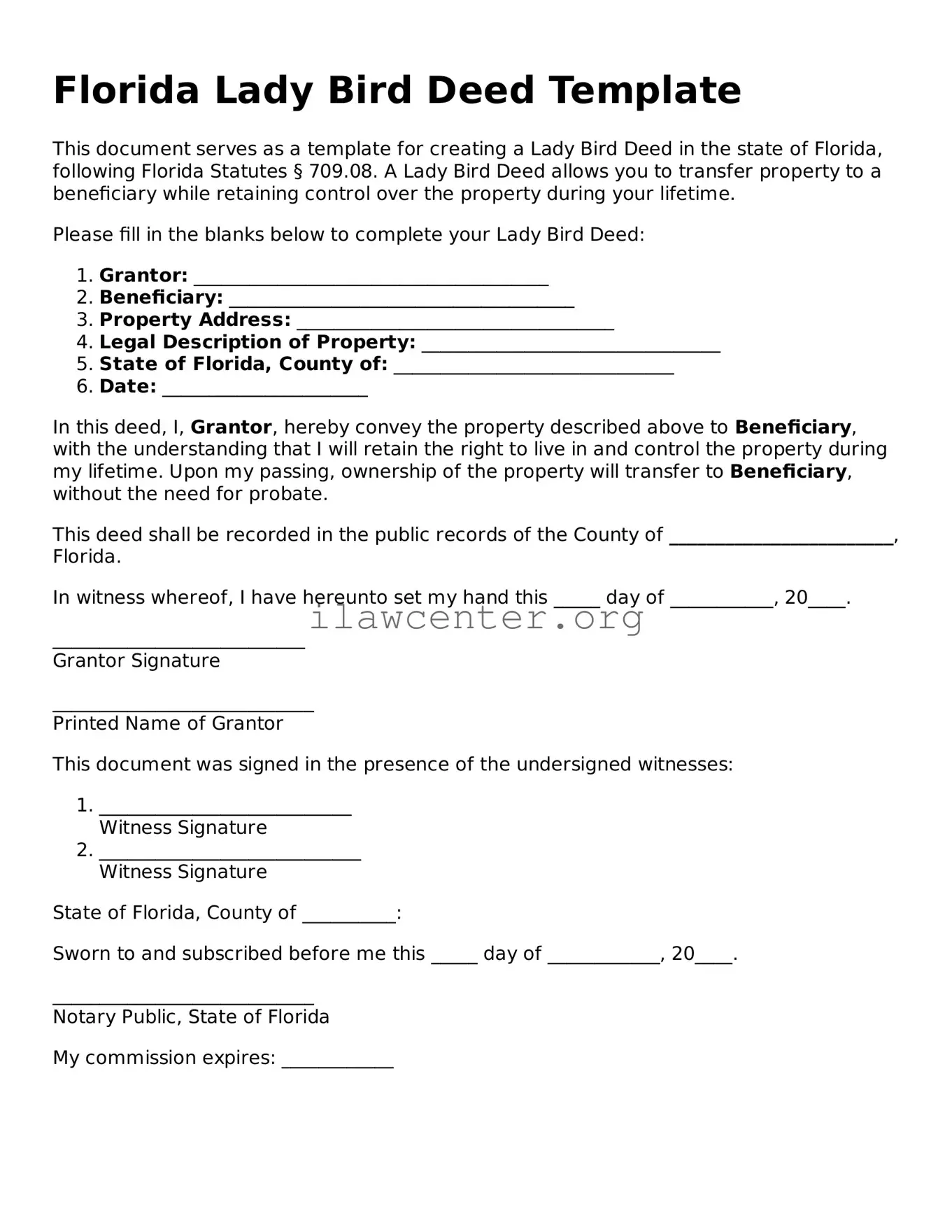

To create a Lady Bird Deed in Florida, a property owner typically needs to complete a deed form, which includes necessary details such as the legal description of the property and the names of the current owner and beneficiaries. It is advisable to have the deed notarized and recorded in the county where the property is located to ensure it is legally binding and enforceable. Consulting with a legal professional can provide more clarity and ensure all requirements are met.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or changed by the property owner at any time while they are alive and competent. This is accomplished by executing a new deed that clearly states the revocation of the previous deed or by drafting a new deed with the desired changes. It is crucial to follow proper legal procedures to ensure the changes are valid.

What happens if the property owner passes away?

Upon the death of the property owner, the property automatically transfers to the named beneficiaries without going through probate. The deed effectively bypasses probate court, streamlining the transfer process. Beneficiaries should ensure that they have a copy of the deed and may need to file it with the county clerk to establish their ownership officially.