What is a Florida Last Will and Testament?

A Florida Last Will and Testament is a legal document that outlines how a person’s assets will be distributed after their death. It allows individuals to specify their wishes regarding the distribution of wealth and property, as well as appoint guardians for minor children if applicable. This document serves to ensure that your intentions are respected and carried out by your loved ones and the court.

Who can create a Last Will and Testament in Florida?

In Florida, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. Being "of sound mind" means that the individual understands the nature of their actions, the extent of their property, and the people who are to benefit from the will. It’s an important requirement to ensure that the document reflects the true wishes of the creator.

What happens if I die without a will in Florida?

If someone dies without a will, they are said to be "intestate." In Florida, state laws will determine how their assets are distributed. This process might not align with the deceased’s wishes, potentially leading to disputes among family members. It is generally advisable to prepare a will to ensure that your specific wishes are honored.

Do I need a lawyer to create a Last Will and Testament in Florida?

While it is not legally required to have a lawyer draft a Last Will and Testament, it is advisable, especially for complicated estates. A lawyer can provide guidance and ensure that all legal requirements are met, reducing the chances of future disputes. However, there are also templates available that can be used for simpler wills.

What are the requirements for a valid will in Florida?

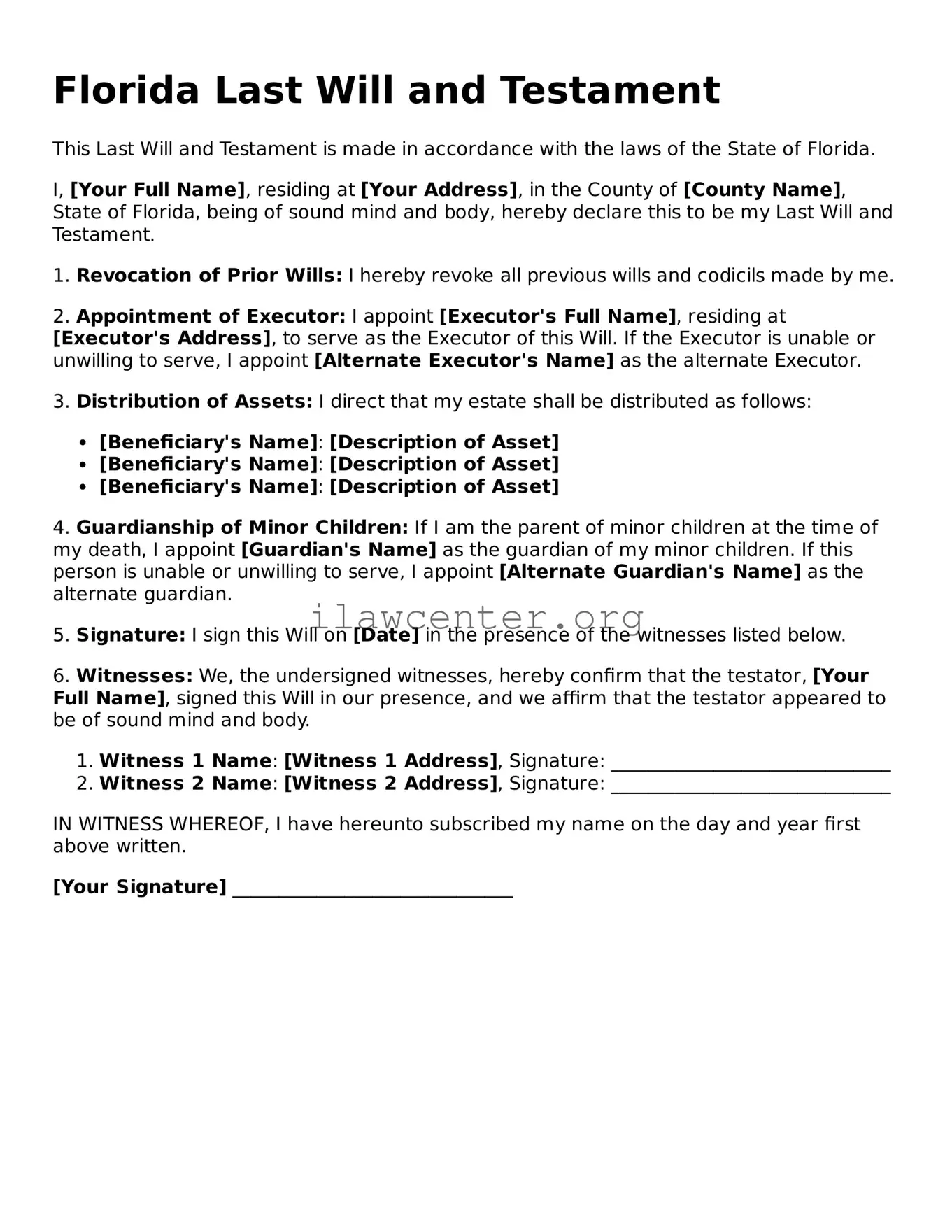

For a will to be valid in Florida, it must be in writing, signed by the person making the will (the testator), and witnessed by two individuals who are at least 18 years old. The witnesses must also sign the will in the presence of the testator. This process ensures that there is a clear and legally recognized record of the testator's wishes.

Can I change or revoke my will in Florida?

Yes, you can change or revoke your will at any time as long as you are of sound mind. To make changes, you can create a new will that explicitly revokes any previous ones or write a codicil, which is an amendment to the existing will. It’s crucial to follow the same legal formalities for these changes to be valid.

What should I include in my Last Will and Testament?

To create a comprehensive Last Will and Testament, consider including details about asset distribution, the appointment of an executor to manage your estate, and the designation of guardians for any minor children. It may also be beneficial to include specific bequests for sentimental items to ensure your intentions are clear.

How is a Last Will and Testament executed in Florida?

To execute a Last Will and Testament in Florida, the testator must sign the document in the presence of two witnesses, who must also sign it. This process should take place in the same room, and it's important that the witnesses are not beneficiaries of the will to avoid conflicts. Once executed, the will should be kept in a safe place and easily accessible to loved ones or the appointed executor.

What role does an executor play in a will?

An executor is the person appointed to carry out the instructions laid out in your will. This individual is responsible for managing your estate, paying any debts, and distributing assets according to your wishes. Choosing a trustworthy executor is essential, as they will have significant responsibilities during a challenging time for your loved ones.