What is a Florida Power of Attorney form?

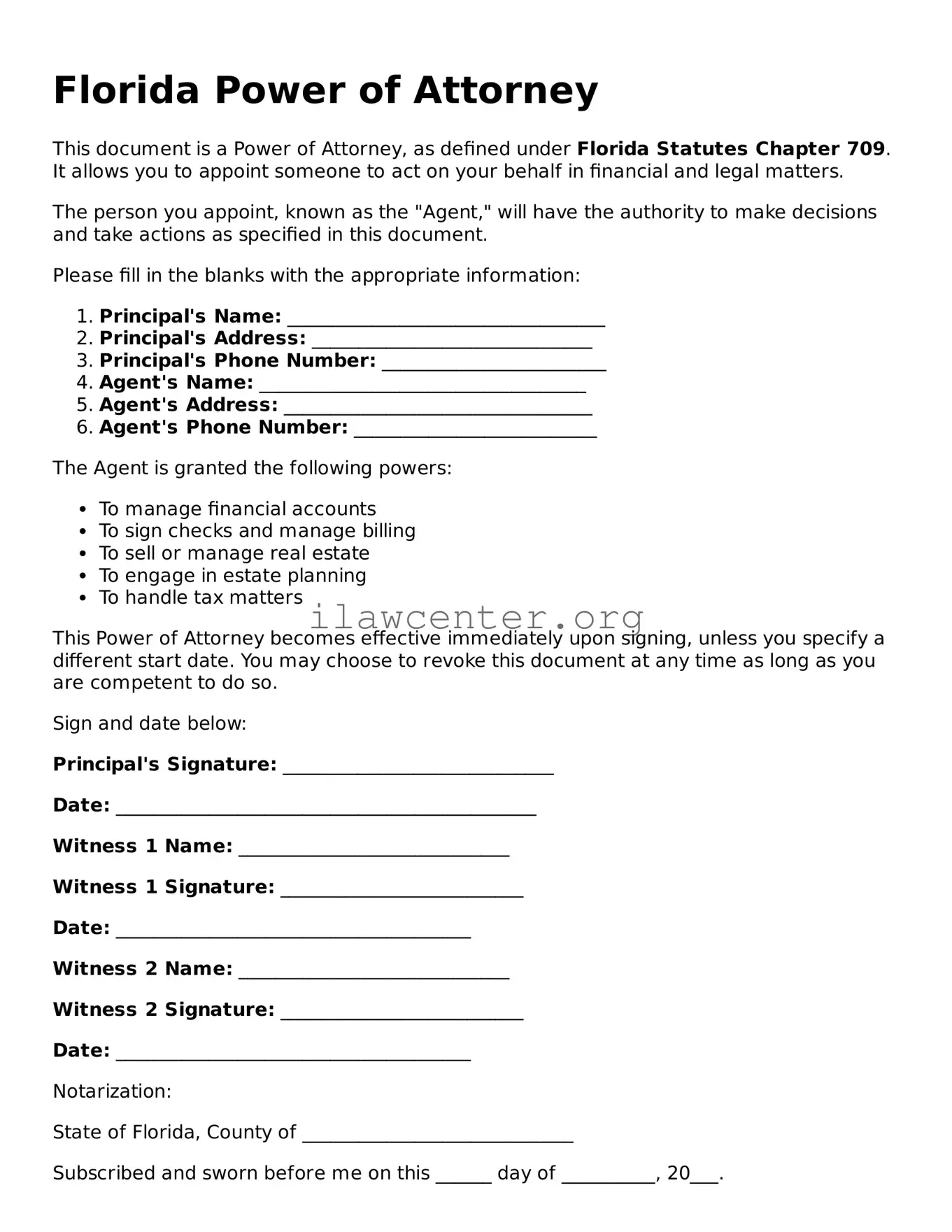

A Florida Power of Attorney form is a legal document that allows an individual, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This document can grant wide-ranging authority or be limited to specific tasks, such as financial management, health care decisions, or real estate transactions. The Power of Attorney can take effect immediately or become effective upon a certain event, such as the principal becoming incapacitated.

Why would someone need a Power of Attorney?

Having a Power of Attorney in place can provide peace of mind. It allows individuals to ensure that their financial and health care decisions are handled according to their wishes if they become unable to make decisions themselves. This could be due to illness, an accident, or advanced age. A Power of Attorney can avoid potential conflicts and ensure that trusted individuals make important decisions.

Can I revoke a Power of Attorney in Florida?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To revoke it, you should create a written revocation document and notify the agent and any third parties who may have relied on the original Power of Attorney. It’s recommended to also destroy any copies of the original document to prevent confusion.

How do I choose an agent for my Power of Attorney?

Choosing an agent is an important decision. It’s best to select someone you trust completely—this could be a family member, a close friend, or a professional such as an attorney. Consider the person’s ability to handle financial matters, their willingness to act in your best interests, and their understanding of your wishes. Openly discuss your expectations and desires with potential agents before making a decision.

Does a Power of Attorney need to be notarized in Florida?

Yes, in Florida, a Power of Attorney must be signed in the presence of a notary public. Additionally, if the document grants powers relating to real estate, the signature of the principal must also be witnessed by two individuals. The notarization and witnessing help to ensure the document’s validity and protect against potential fraud.

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become unable to make decisions for yourself, your loved ones may need to go through a legal process called guardianship. This process can be time-consuming, costly, and may not align with your wishes. A Power of Attorney helps avoid such complications by allowing you to plan ahead and designate someone you trust to make decisions on your behalf.