What is a Florida prenuptial agreement?

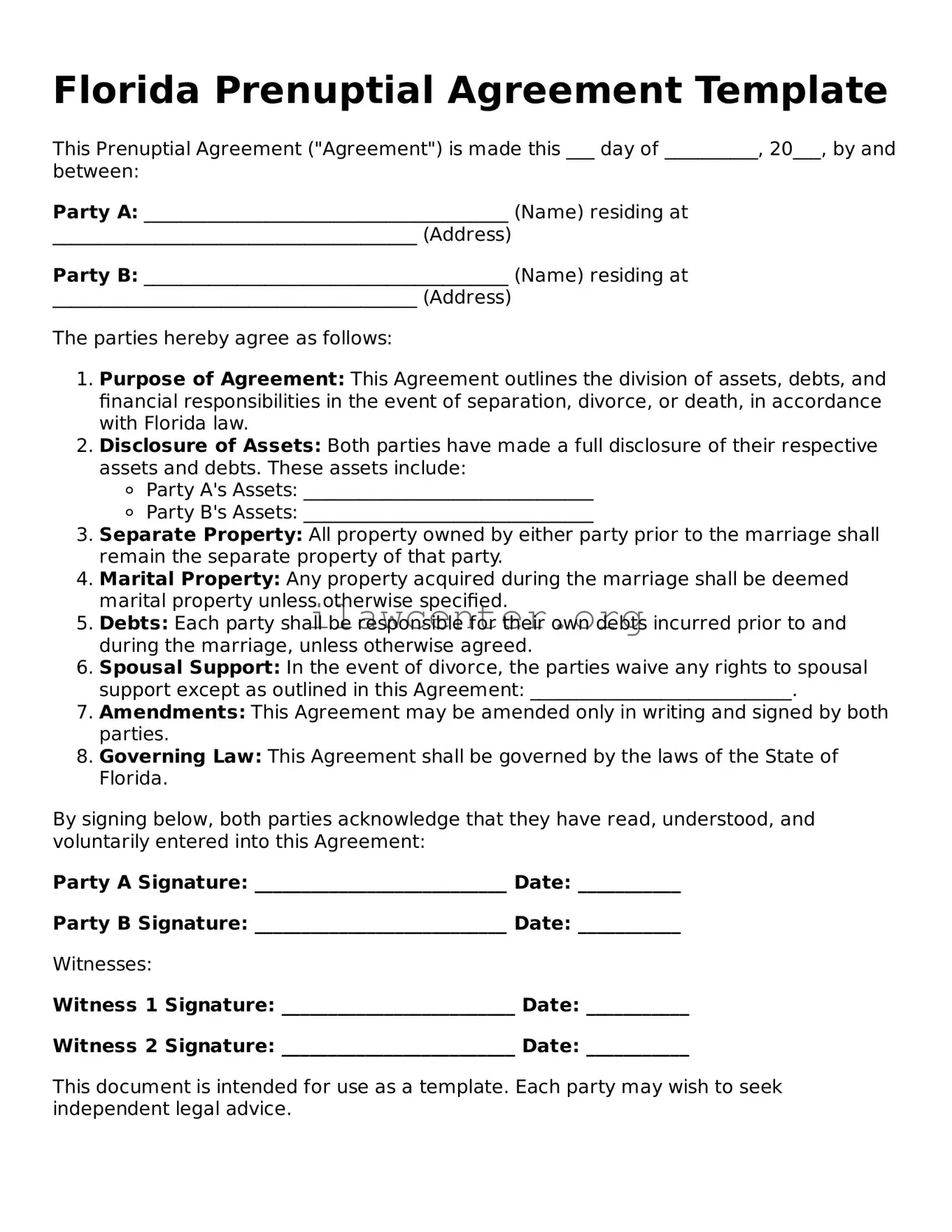

A Florida prenuptial agreement is a legal document created by two individuals before they get married. It outlines how assets and debts will be managed during the marriage and what will happen if the marriage ends through divorce or death. It helps protect individual assets and can address spousal support, property division, and more.

Why should I consider a prenuptial agreement?

Many couples choose prenuptial agreements to ensure clarity and security regarding their financial future. This agreement can protect individual wealth, clarify financial responsibilities during the marriage, and reduce conflicts in case of a divorce. It’s especially important for those with significant assets, business ownership, or children from previous relationships.

What should be included in a Florida prenuptial agreement?

A comprehensive Florida prenuptial agreement can cover various topics such as the division of property, spousal support obligations, management of debts, and any specific terms unique to your situation. Each couple's agreement should be tailored to their needs and financial circumstances. It’s crucial to be transparent about your finances with your partner.

How do we create a prenuptial agreement?

Creating a prenuptial agreement typically involves discussions between both parties about their financial situations and desires for the marriage. It’s advisable to consult a lawyer who specializes in family law to draft the agreement. Both parties should have independent legal representation to ensure fairness and avoid conflicts of interest.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified after marriage. Both spouses must agree to any changes, and it’s essential to document these changes formally. Like the original agreement, any modifications should also be created with legal assistance to ensure they are enforceable.

Is a prenuptial agreement enforceable in Florida?

Yes, prenuptial agreements are generally enforceable in Florida, provided they meet certain requirements. These include written form, voluntary execution by both parties, full disclosure of assets, and fair terms. If any of these elements are missing, the agreement may face challenges in court.

What if I don’t have a prenuptial agreement?

If you don’t have a prenuptial agreement, Florida law will dictate how your assets and debts will be divided in case of divorce. Florida is an equitable distribution state, meaning assets will be divided fairly but not necessarily equally. Without an agreement, determining what is “fair” can lead to complications and disputes.

When should we start discussing a prenuptial agreement?

It’s best to discuss a prenuptial agreement well before the wedding. Initiating the conversation early allows both partners to consider the implications and address concerns without the pressure of an impending marriage. Open, honest communication is key to ensuring both parties feel comfortable with the agreement.