What is a Florida Quitclaim Deed?

A Florida Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without making any guarantees about the title. It essentially conveys whatever interest the seller has in the property at the time of the transfer. The grantor (the person transferring ownership) does not provide any warranties or claims about the property's title, which means that the buyer (the grantee) assumes the risk associated with any potential title issues.

When should I use a Quitclaim Deed in Florida?

A Quitclaim Deed is commonly used in situations where the parties know each other well, such as transferring property between family members, adding or removing a spouse from a title, or during a divorce settlement. It is appropriate when the grantor wants to quickly transfer their interest without the formalities and guarantees that come with a warranty deed.

Are there any specific requirements for a Quitclaim Deed in Florida?

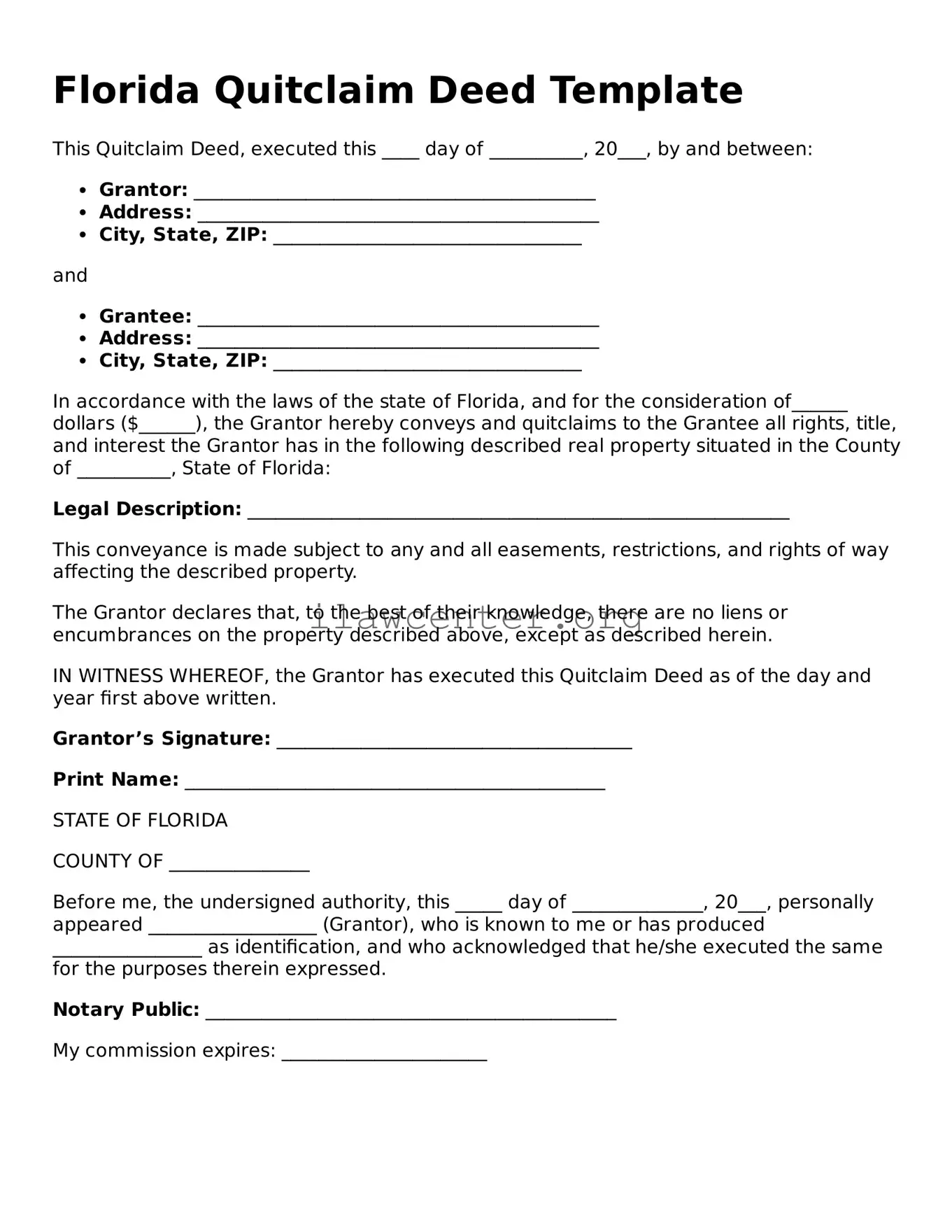

Yes, there are several requirements for a Quitclaim Deed to be valid in Florida. The deed must be in writing, must include a description of the property, and must be signed by the grantor. Additionally, it is important to have the deed notarized and recorded with the appropriate county clerk’s office to provide public notice of the transfer. This ensures that the transfer becomes part of the public record.

Does a Quitclaim Deed eliminate all claims on the property?

No, a Quitclaim Deed does not eliminate all claims on the property. Since the grantor does not guarantee a clear title, any previous claims or liens on the property still exist even after the transfer. It is advisable for the grantee to conduct thorough research on the title and consider obtaining title insurance to protect against potential issues.

What fees are associated with filing a Quitclaim Deed in Florida?

Filing a Quitclaim Deed typically involves some fees, including recording fees charged by the county clerk’s office. These fees can vary by county. Additionally, if you choose to have the deed prepared by a legal professional, there may be costs associated with that service. It is essential to budget for these costs when considering a quitclaim transfer.

Can a Quitclaim Deed be revoked once it is executed?

No, a Quitclaim Deed cannot be revoked once it has been executed and recorded. The transfer of ownership is final, and the grantor cannot take back the deed or reclaim ownership of the property. If the grantor wishes to regain ownership, it would require a different legal process, typically involving a new deed or court action.

Do I need an attorney to prepare a Quitclaim Deed in Florida?

While it is not legally required to have an attorney prepare a Quitclaim Deed in Florida, it is often recommended. An attorney can ensure that all legal requirements are met and can provide guidance on the implications of the transfer. This can help prevent any unintended issues or errors, making the process smoother and more secure.