Instructions on Utilizing Florida Transfer-on-Death Deed

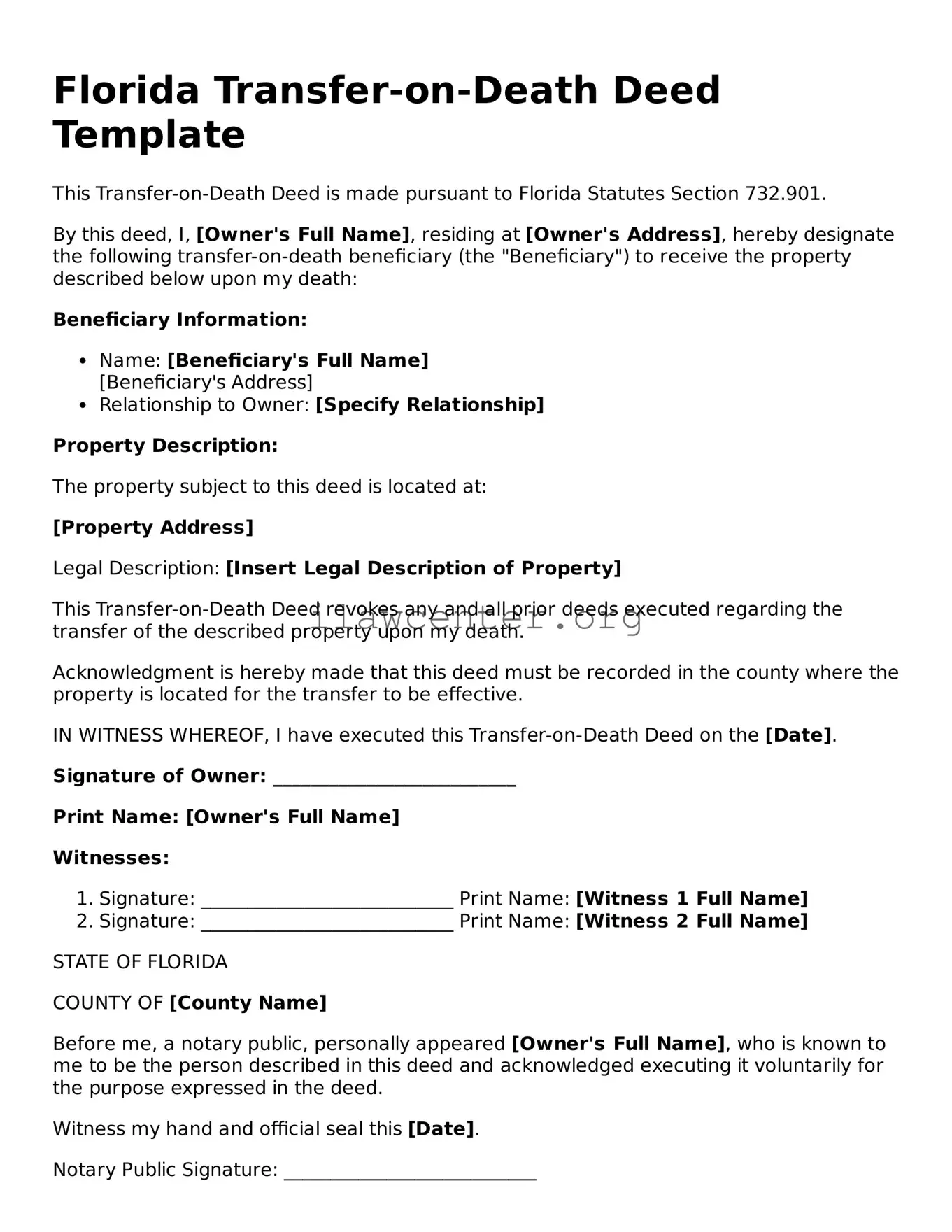

Once you have your Florida Transfer-on-Death Deed form ready, it’s important to carefully fill it out. This form allows you to designate beneficiaries who will receive ownership of your property after your death. Ensuring accurate information will prevent any complications later on.

- Begin by entering your name as the current property owner at the top of the form.

- Provide your current address immediately after your name.

- Next, fill in the legal description of the property you wish to transfer. This may include the address, parcel number, and any other required identifiers.

- Include the name(s) of your designated beneficiary or beneficiaries. Make sure to double-check the spelling.

- List the relationship of your beneficiaries to you, if applicable. This can be family, friends, or any other individuals.

- Sign the form in the designated area. It must be signed in front of a notary public.

- After signing, ensure the notary public fills out the notary section, confirming your identity and witnessing your signature.

- Finally, file the completed deed with the county clerk's office where the property is located. Make sure to keep a copy for your records.

Completing this form accurately is the first step in ensuring your wishes are honored. After filing, it’s good to inform your beneficiaries and keep them updated on any changes in your property or wishes.