Fillable General Power of Attorney Document

A General Power of Attorney form is a powerful legal document that allows one person to grant another the authority to act on their behalf in a variety of financial and legal matters. By using this form, individuals can ensure their interests are managed effectively, even if they become unable to do so themselves. Ready to take control of your financial future? Fill out the form by clicking the button below!

The General Power of Attorney form serves as a crucial legal document that allows one individual—known as the principal—to designate another individual, the agent, with the authority to make decisions and take actions on their behalf. This form typically encompasses a broad range of powers, enabling the agent to handle financial transactions, manage property, and make legal decisions that align with the principal's interests. Importantly, the authority granted can be comprehensive, covering everything from managing bank accounts and paying bills to buying or selling real estate. It can be activated immediately or take effect upon the principal's incapacity, depending on how it is structured. Additionally, while this document provides significant leverage to the agent, it also requires a high level of trust, as the agent is expected to act in the best interest of the principal. Understanding the implications of this form is vital, as it reflects not only a practical arrangement for managing affairs but also a relationship grounded in fiduciary responsibility. Clear communication of the principal's intentions and the scope of powers granted can prevent potential misuse and ensure that the agent effectively represents the principal's wishes.

General Power of Attorney Preview

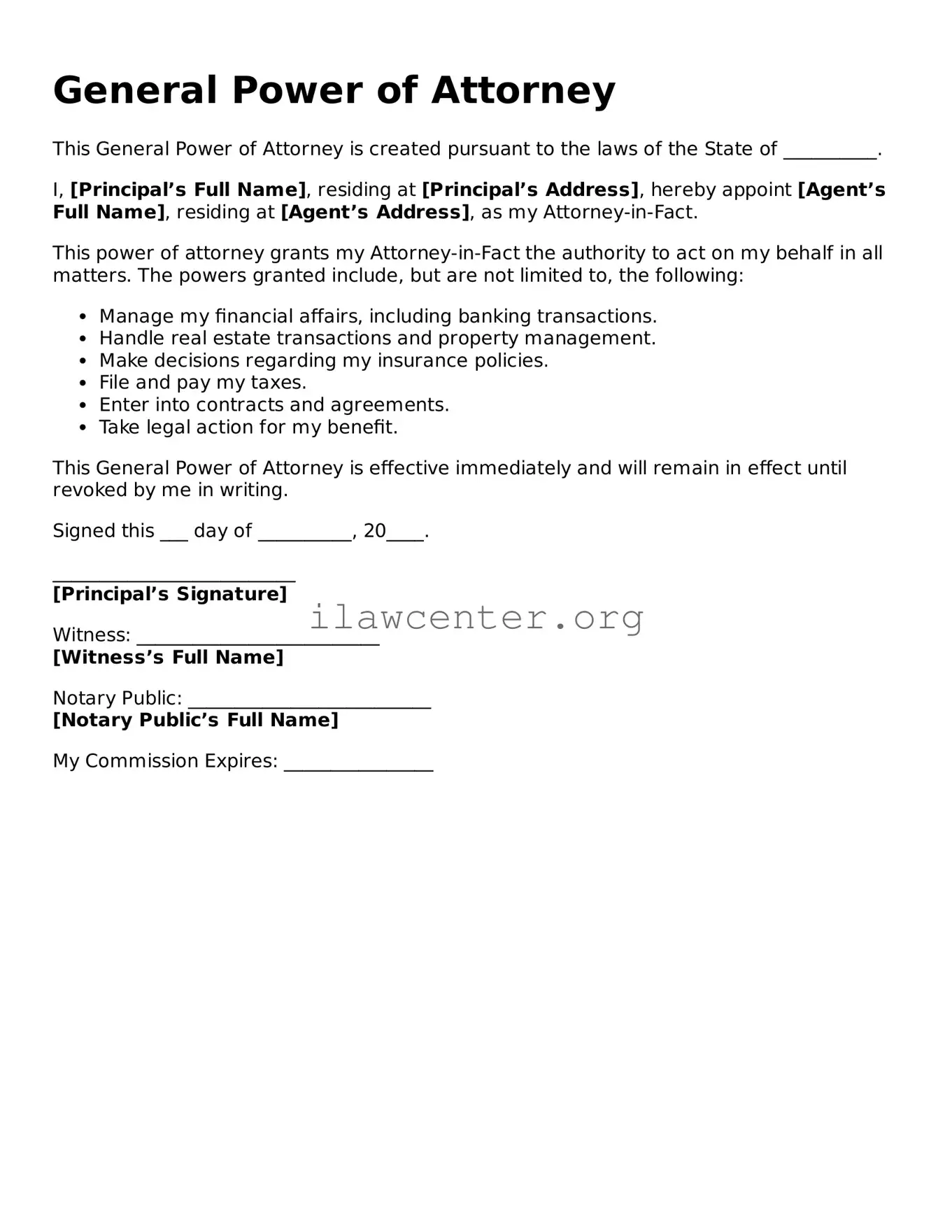

General Power of Attorney

This General Power of Attorney is created pursuant to the laws of the State of __________.

I, [Principal’s Full Name], residing at [Principal’s Address], hereby appoint [Agent’s Full Name], residing at [Agent’s Address], as my Attorney-in-Fact.

This power of attorney grants my Attorney-in-Fact the authority to act on my behalf in all matters. The powers granted include, but are not limited to, the following:

- Manage my financial affairs, including banking transactions.

- Handle real estate transactions and property management.

- Make decisions regarding my insurance policies.

- File and pay my taxes.

- Enter into contracts and agreements.

- Take legal action for my benefit.

This General Power of Attorney is effective immediately and will remain in effect until revoked by me in writing.

Signed this ___ day of __________, 20____.

__________________________

[Principal’s Signature]

Witness: __________________________

[Witness’s Full Name]

Notary Public: __________________________

[Notary Public’s Full Name]

My Commission Expires: ________________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A General Power of Attorney allows one person to appoint another to act on their behalf in legal and financial matters. |

| Scope of Authority | The agent can handle a wide range of activities, from managing bank accounts to signing documents. |

| Durability | It can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| State-Specific Laws | Each state has its own rules. In California, it follows the California Probate Code, while Texas adheres to the Texas Estates Code. |

| Requirements | Generally, the form must be signed by the principal and may need witnesses or notarization, depending on state laws. |

| Common Use Cases | Individuals commonly use it for financial management, healthcare decisions, or during travel. |

| Limitations | Some decisions, such as making a will, typically cannot be delegated through a General Power of Attorney. |

| Agent's Responsibility | The agent must act in the best interest of the principal and can be held accountable for mismanagement. |

Instructions on Utilizing General Power of Attorney

Filling out the General Power of Attorney form is an important step in designating someone to handle your financial and legal decisions. Here’s what to do next to ensure everything is completed correctly and efficiently.

- Obtain the General Power of Attorney form. You can find templates online or at a local office supply store.

- Carefully read through the entire form to understand what information you will need to provide.

- Fill in your full name and address in the designated sections. This identifies you as the principal.

- Enter the name and address of your chosen agent, the person you trust to act on your behalf.

- Specify the powers you want to grant the agent. This may include managing finances, selling property, or making health care decisions.

- Decide on any limitations to the powers granted. Clearly outline anything your agent should not do.

- Include an effective date. This can be immediate or set to activate at a later date.

- Sign and date the form in the appropriate section to make it official. Consider having a witness present.

- Consider getting the form notarized. While not always required, notarization adds an extra layer of validation.

- Keep copies of the finalized form in a safe place and give a copy to your agent.

Important Facts about General Power of Attorney

What is a General Power of Attorney?

A General Power of Attorney is a legal document that grants an individual, often referred to as the “agent” or “attorney-in-fact,” the authority to act on behalf of another person, known as the “principal.” This authority encompasses a broad range of decisions, including managing financial matters, handling property transactions, and making legal decisions. It is essential for individuals who anticipate a need for someone else to manage their affairs, either due to health reasons or other circumstances that may impede their ability to do so.

When should I consider using a General Power of Attorney?

Individuals may want to create a General Power of Attorney in various situations. If you are facing a medical condition that might impair your capacity to make decisions, or if you are planning to travel for an extended period, having such a document can ensure that your financial and legal matters are managed appropriately. Additionally, it can be beneficial for seniors looking to delegate responsibilities to a trusted family member or friend.

What powers does a General Power of Attorney typically grant?

The powers granted under a General Power of Attorney can be extensive. They often include managing bank accounts, paying bills, buying or selling property, making investment decisions, and handling tax matters. However, it is crucial to note that the principal can define the scope of these powers. Customization can occur based on individual needs and preferences, ensuring that the agent acts in the principal's best interest.

Does a General Power of Attorney remain in effect if the principal becomes incapacitated?

A General Power of Attorney typically becomes ineffective if the principal becomes incapacitated. For those who wish to provide continued authority regardless of their health status, a Durable Power of Attorney is a more appropriate choice. A Durable Power of Attorney remains valid even in the event of the principal’s incapacity, ensuring that their affairs can be managed continuously.

Can I revoke a General Power of Attorney?

Yes, a General Power of Attorney can be revoked by the principal at any time, as long as they are competent. To revoke the document, the principal should provide written notice to the agent and anyone who had been relying on the General Power of Attorney. It is also advisable to formally terminate the existing document and, if necessary, create a new power of attorney to designate a different agent.

What should I consider when choosing an agent?

Selecting an agent is a significant decision that should involve careful consideration. Choose someone you trust implicitly, as this person will have access to your financial and personal matters. Ideally, the agent should demonstrate reliability, good judgment, and a willingness to act in your best interest. It is also helpful to discuss the responsibilities with the chosen agent to ensure they understand the role they are taking on.

Are there any risks associated with a General Power of Attorney?

Yes, there are potential risks involved with granting a General Power of Attorney. The primary concern is the risk of misuse of power. Trustworthiness is paramount, as the agent holds considerable authority over the principal's affairs. To mitigate risks, it’s advisable to limit the powers granted, monitor the agent's actions, and maintain transparency. All parties involved, including family members, should be informed of the arrangements to provide additional oversight and support.

Common mistakes

Filling out a General Power of Attorney (GPOA) form can be a straightforward process, but individuals often make common mistakes that can lead to complications. One of the most frequent errors is failing to specify the powers granted. The GPOA allows individuals to delegate authority to another person, but without detailing those powers, the document may be ambiguous. This lack of clarity can create confusion about the agent's capabilities.

Another common mistake is not signing the document properly. While it may seem trivial, the requirements for signing a GPOA can vary by state. Generally, the principal, or the person granting powers, must sign the document, and some jurisdictions may require witnesses or notarization. Omitting these necessary steps can render the document invalid.

People also tend to overlook the importance of choosing the right agent. While it may be convenient to appoint a family member or friend, they may not always be the best choice. An agent should be trustworthy and capable of handling the responsibilities that come with the authority granted. If the wrong person is selected, it can lead to disputes or a lack of confidence in managing important decisions.

Moreover, individuals sometimes forget to review or update their GPOA after life changes occur. Events such as marriage, divorce, or the death of a designated agent can significantly impact the effectiveness of the document. Regularly reviewing the GPOA ensures that it reflects current wishes and situations, which is critical for its intended purpose.

Finally, many individuals neglect to discuss their intentions with their chosen agent. Clear communication is essential in a GPOA. If the designated agent is unaware of the principal’s wishes, they may unintentionally make decisions that do not align with the principal's values or preferences. Ensuring that the agent understands their responsibilities is key to achieving the desired outcomes.

Documents used along the form

The General Power of Attorney form is a crucial document, allowing someone to make decisions on your behalf. However, other forms and documents often work alongside it to ensure all aspects of your affairs are covered. Below are several documents you may also consider.

- Durable Power of Attorney: Similar to a General Power of Attorney, this document remains valid even if you become incapacitated. It ensures continued management of your affairs when you cannot do so yourself.

- Healthcare Power of Attorney: This form specifically designates someone to make medical decisions for you if you are unable to do so. It covers everything from treatment options to end-of-life care decisions.

- Living Will: A Living Will expresses your wishes concerning medical treatment in situations where you may not be able to communicate your preferences. It provides guidance to your healthcare agents.

- Will: A Will details how you want your assets distributed after your passing. It appoints an executor to manage your estate and can include guardianship provisions for minor children.

- Trust: A Trust holds assets for a beneficiary. It can help avoid probate and allows for more control over how your assets are distributed and managed.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization: This form allows designated individuals to access your medical information. It's crucial when you need others to make informed decisions about your care.

- Financial Worksheets: These documents gather all your financial information, including accounts, debts, and assets. They provide your designated agent with a comprehensive view of your financial situation.

- Asset Inventory List: This list details your personal belongings and assets. It is useful for your agent to understand what you own and how best to manage your property.

Having these documents in place can provide peace of mind, ensuring your wishes are honored and your affairs are managed smoothly. Consider discussing these options with a trusted advisor or legal professional to determine what best meets your needs.

Similar forms

- Durable Power of Attorney: This document allows someone to make decisions on your behalf, even if you become incapacitated. Unlike a general power of attorney, it remains effective even when you cannot manage your affairs yourself.

- Limited Power of Attorney: In contrast to a general power of attorney, this form restricts the agent's authority to specific tasks or time periods. It grants the agent power only for certain matters, such as handling a real estate transaction.

- Health Care Proxy: This document appoints a person to make medical decisions for you if you are unable to communicate your wishes. It focuses on health care decisions, unlike a general power of attorney which can cover a wide range of matters.

- Living Will: A living will expresses your wishes regarding medical treatment in situations where you may not be able to state them yourself. While it specifies treatment preferences, a general power of attorney grants broader authority to an agent.

- Financial Power of Attorney: Similar to the general power of attorney, this document allows someone to manage your financial affairs. However, it is often more focused on financial matters specifically rather than a broader range of responsibilities.

- Trust: A trust can manage your assets during your lifetime and after. While both instruments can distribute assets, a trust does so under specific terms, while a general power of attorney allows for more immediate control and decision-making.

Dos and Don'ts

When filling out a General Power of Attorney form, it's essential to be careful and thorough. Here is a helpful list of what you should and shouldn't do in this process:

- Do: Clearly identify the principal and the agent by providing their full names and addresses.

- Do: Specify the powers you are granting to your agent, making sure to include only those you wish to authorize.

- Do: Ensure the document is signed and dated in the presence of a notary public to enhance its validity.

- Do: Keep a copy of the completed form in a safe place and provide copies to your agent and any relevant parties.

- Don't: Leave any blank spaces on the form, as this could lead to potential misunderstandings or misuse of authority.

- Don't: Use vague language. Be specific about the decisions you are allowing your agent to make on your behalf.

- Don't: Assume that the form does not need to be updated. Review and revise the document if your circumstances change.

- Don't: Forget to check the laws in your state, as requirements for a valid Power of Attorney can vary.

Misconceptions

When it comes to legal documents, misunderstandings are common. The General Power of Attorney (GPOA) form is no exception. Here’s a breakdown of some common misconceptions about this important legal tool:

- A General Power of Attorney is the same as a Durable Power of Attorney. Many people believe these two are interchangeable. However, a General Power of Attorney becomes invalid if the principal (the person who grants authority) becomes incapacitated, while a Durable Power of Attorney remains valid under those circumstances.

- Anyone can be appointed as an agent without limitations. It’s a common belief that there are no restrictions on who can serve as an agent under a GPOA. In reality, individuals must be legally competent and often at least 18 years old to be appointed.

- The General Power of Attorney allows an agent to make any decision on behalf of the principal. While an agent does have wide-ranging authority, they are bound to act in the best interest of the principal and must only perform tasks specified within the document.

- Once a GPOA is signed, it cannot be revoked. This is not true. The principal retains the right to revoke the GPOA at any time, provided they are capable of making decisions. This ensures that control remains with the principal.

- A General Power of Attorney must be filed with the court to be valid. Unlike some legal documents, a GPOA typically does not need to be filed with a court. It becomes effective as soon as it is signed, although some institutions may require a copy for their records.

- A General Power of Attorney is only for financial matters. While many use it for financial decisions, a GPOA can also be used to grant authority for health care decisions, property management, and more, depending on how it is written.

- If I have a General Power of Attorney, I don’t need a will. Some individuals think having a GPOA eliminates the need for a will. However, these documents serve different purposes. A GPOA manages decisions while the principal is alive, while a will outlines how assets are distributed after death.

- A General Power of Attorney is only useful in emergencies. While it can be a great help during unexpected situations, many use this form to plan for future needs, like travel or hospitalization.

Understanding these misconceptions can help individuals make informed decisions when considering a General Power of Attorney. It’s always advisable to seek guidance to ensure that you have the right documentation to fit your unique needs.

Key takeaways

Understanding the General Power of Attorney form is essential for anyone considering granting authority to another individual to act on their behalf. Below are key points to keep in mind when filling out and using this form.

- The General Power of Attorney grants broad authority to an agent, allowing them to make decisions regarding financial and legal matters.

- This document must be signed by the principal, the person granting the power, in the presence of a notary public.

- The scope of authority can be tailored; specific powers can be limited or expanded based on the principal's needs.

- The agent has a fiduciary duty to act in the best interests of the principal, which includes being honest and maintaining accurate records.

- Once signed, the General Power of Attorney is effective immediately, unless the principal specifies a delayed start date.

- It can remain effective even if the principal becomes incapacitated, depending on the terms specified in the document.

- The principal can revoke the General Power of Attorney at any time, provided they are of sound mind.

- It is advisable to provide a copy of the document to all relevant parties, including the agent and financial institutions.

- State laws can vary significantly regarding powers of attorney; reviewing local regulations is crucial.

- Consider consulting a legal expert to ensure that the document meets all necessary legal requirements and reflects the principal's wishes accurately.

Fill out Common Types of General Power of Attorney Templates

General Power of Attorney California - This form allows the individual to outline specific limitations on the powers granted to the agent.