Instructions on Utilizing Generic Direct Deposit

Once you've completed the Generic Direct Deposit form, it's crucial to ensure that all information is accurate. This will help you avoid any potential delays in receiving your funds. Below are the steps to fill out the form correctly.

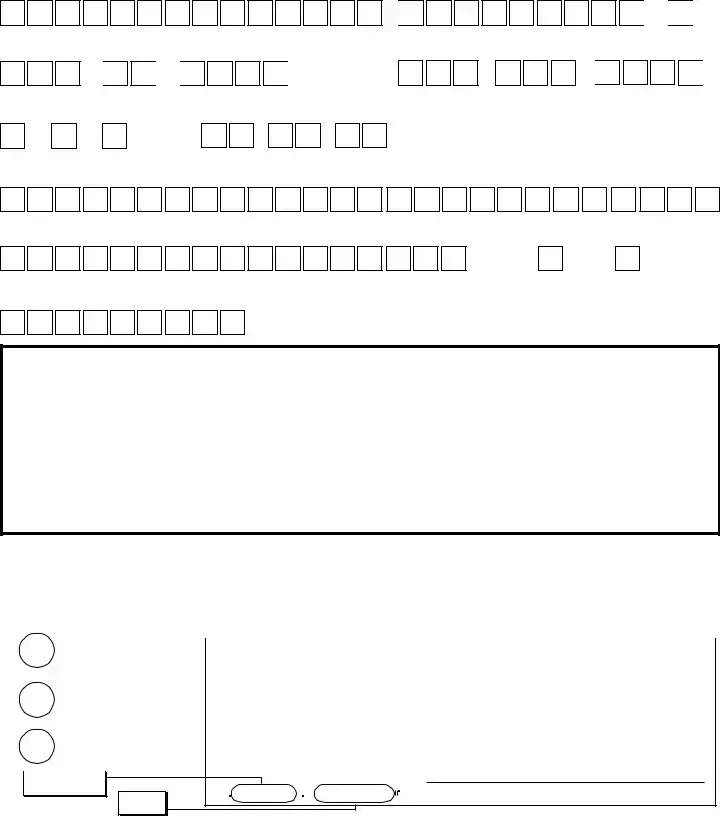

- Fill in your last name, first name, and middle initial in the specified boxes.

- Enter your Social Security Number formatted as XXX-XX-XXXX.

- Choose the action you wish to take: New, Change, or Cancel.

- Provide the effective date by entering the month, day, and year.

- Write your work phone number in the format XXX-XXX-XXXX.

- Input the name of your financial institution.

- Enter your account number, ensuring you include hyphens but omit spaces and special symbols.

- Select the type of account: Savings or Checking.

- Fill in the Routing Transit Number, making sure all nine boxes are completed and the first two numbers fall within the specified range.

- Indicate the ownership type of the account: Self, Joint, or Other.

- Ensure you sign and date the form at the bottom.

- If applicable, have anyone else named on the account sign and date their acknowledgment as well.

After completing these steps, take a moment to double-check everything. Accuracy is key, so consider calling your financial institution to confirm they'll accept direct deposits with the information provided.

□

□