Fillable Gift Deed Document

A Gift Deed form is a legal document that allows one person to transfer ownership of property or assets to another person without expecting payment in return. This form outlines the details of the gift, including the parties involved and the description of the property. If you're ready to make a generous gift, fill out the form by clicking the button below.

A Gift Deed form is an important legal document that facilitates the transfer of property or assets from one person to another without the exchange of money. It is a straightforward way for individuals to pass on their possessions to family members, friends, or charitable organizations. This form outlines the details of the gift, including the name of the giver (donor), the receiver (donee), and a clear description of the item or property being given. By signing this document, both parties acknowledge their agreement to the terms, ensuring that the transfer is legitimate and recognized by law. Furthermore, the Gift Deed may also address any conditions or restrictions related to the gift. Understanding the nuances of this form can help avoid potential disputes in the future and provide peace of mind that a cherished item or property has been passed on as intended.

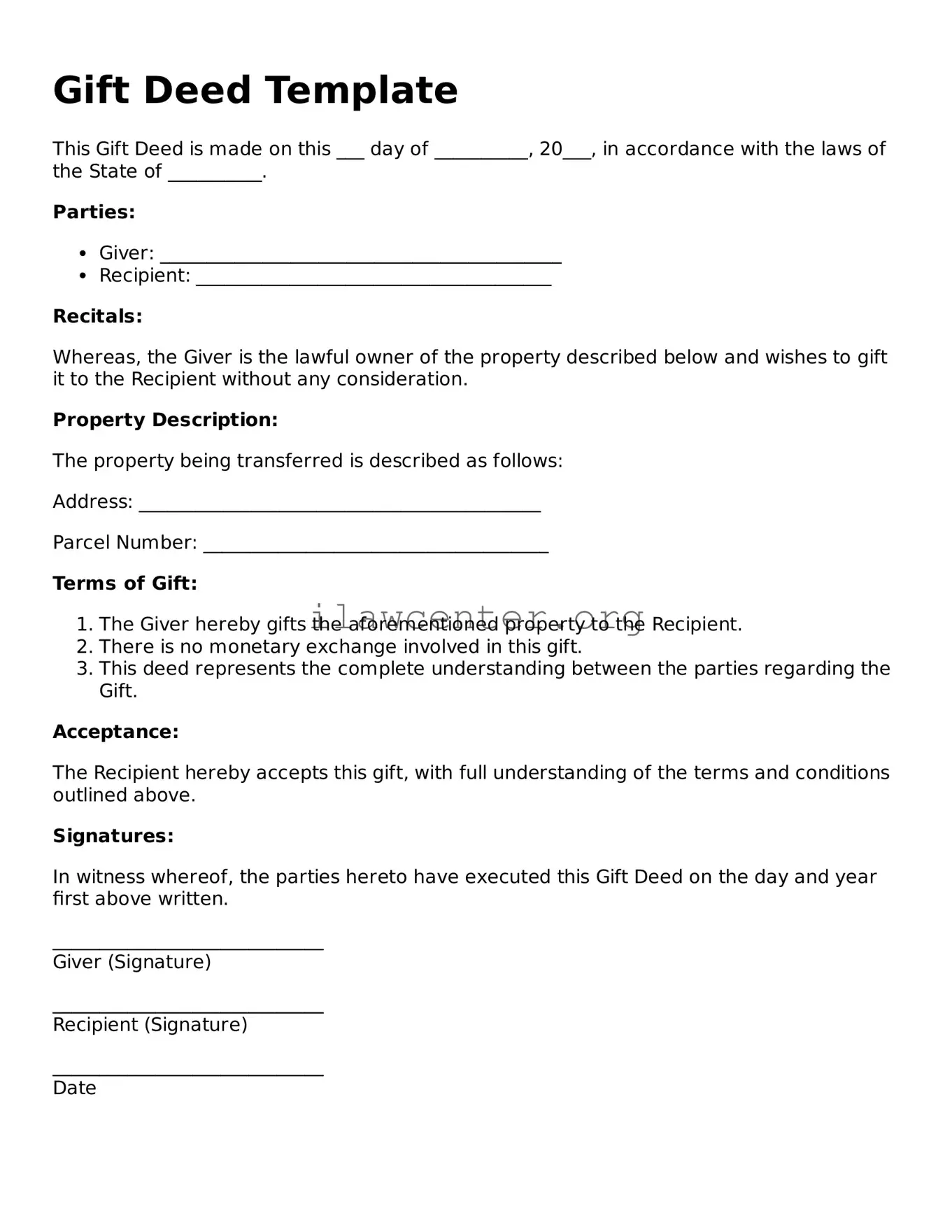

Gift Deed Preview

Gift Deed Template

This Gift Deed is made on this ___ day of __________, 20___, in accordance with the laws of the State of __________.

Parties:

- Giver: ___________________________________________

- Recipient: ______________________________________

Recitals:

Whereas, the Giver is the lawful owner of the property described below and wishes to gift it to the Recipient without any consideration.

Property Description:

The property being transferred is described as follows:

Address: ___________________________________________

Parcel Number: _____________________________________

Terms of Gift:

- The Giver hereby gifts the aforementioned property to the Recipient.

- There is no monetary exchange involved in this gift.

- This deed represents the complete understanding between the parties regarding the Gift.

Acceptance:

The Recipient hereby accepts this gift, with full understanding of the terms and conditions outlined above.

Signatures:

In witness whereof, the parties hereto have executed this Gift Deed on the day and year first above written.

_____________________________

Giver (Signature)

_____________________________

Recipient (Signature)

_____________________________

Date

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Consideration | The transfer in a Gift Deed is made voluntarily, and no consideration (payment) is required from the recipient. |

| State-Specific Forms | Each state may have its own specific form and requirements for a Gift Deed. For example, in California, the governing law is outlined in the California Civil Code. |

| Tax Implications | Gifts may have tax implications for both the giver and the recipient. The IRS has rules regarding gift taxes, which should be considered during the transfer. |

Instructions on Utilizing Gift Deed

Filling out a Gift Deed form is a crucial step in transferring ownership of property or assets from one person to another without any exchange of payment. Once completed, the form needs to be properly signed and may require notarization. Ensure all information is accurate to avoid any legal complications in the future.

- Obtain the Gift Deed form from a legal office or download it from a reputable website.

- Fill in the date at the top of the form.

- Enter the name and address of the donor (the person giving the gift).

- Provide the name and address of the recipient (the person receiving the gift).

- Clearly describe the property or asset being gifted. Include details such as addresses, identification numbers, or any identifying characteristics.

- Include any specific conditions or terms associated with the gift, if applicable.

- Sign and date the form in the designated areas. Ensure the donor's signature is clear and legible.

- If required by state law, have the form notarized. A notary will verify the identities of the parties involved and witness the signing.

- Make copies of the signed Gift Deed for both the donor and the recipient for their records.

- File the original Gift Deed with the appropriate local government office, if necessary, to officially record the transfer.

Important Facts about Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document used to voluntarily transfer ownership of property from one person to another without any exchange of money. This type of deed signifies that the giver, known as the donor, intends to make a gift to the receiver, referred to as the donee. It’s important for the gift deed to clearly outline the property being transferred and to be signed by both parties to ensure a valid transfer of ownership.

Who can create a Gift Deed?

Any adult person who is the legal owner of a property or asset can create a Gift Deed. The donor must be of sound mind and capable of making a gift. It’s also important that the donor has the legal right to transfer the property without any restraints or claims from others.

What properties can be gifted using a Gift Deed?

A Gift Deed can be used to transfer various types of properties, including real estate, cash, stocks, and personal belongings like jewelry or vehicles. However, it must be noted that some property types may have specific legal or tax implications when gifted, so it's advisable to check local regulations before proceeding.

Are there tax implications for the donor and the recipient?

Yes, there can be tax implications for both the donor and the recipient. The donor may be subject to gift tax if the value of the gift exceeds a certain annual limit set by the IRS. On the other hand, the recipient may need to report the gift as income if it meets specific thresholds. It's essential to consult with a tax professional to understand the potential tax consequences fully.

Do I need witnesses or notarization for a Gift Deed to be valid?

The requirements for witnesses or notarization can vary by state. In many cases, having the Gift Deed notarized and, ideally, having witnesses sign the document can significantly strengthen its validity. Always check local laws to ensure compliance and to prevent any potential disputes in the future.

Can a Gift Deed be revoked or changed after it has been executed?

Once a Gift Deed has been executed, it is generally considered irrevocable. However, if specific conditions were included in the deed allowing for revocation, or if the donor becomes incapacitated, there may be circumstances that allow for the deed to be challenged. Consulting with a legal expert can provide clarity on any specific situation.

What information is needed to complete a Gift Deed?

To complete a Gift Deed, both the donor and the donee’s full names, addresses, and any relevant identifying information are required. A detailed description of the property being gifted, including any identification numbers like parcel numbers for real estate, should be included to avoid ambiguity. Signatures from both parties, along with any witnesses if needed, are also necessary to validate the deed.

How do I record a Gift Deed?

To officially record a Gift Deed, it typically needs to be filed with the local county recorder’s office or land registry, depending on the nature of the property. Recording the deed helps establish formal public acknowledgment of the transfer of ownership and protects the interests of the new owner. There may be a nominal fee for recording the document, which varies by location.

Common mistakes

Filling out a Gift Deed form can seem straightforward, but many individuals encounter pitfalls that can complicate the process. One common mistake occurs when the donor fails to provide their complete name and address. This information is essential, as it establishes the identity of the person making the gift. Omitting or incorrectly entering this information can lead to confusion or disputes down the road.

Another frequent error is not clearly describing the gift being transferred. Vague descriptions may seem harmless, but they can lead to ambiguity regarding what exactly is being gifted. A well-defined description should include details such as the type of property, its location, and its value. Clarity in this section helps ensure that both the donor and recipient understand the specifics of the transaction.

Many also overlook the importance of including the date of the gift. A missing or incorrect date can cause issues if questions about the gift arise later. This date typically marks the moment the gift is officially made, and lacking this information can complicate matters related to taxes or ownership rights.

Another area where mistakes occur is in the witness section. Some states require that a Gift Deed be notarized or witnessed to be valid. Failing to have a witness present when signing can invalidate the deed. It's critical to check local requirements to ensure compliance with all legal standards.

Moreover, many people neglect to ensure that the recipient's information is accurate. Incorrectly spelling the recipient’s name or providing an incomplete address can lead to legal complications, particularly if future disputes arise. Precision is vital in this context to ensure the recipient can legally claim ownership of the gift.

Tax implications are often overlooked as well. Individuals may fill out a Gift Deed without considering the potential tax obligations that can result from gifting property. Understanding the annual exclusion limit and the tax implications for larger gifts is essential to avoid unexpected tax liabilities.

Another mistake comes from not keeping a copy of the completed Gift Deed. Documentation serves as proof of the transaction and can be critical if any disputes occur in the future. Failing to retain a copy can result in complications if the terms of the gift are ever called into question.

Lastly, many forget to provide adequate legal descriptions of real estate properties, if applicable. Simply naming a street is insufficient in many jurisdictions. An accurate legal description, often found in the property's deed, is necessary to properly transfer ownership. Obtaining a survey or legal description ensures precision in the title transfer process.

Documents used along the form

A Gift Deed is a formal document that legally transfers ownership of property or assets from one person to another without any exchange of payment. It is important to have specific forms and documents ready when preparing a Gift Deed to ensure that all legal requirements are met and future complications are avoided. Below is a list of additional documents that are often utilized alongside the Gift Deed.

- Identifications of Parties: Copies of government-issued IDs, such as a driver's license or passport, for both the giver and the recipient, help confirm identities and provide proof of age and legal capacity to execute the gift.

- Property Description: A detailed description of the property being gifted, including its address, legal description, and any relevant tax identification numbers, allows for clear identification of the asset being transferred.

- Witness Statements: Having witnesses sign a separate statement can provide additional validation to the Gift Deed, affirming that the gifting process was voluntary and conducted without duress.

- Tax Acknowledgment Form: Since gifts can have tax implications, a document specifying the fair market value of the gift and the acknowledgement of potential tax obligations helps parties understand their financial responsibilities.

- Affidavit of No Consideration: This particular affidavit confirms that no payment or consideration is exchanged for the gift, thus clarifying the nature of the transaction for future reference.

Preparing a Gift Deed alongside these additional documents can create a smoother process and provide clear protection for all parties involved. Understanding the purpose of each document not only simplifies the task but also ensures that you are effectively completing a significant legal transaction.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a gift deed, it involves transferring property. Both documents require the intent to give and typically need to be in writing.

- Trust Deed: A trust deed establishes a trust, which holds property for the benefit of others. Similar to a gift deed, it involves conveying property, but it often addresses ongoing management of that property.

- Property Deed: A property deed transfers ownership of real estate from one person to another. Like a gift deed, it provides evidence of the transfer and requires clear intent and legal compliance.

- Bill of Sale: A bill of sale transfers ownership of personal property. Similar to a gift deed, it documents the transaction and signifies the intent to transfer ownership.

- Lease Agreement: A lease agreement allows one person to use property owned by another for a set period. While it does not transfer ownership, it is similar in that it creates an arrangement regarding property use.

- Partition Deed: A partition deed divides property among co-owners. Similar to a gift deed, it facilitates the transfer of interests in property and involves mutual agreement among parties.

- Quitclaim Deed: A quitclaim deed transfers one party's interest in property without guarantees. It is used to simplify property transfers, much like a gift deed, but with less legal protection for the recipient.

- Promissory Note: A promissory note is a written promise to pay a specific amount. While not a property transfer, it involves an obligation similar to some gift deeds that may come with conditions.

- Affidavit of Heirship: This document confirms the heirs of a deceased person's estate. It is similar in that it facilitates the transfer of property after someone passes away, but does so without a formal will.

- Power of Attorney: A power of attorney allows someone to act on behalf of another. It doesn’t transfer property outright but can enable gifting or managing property in the same spirit as a gift deed.

Dos and Don'ts

When filling out a Gift Deed form, it's essential to approach the process with care. Here are five important do's and don'ts to keep in mind:

- Do ensure that all names and addresses are accurate and match the legal identification documents.

- Do clearly describe the gift being transferred, including any specific details that make it identifiable.

- Do have all parties involved sign the document in the presence of a witness, if required by state law.

- Don't leave any blank spaces on the form, as this could lead to confusion or disputes later.

- Don't forget to check your state's requirements for notarization or any other necessary formalities.

Following these guidelines can help ensure that the Gift Deed is valid and effective, making the process smoother for everyone involved.

Misconceptions

There are several misconceptions surrounding the Gift Deed form that can lead to confusion. Understanding the truth behind these misconceptions is vital for anyone considering this type of transaction.

-

Misconception 1: A Gift Deed is the same as a Will.

This is incorrect. A Gift Deed transfers ownership of property immediately, while a Will only takes effect after the person’s death.

-

Misconception 2: You don't need to register a Gift Deed.

This is false. Registration is necessary to make the transfer legal and valid. Without registration, the gift may not hold up in court.

-

Misconception 3: A Gift Deed can be revoked easily.

Once a Gift Deed is executed and delivered, it generally cannot be revoked. The donor relinquishes ownership at that moment.

-

Misconception 4: Any property can be gifted using a Gift Deed.

This is not entirely true. Certain restrictions exist concerning the type of property that can be gifted, especially if it is subject to liens or claims.

-

Misconception 5: Gifts to family members are automatically exempt from taxes.

This is misleading. While there are exemptions, significant gifts may be subject to federal gift tax regulations.

Clarifying these misconceptions is crucial for anyone looking to navigate the process of gifting property. Be sure to seek proper guidance if you have questions or concerns.

Key takeaways

When considering the Gift Deed form, there are several important aspects to keep in mind. Understanding these can help ensure that the process is smooth and legally sound.

- Each gift must be made voluntarily; coercion or undue pressure should not be involved in the decision-making process.

- The legal description of the property being gifted must be clear and accurate, avoiding any ambiguity that could lead to complications later.

- Both the giver and the recipient should understand the implications of the gift. Tax consequences and future ownership issues could arise after the deed is executed.

- It is advisable to have the Gift Deed notarized. This step adds an extra layer of authenticity and can help in avoiding disputes in the future.

By adhering to these key points, individuals can navigate the Gift Deed process more effectively, ensuring that their intentions are accurately reflected and legally upheld.

Fill out Common Types of Gift Deed Templates

Tod in California - This deed ensures that the property is transferred automatically upon the owner's death.

Lady Bird Deed Form Michigan - The Lady Bird Deed can simplify the process of passing on real estate to heirs.