Instructions on Utilizing Idaho Deed

After obtaining the Idaho Deed form, you will need to carefully complete it to ensure that it meets all legal requirements for transferring property. This process involves gathering relevant information about the property and the parties involved. Accuracy is crucial, as any mistakes can delay the transfer or lead to legal challenges.

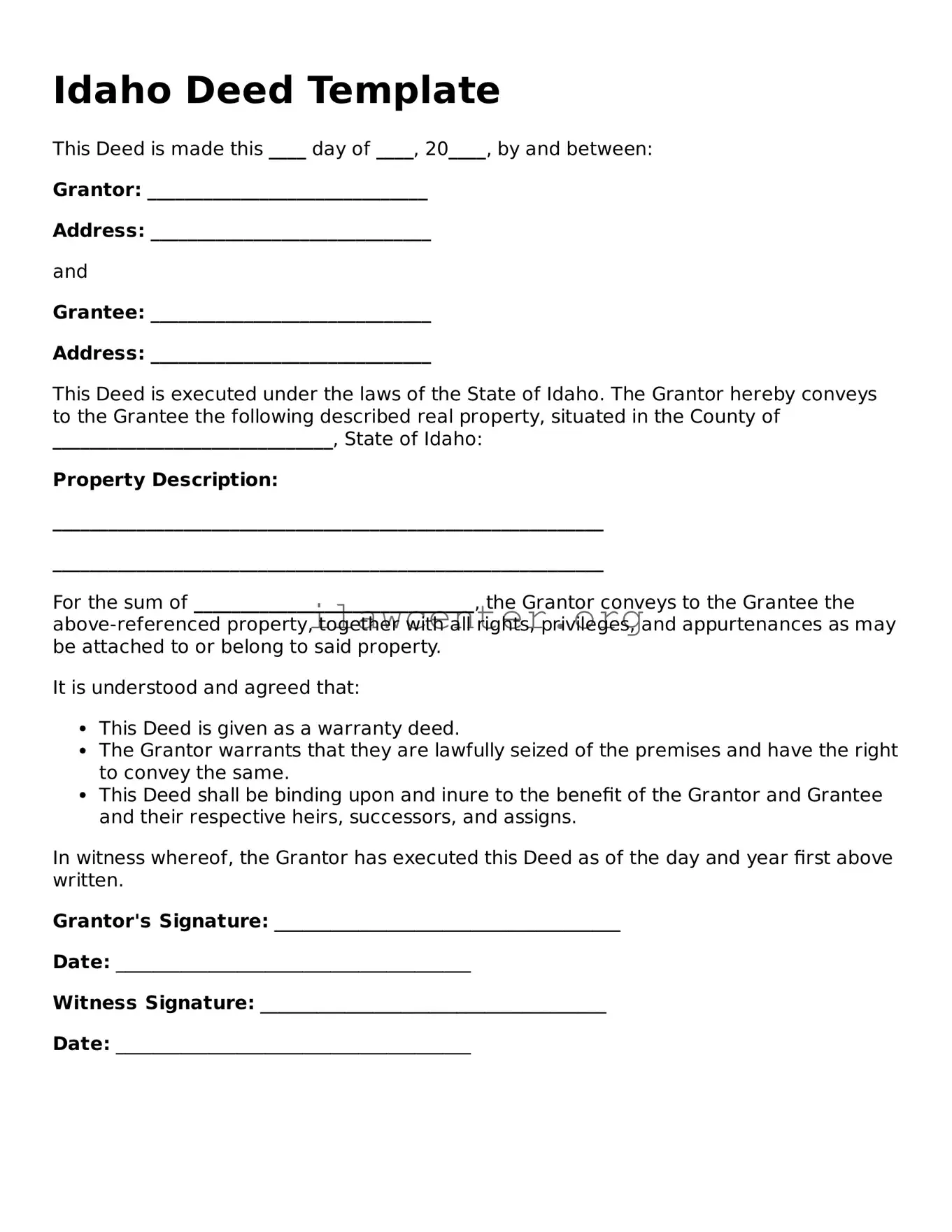

- Begin by entering the date on which the deed is being executed at the top of the form.

- Next, provide the Names and addresses of both the grantor (seller) and grantee (buyer). Be sure to use complete and correct information.

- Identify the property being transferred. Include the legal description as well as the physical address. The legal description is critical for clarity.

- Indicate the consideration or value exchanged for the property. This amount typically reflects the purchase price.

- Include any special provisions that may apply, such as easements or restrictions—if relevant to the sale.

- Both parties must sign the deed. Ensure that the signature lines for the grantor and grantee are clearly marked.

- After signing, the deed should be witnessed or notarized, as required by Idaho law. This step adds an extra layer of authenticity.

- Once completed, the deed must be filed with the appropriate county recorder’s office in the county where the property is located.

After following these steps, make sure to keep a copy for your records. Filing the deed with the county ensures the transfer is officially documented and protects the interests of all parties involved.